Form 4160

What is the Form 4160

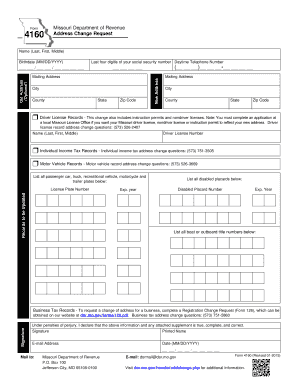

The Form 4160 is a document used primarily by taxpayers in the United States to report specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses that need to disclose certain details regarding their income, deductions, and credits. Understanding the purpose of Form 4160 is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

How to use the Form 4160

Using Form 4160 involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submitting it to the IRS. Proper use of this form can facilitate smoother processing of your tax return and help prevent issues with the IRS.

Steps to complete the Form 4160

Completing Form 4160 requires attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, accurately report your income sources, such as wages, dividends, and interest. Follow this by detailing any deductions you are eligible for, ensuring to include supporting documentation. Finally, sign and date the form before submission. Each step is vital for ensuring that your form is processed without delays.

Legal use of the Form 4160

The legal use of Form 4160 is governed by IRS regulations. It is essential to ensure that all information reported is truthful and accurate, as providing false information can lead to severe penalties. The form must be submitted by the designated deadline to avoid late fees or additional interest on unpaid taxes. Understanding the legal implications of using Form 4160 helps maintain compliance and protects taxpayers from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for Form 4160 are critical for avoiding penalties. Typically, the form must be submitted by April 15 of the tax year. However, extensions may be available under certain circumstances. It is important to stay informed about specific deadlines each year, as they can change based on IRS regulations and tax law updates. Marking these dates on your calendar can help ensure timely submission.

Required Documents

To complete Form 4160 accurately, several documents are required. These include W-2 forms from employers, 1099 forms for other income sources, and receipts for any deductions being claimed. Additionally, taxpayers may need to provide documentation for credits they are eligible for. Gathering these documents beforehand can streamline the completion process and help avoid errors.

Examples of using the Form 4160

Form 4160 can be used in various scenarios, such as reporting income from freelance work or rental properties. For instance, a self-employed individual may use this form to report income earned through contract work, while a landlord may report rental income and associated expenses. Understanding the different contexts in which Form 4160 is applicable can help taxpayers utilize it effectively for their specific financial situations.

Quick guide on how to complete form 4160 65798742

Effortlessly Prepare Form 4160 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your papers quickly and efficiently. Manage Form 4160 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form 4160 with Ease

- Find Form 4160 and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 4160 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4160 65798742

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4160 and how can I use it with airSlate SignNow?

Form 4160 is a document used for various official purposes, and airSlate SignNow allows you to quickly eSign and send this form with ease. Utilizing our platform, you can complete Form 4160 electronically, streamlining your workflow.

-

Is there a cost associated with using airSlate SignNow to manage Form 4160?

Yes, airSlate SignNow offers several pricing plans tailored to various business needs. These plans provide access to features that support the creation, sending, and eSigning of Form 4160 at an affordable rate, ensuring you get the best value.

-

What features does airSlate SignNow offer for Form 4160?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for your Form 4160. These tools enhance productivity and ensure that you can manage your documents efficiently.

-

How does airSlate SignNow ensure the security of my Form 4160?

With airSlate SignNow, your Form 4160 is protected with bank-level encryption to ensure confidentiality. We also provide features like password protection and two-factor authentication to keep your documents safe.

-

Can I integrate airSlate SignNow with other applications for handling Form 4160?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easy to manage Form 4160 alongside the tools you already use. This flexibility enhances your workflow and ensures a smooth document management experience.

-

What are the benefits of using airSlate SignNow for Form 4160 over traditional methods?

Using airSlate SignNow for Form 4160 signNowly reduces the time spent on paperwork and eliminates the need for physical signatures. Moreover, our platform offers convenience, electronic tracking, and the ability to access documents from anywhere.

-

Is it easy to share Form 4160 with others using airSlate SignNow?

Yes, sharing Form 4160 with airSlate SignNow is incredibly simple. You can send the document to multiple recipients with just a few clicks, allowing for quick feedback and collaboration.

Get more for Form 4160

- Instructions for form 2290 rev july 2017 instructions for form 2290 heavy highway vehicle use tax return

- Tqcvl form

- Unless the insured designated otherwise you have four options option a alliance account this is an account opened for you by form

- Request for dual va employee and trainee appointment form

- Va form 4637

- Sglv 8286a election form

- 22 0997 vet tec pilot program training provider application form

- Cheyenne vamc demographic form

Find out other Form 4160

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template