Auditing Bmv Sales Tax Ohio Form

What is the Auditing Bmv Sales Tax Ohio Form

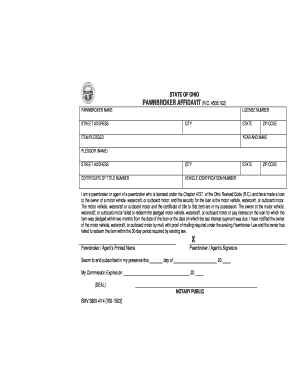

The Auditing Bmv Sales Tax Ohio Form is a specific document used by businesses in Ohio to report and audit sales tax related to vehicle transactions. This form is essential for ensuring compliance with state tax regulations and accurately reflecting sales tax obligations. It serves as a record for the Ohio Bureau of Motor Vehicles (BMV) and helps in the assessment of taxes owed on vehicle sales, including purchases, leases, and other transactions involving motor vehicles.

How to use the Auditing Bmv Sales Tax Ohio Form

Using the Auditing Bmv Sales Tax Ohio Form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to vehicle sales, including invoices and receipts. Next, fill out the form with accurate sales figures, tax rates, and any exemptions that may apply. It is important to review the form for completeness and accuracy before submission. Once completed, the form can be submitted electronically or via mail to the appropriate state agency, depending on the guidelines provided by the Ohio BMV.

Steps to complete the Auditing Bmv Sales Tax Ohio Form

Completing the Auditing Bmv Sales Tax Ohio Form requires careful attention to detail. Follow these steps:

- Gather all relevant sales documentation, including purchase agreements and tax exemption certificates.

- Enter the seller's and buyer's information accurately, including names, addresses, and contact details.

- Detail the vehicle information, such as make, model, year, and Vehicle Identification Number (VIN).

- Calculate the total sales price and the applicable sales tax based on Ohio's tax rates.

- Review all entries for accuracy and completeness.

- Submit the form electronically or by mail, ensuring it is sent to the correct address.

Legal use of the Auditing Bmv Sales Tax Ohio Form

The legal use of the Auditing Bmv Sales Tax Ohio Form is governed by Ohio state tax laws. This form must be completed accurately to ensure compliance with sales tax regulations. An electronic submission of the form is considered legally binding, provided it meets the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Proper use of this form helps avoid penalties and ensures that all sales tax obligations are met.

Required Documents

To complete the Auditing Bmv Sales Tax Ohio Form, several documents are typically required:

- Invoices or receipts for vehicle sales.

- Tax exemption certificates, if applicable.

- Proof of payment of sales tax, if already submitted.

- Any prior correspondence with the Ohio BMV regarding sales tax.

Form Submission Methods

The Auditing Bmv Sales Tax Ohio Form can be submitted through various methods. Businesses may choose to file the form electronically via the Ohio BMV's online portal, which often provides a faster processing time. Alternatively, the form can be printed and mailed to the appropriate state agency. In-person submissions may also be possible at designated BMV locations. Each method has specific guidelines, so it is important to review these before submission.

Quick guide on how to complete auditing bmv sales tax ohio form

Effortlessly Prepare Auditing Bmv Sales Tax Ohio Form on Any Device

The management of online documents has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, adjust, and eSign your documents rapidly without delays. Handle Auditing Bmv Sales Tax Ohio Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric procedures today.

The simplest method to adjust and eSign Auditing Bmv Sales Tax Ohio Form effortlessly

- Acquire Auditing Bmv Sales Tax Ohio Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of your documents or conceal sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Decide how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry over lost or misfiled documents, tedious searches for forms, or errors that necessitate the printing of new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any chosen device. Modify and eSign Auditing Bmv Sales Tax Ohio Form while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the auditing bmv sales tax ohio form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Auditing Bmv Sales Tax Ohio Form?

The Auditing Bmv Sales Tax Ohio Form is a document used for reporting sales tax related to vehicle transactions in Ohio. It helps businesses ensure compliance with state tax regulations. Properly completing this form is crucial for avoiding penalties and ensuring accurate tax reporting.

-

How can airSlate SignNow assist with the Auditing Bmv Sales Tax Ohio Form?

airSlate SignNow simplifies the process of completing the Auditing Bmv Sales Tax Ohio Form by providing an intuitive e-signature solution. Our platform allows users to fill out, sign, and send documents securely. This streamlines your workflow and eliminates the need for printing and physical paperwork.

-

Is airSlate SignNow cost-effective for handling the Auditing Bmv Sales Tax Ohio Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Auditing Bmv Sales Tax Ohio Form. With flexible pricing plans, you can select the option that best fits your business needs. This makes it affordable for businesses of all sizes to ensure compliance without overspending.

-

What features are available for managing the Auditing Bmv Sales Tax Ohio Form?

With airSlate SignNow, you get features like automated workflows, templates for the Auditing Bmv Sales Tax Ohio Form, and audit trails for tracking document status. Additionally, our platform offers secure cloud storage, ensuring easy access to your forms anytime. These features enhance efficiency and reduce errors.

-

Can I integrate airSlate SignNow with other tools for the Auditing Bmv Sales Tax Ohio Form?

Absolutely! airSlate SignNow integrates seamlessly with various tools and applications, making it easy to manage the Auditing Bmv Sales Tax Ohio Form. Whether you're using CRM systems or accounting software, our integrations enhance your overall workflow and data management.

-

What are the benefits of using airSlate SignNow for the Auditing Bmv Sales Tax Ohio Form?

Using airSlate SignNow for the Auditing Bmv Sales Tax Ohio Form offers numerous benefits, including improved efficiency, reduced turnaround times, and enhanced accuracy. Our e-signature solution not only saves time but also ensures that your documents are securely signed and filed. This enables you to focus more on your core business activities.

-

Is there customer support available for questions regarding the Auditing Bmv Sales Tax Ohio Form?

Yes, airSlate SignNow provides excellent customer support for users needing assistance with the Auditing Bmv Sales Tax Ohio Form. Our dedicated support team is available via chat, email, and phone to answer any queries you may have. This ensures that you navigate the e-signature process with ease.

Get more for Auditing Bmv Sales Tax Ohio Form

Find out other Auditing Bmv Sales Tax Ohio Form

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple