VAT Voluntary Disclosures VAT652 Help Accountants Form

What is the VAT Voluntary Disclosures VAT652 Help Accountants

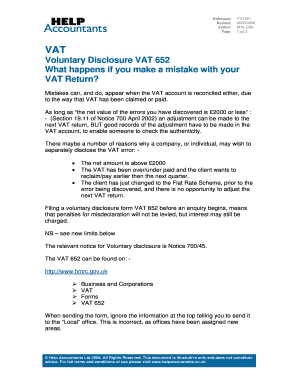

The VAT Voluntary Disclosures VAT652 Help Accountants form is a critical document used by accountants to report and rectify any discrepancies related to Value Added Tax (VAT) obligations. This form allows businesses to voluntarily disclose any underreported or overreported VAT amounts, ensuring compliance with tax regulations. By utilizing this form, accountants can help their clients mitigate potential penalties and interest that may arise from non-compliance. The process emphasizes transparency and accountability in financial reporting, aligning with the legal requirements set forth by the Internal Revenue Service (IRS).

How to use the VAT Voluntary Disclosures VAT652 Help Accountants

Using the VAT Voluntary Disclosures VAT652 Help Accountants form involves several key steps. First, accountants need to gather all relevant financial records and VAT-related documents. This includes invoices, receipts, and previous VAT returns. Next, they should accurately assess the discrepancies that need to be reported. Once the information is compiled, the form should be filled out carefully, ensuring all sections are completed with precise data. After completing the form, it can be submitted electronically or by mail, depending on the preferred method of submission. Utilizing an electronic signature solution can streamline this process, ensuring that the form is legally binding and compliant with eSignature regulations.

Steps to complete the VAT Voluntary Disclosures VAT652 Help Accountants

Completing the VAT Voluntary Disclosures VAT652 Help Accountants form requires a structured approach:

- Gather all necessary documentation, including past VAT returns and financial records.

- Identify any discrepancies in VAT reporting, such as underreported or overreported amounts.

- Complete the VAT652 form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, ensuring compliance with submission guidelines.

Legal use of the VAT Voluntary Disclosures VAT652 Help Accountants

The legal use of the VAT Voluntary Disclosures VAT652 Help Accountants form is essential for maintaining compliance with tax laws. This form serves as a formal declaration of any discrepancies in VAT reporting. To ensure its legal validity, the form must be completed accurately and submitted within the specified deadlines. Additionally, using a reputable electronic signature solution can enhance the legal standing of the document, as it complies with federal regulations such as the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

Filing Deadlines / Important Dates

Filing deadlines for the VAT Voluntary Disclosures VAT652 Help Accountants form are crucial for avoiding penalties. Generally, it is advisable to submit the form as soon as discrepancies are identified. The IRS may have specific deadlines for voluntary disclosures, which can vary based on the nature of the discrepancies and the fiscal year in question. Accountants should stay informed about these deadlines to ensure timely submissions and compliance with tax regulations.

Required Documents

To complete the VAT Voluntary Disclosures VAT652 Help Accountants form, certain documents are required:

- Previous VAT returns and related financial statements.

- Invoices and receipts that support the reported VAT amounts.

- Any correspondence with the IRS regarding VAT issues.

- Documentation outlining the discrepancies that need to be disclosed.

Quick guide on how to complete vat voluntary disclosures vat652 help accountants

Complete VAT Voluntary Disclosures VAT652 Help Accountants with ease on any device

Digital document handling has become popular among organizations and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage VAT Voluntary Disclosures VAT652 Help Accountants on any system with airSlate SignNow Android or iOS applications and streamline any document-centered procedure today.

The simplest way to modify and eSign VAT Voluntary Disclosures VAT652 Help Accountants effortlessly

- Locate VAT Voluntary Disclosures VAT652 Help Accountants and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign VAT Voluntary Disclosures VAT652 Help Accountants and guarantee excellent communication at each stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat voluntary disclosures vat652 help accountants

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are VAT Voluntary Disclosures VAT652?

VAT Voluntary Disclosures VAT652 are submissions made to HMRC by businesses to rectify past VAT errors without facing penalties. These disclosures allow accountants to ensure compliance and maintain the integrity of financial records. Understanding these disclosures is crucial for accountants assisting their clients in navigating the complexities of VAT regulations.

-

How can airSlate SignNow assist with VAT Voluntary Disclosures VAT652?

airSlate SignNow provides an efficient platform for accountants to prepare, sign, and send documents related to VAT Voluntary Disclosures VAT652. The solution streamlines workflows, ensuring that accountants can focus on compliance rather than administrative burdens. Its user-friendly interface simplifies document management, making it easier to handle such disclosures promptly.

-

What features does airSlate SignNow offer for accountants dealing with VAT Voluntary Disclosures VAT652?

Key features of airSlate SignNow that assist accountants with VAT Voluntary Disclosures VAT652 include customizable templates, eSignature capabilities, and document tracking. These features enhance the accuracy of filings and improve overall efficiency in managing VAT disclosures. Accountants can ensure that all necessary documentation is completed correctly and submitted on time.

-

Is airSlate SignNow cost-effective for accountants managing VAT Voluntary Disclosures VAT652?

Yes, airSlate SignNow is known for its cost-effective pricing plans tailored for accountants managing VAT Voluntary Disclosures VAT652. The solution minimizes paper usage and reduces the need for physical storage, leading to additional savings. Moreover, by streamlining the document workflow, it enhances productivity, making it a smart investment for accounting professionals.

-

How can accountants integrate airSlate SignNow with their current systems for VAT Voluntary Disclosures VAT652?

AirSlate SignNow offers seamless integrations with popular accounting software and document management systems, making it easier for accountants to manage VAT Voluntary Disclosures VAT652. These integrations enhance workflow efficiency and allow for better data management. Accountants can easily connect their existing tools and leverage the capabilities of SignNow to support their VAT disclosure processes.

-

What are the benefits of using airSlate SignNow for VAT Voluntary Disclosures VAT652?

Using airSlate SignNow for VAT Voluntary Disclosures VAT652 offers several benefits, including reduced processing time and improved accuracy in submitting disclosures. The eSigning functionality ensures that documents are signed quickly, which is vital for compliance. Additionally, the platform's document storage capabilities help accountants maintain easy access to important records.

-

How secure is airSlate SignNow for handling VAT Voluntary Disclosures VAT652?

AirSlate SignNow takes security seriously, implementing advanced encryption and compliance measures to protect sensitive information related to VAT Voluntary Disclosures VAT652. Accountants can trust that their documents are safeguarded against unauthorized access. This commitment to security ensures peace of mind for both accountants and their clients.

Get more for VAT Voluntary Disclosures VAT652 Help Accountants

Find out other VAT Voluntary Disclosures VAT652 Help Accountants

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation