BRT 801A WV State Tax Department Form

What is the BRT 801A WV State Tax Department

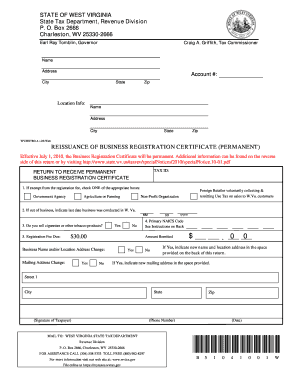

The BRT 801A form is a crucial document used by the West Virginia State Tax Department. It serves as a business registration tax form that helps the state track and manage business activities within its jurisdiction. This form is typically required for businesses operating in West Virginia to ensure compliance with state tax regulations. By submitting the BRT 801A, businesses provide essential information that enables the state to assess taxes accurately and maintain an updated registry of active business entities.

How to use the BRT 801A WV State Tax Department

Using the BRT 801A form involves several steps to ensure accurate completion and submission. First, gather all necessary information about your business, including its legal name, address, and federal employer identification number (EIN). Next, fill out the form carefully, ensuring that all sections are completed accurately. Once the form is filled out, it can be submitted electronically or by mail, depending on your preference. Utilizing a digital platform like signNow can streamline the process, allowing for easy eSigning and secure submission.

Steps to complete the BRT 801A WV State Tax Department

Completing the BRT 801A form requires attention to detail. Begin by downloading the form from the West Virginia State Tax Department's official website. Follow these steps:

- Enter your business name and address in the designated fields.

- Provide your federal EIN and relevant contact information.

- Indicate the type of business entity you are registering.

- Review the form for accuracy and completeness.

- Sign the form electronically or by hand, depending on your submission method.

After completing these steps, submit the form as instructed, ensuring you keep a copy for your records.

Legal use of the BRT 801A WV State Tax Department

The BRT 801A form is legally binding when completed and submitted according to West Virginia state law. It is essential that the information provided is truthful and accurate, as any discrepancies may lead to penalties or legal issues. The form must be signed by an authorized representative of the business, which can include electronic signatures that comply with the ESIGN Act. This legal framework ensures that eSignatures are recognized as valid and enforceable, making digital completion a reliable option.

Key elements of the BRT 801A WV State Tax Department

Several key elements are essential when filling out the BRT 801A form. These include:

- Business Information: This includes the legal name, address, and type of business entity.

- Federal EIN: A unique identifier assigned by the IRS for tax purposes.

- Contact Information: Details for reaching the business or its representative.

- Signature: Required to validate the form, which can be done electronically.

Each of these elements plays a critical role in ensuring the form is processed correctly by the West Virginia State Tax Department.

Form Submission Methods for the BRT 801A WV State Tax Department

The BRT 801A form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer to submit the form electronically through the West Virginia State Tax Department's online portal.

- Mail: The form can also be printed and mailed to the appropriate address specified by the tax department.

- In-Person: Businesses may choose to deliver the form in person at designated tax department offices.

Choosing the right submission method can enhance efficiency and ensure timely processing of the registration.

Quick guide on how to complete brt 801a wv state tax department

Complete BRT 801A WV State Tax Department seamlessly on any gadget

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitution for conventional printed and signed documents, allowing you to access the correct form and securely maintain it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage BRT 801A WV State Tax Department on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-focused task today.

How to modify and eSign BRT 801A WV State Tax Department effortlessly

- Locate BRT 801A WV State Tax Department and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Edit and eSign BRT 801A WV State Tax Department and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the brt 801a wv state tax department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BRT 801A WV State Tax Department form?

The BRT 801A WV State Tax Department form is a tax document used for reporting certain business activities in West Virginia. This form is essential for businesses to ensure compliance with state tax regulations. It provides detailed information that helps the state calculate taxes owed accurately.

-

How can airSlate SignNow help with the BRT 801A WV State Tax Department form?

airSlate SignNow offers an efficient way to create, eSign, and send the BRT 801A WV State Tax Department form securely. Our platform enables businesses to manage this documentation process digitally, reducing errors and saving time. You can easily track the form's status and ensure timely submissions.

-

Is there a cost associated with using airSlate SignNow for the BRT 801A WV State Tax Department?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions allow you to eSign documents and streamline your workflow while managing your BRT 801A WV State Tax Department form. We provide transparent pricing with no hidden fees, ensuring you get great value.

-

Can I integrate airSlate SignNow with other applications for handling the BRT 801A WV State Tax Department?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications like Google Drive, Dropbox, and various CRM systems. This integration allows you to store and manage your BRT 801A WV State Tax Department documents in one place. It enhances your workflow, making it simpler and more efficient.

-

What are the benefits of using airSlate SignNow for BRT 801A WV State Tax Department documentation?

Using airSlate SignNow for your BRT 801A WV State Tax Department documentation provides several advantages, including improved efficiency, security, and ease of use. You can complete documents faster with eSigning features, ensure they are securely stored, and access them anytime. This streamlines the entire tax filing process.

-

Is airSlate SignNow compliant with regulations related to the BRT 801A WV State Tax Department?

Yes, airSlate SignNow is designed to comply with all relevant regulations and standards necessary for handling sensitive tax documents like the BRT 801A WV State Tax Department form. We prioritize data security and confidentiality to provide peace of mind for our users. You can trust that your information is protected.

-

How do I get started with airSlate SignNow for my BRT 801A WV State Tax Department needs?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website and choose the plan that suits your needs for the BRT 801A WV State Tax Department. Our intuitive platform guides you through creating and managing your documents efficiently.

Get more for BRT 801A WV State Tax Department

- The cautionary instruction on income taxes in negligence form

- Products liability claims for failure to warnjustia form

- Strict liability rules for defective products product liability form

- 01 bad faith breach of implied obligation insurance failure to settle first party form

- 4607 week 7 assault and battery course hero form

- Defenses to intentional torts module 3 of 5 lawshelf form

- The ampquotprivilegeampquot defense to a civil battery claimalllaw form

- Full text of ampquotthe law of tortsampquot internet archive form

Find out other BRT 801A WV State Tax Department

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form