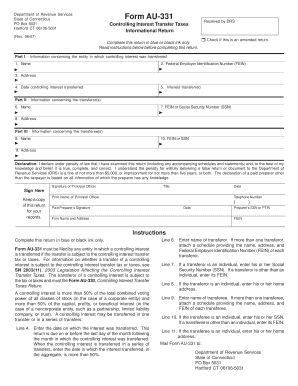

Tennessee Controlling Interst Trasnfer Tax Form

What is the Tennessee Controlling Interest Transfer Tax

The Tennessee Controlling Interest Transfer Tax is a tax levied on the transfer of controlling interests in certain entities, primarily aimed at real estate transactions. This tax applies when an individual or entity acquires a controlling interest in a partnership, corporation, or limited liability company that owns real property in Tennessee. Understanding this tax is crucial for both buyers and sellers involved in such transactions, as it can significantly affect the overall cost and legal obligations associated with the transfer.

Steps to complete the Tennessee Controlling Interest Transfer Tax

Completing the Tennessee Controlling Interest Transfer Tax form involves several key steps:

- Identify the transaction that triggers the tax, such as a sale or transfer of controlling interest.

- Gather necessary documentation, including details about the entity and the transaction.

- Calculate the tax based on the fair market value of the controlling interest being transferred.

- Complete the appropriate tax form, ensuring all required fields are filled accurately.

- Submit the form and payment to the relevant state department, either online or via mail.

Legal use of the Tennessee Controlling Interest Transfer Tax

The legal framework governing the Tennessee Controlling Interest Transfer Tax is defined by state law. Compliance is essential to avoid penalties and ensure that the transfer is recognized as valid. The tax must be paid at the time of the transfer, and failure to comply can result in legal consequences, including fines or delays in the transaction. It is advisable to consult legal counsel or a tax professional to navigate the complexities of this tax.

Required Documents

When filing the Tennessee Controlling Interest Transfer Tax, certain documents are required to ensure compliance and accuracy:

- Proof of the transaction, such as a purchase agreement or transfer document.

- Details of the entity involved, including its legal structure and ownership information.

- Valuation documentation to support the fair market value of the controlling interest.

- Completed tax form with all necessary signatures and dates.

Filing Deadlines / Important Dates

Timely filing of the Tennessee Controlling Interest Transfer Tax is crucial. The tax must be submitted within a specific timeframe after the transfer occurs, typically within thirty days. Failure to file on time may result in additional penalties or interest charges. It is important to keep track of these deadlines to ensure compliance and avoid unnecessary costs.

Examples of using the Tennessee Controlling Interest Transfer Tax

Understanding practical applications of the Tennessee Controlling Interest Transfer Tax can clarify its implications. For instance, if a corporation that owns real estate is sold, the new owners must file the tax based on the value of the controlling interest acquired. Similarly, if a partnership transfers its controlling interest to a new partner, the tax applies. These examples illustrate how the tax impacts various types of transactions and the importance of proper documentation and filing.

Quick guide on how to complete tennessee controlling interst trasnfer tax

Effortlessly Prepare Tennessee Controlling Interst Trasnfer Tax on Any Device

The digital management of documents has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without interruptions. Manage Tennessee Controlling Interst Trasnfer Tax on any device using the airSlate SignNow applications for Android or iOS, and enhance your document-related processes today.

How to Edit and Electronically Sign Tennessee Controlling Interst Trasnfer Tax with Ease

- Obtain Tennessee Controlling Interst Trasnfer Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with specific tools available from airSlate SignNow designed for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all details thoroughly and click on the Done button to finalize your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your PC.

Put an end to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Tennessee Controlling Interst Trasnfer Tax and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee controlling interst trasnfer tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tennessee controlling interest transfer tax?

The Tennessee controlling interest transfer tax is a tax imposed on the transfer of controlling interests in entities, such as corporations or partnerships. This tax applies when an individual or entity acquires a controlling interest in an organization based in Tennessee. Understanding this tax is crucial for businesses to ensure compliance and avoid penalties.

-

How does airSlate SignNow help with tennessee controlling interest transfer tax documentation?

airSlate SignNow streamlines the documentation process required for compliance with the Tennessee controlling interest transfer tax. With our eSignature solution, users can quickly send, sign, and manage necessary documents electronically, saving time and reducing the risk of errors. This efficiency helps businesses stay compliant with Tennessee tax regulations effortlessly.

-

What are the costs associated with airSlate SignNow for managing tennessee controlling interest transfer tax?

Pricing for airSlate SignNow varies depending on the features you need, but it remains competitive and cost-effective for businesses dealing with the Tennessee controlling interest transfer tax. We offer various subscription plans that cater to different business sizes and needs, ensuring that every organization can access the tools required for compliance without breaking the bank.

-

Can airSlate SignNow integrate with other applications for managing tennessee controlling interest transfer tax?

Yes, airSlate SignNow offers integrations with various applications that can help businesses manage their documentation related to the Tennessee controlling interest transfer tax. By connecting with popular tools like Google Drive, Salesforce, and other document management systems, users can streamline their workflows and simplify the tax compliance process.

-

What benefits does airSlate SignNow offer for tennessee controlling interest transfer tax processes?

Using airSlate SignNow for the Tennessee controlling interest transfer tax processes offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance tracking. The platform's user-friendly interface allows businesses to easily manage documents, ensuring that all necessary signatures and records are in order. This leads to a more organized approach to tax compliance.

-

Is airSlate SignNow legally compliant for tennessee controlling interest transfer tax documentation?

Yes, airSlate SignNow is designed to be fully compliant with the legal standards for electronic signatures and documentation, including those related to the Tennessee controlling interest transfer tax. Our platform adheres to the ESIGN Act and UETA, ensuring that all electronically signed documents are legally binding and can be used for compliance purposes.

-

How secure is airSlate SignNow for handling tennessee controlling interest transfer tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and security protocols to protect documents related to the Tennessee controlling interest transfer tax. Our platform ensures that sensitive information is safeguarded against unauthorized access, providing peace of mind for businesses as they manage their tax-related documentation.

Get more for Tennessee Controlling Interst Trasnfer Tax

Find out other Tennessee Controlling Interst Trasnfer Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors