2220 Form

What is the 2220?

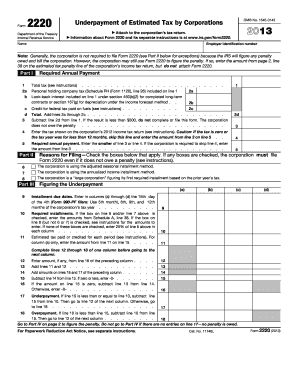

The 2220 form, officially known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts, is a crucial document used by taxpayers in the United States to report and calculate any underpayment of estimated tax. This form is particularly relevant for individuals who may not have had sufficient tax withheld from their income throughout the year. It helps to determine if additional payments are necessary to avoid penalties when filing annual tax returns.

How to use the 2220

Using the 2220 form involves several steps to ensure accurate reporting of estimated tax payments. Taxpayers must first gather their income information and any applicable deductions. After calculating their total tax liability for the year, they can determine whether they have underpaid their estimated taxes. The form requires specific calculations to assess the amount owed, including any penalties for underpayment. Once completed, the form should be submitted along with the annual tax return or as a standalone document if required.

Steps to complete the 2220

Completing the 2220 form requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year based on your expected income and deductions.

- Determine the amount of tax already paid through withholding or estimated payments.

- Use the form to calculate any underpayment and the associated penalty, if applicable.

- Review the completed form for accuracy before submission.

Legal use of the 2220

The legal use of the 2220 form is essential for compliance with IRS regulations. It serves as a formal declaration of any underpayment of estimated taxes and is necessary to avoid penalties. To ensure the form is legally binding, it must be filled out accurately and submitted within the specified deadlines. Additionally, using a reliable platform for electronic submission can enhance the legal standing of the completed document.

Filing Deadlines / Important Dates

Filing deadlines for the 2220 form align with the annual tax filing schedule. Typically, taxpayers must submit the form by the due date of their tax return, which is usually April fifteenth for individuals. However, if an extension is filed, the deadline may vary. It is crucial to be aware of these dates to avoid penalties for late submission.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the 2220 form. These guidelines outline eligibility criteria, calculation methods for underpayment, and the penalties associated with non-compliance. Familiarity with these guidelines ensures that taxpayers can accurately complete the form and adhere to all legal requirements.

Quick guide on how to complete 2220

Effortlessly Prepare 2220 on Any Device

Managing documents online has gained popularity among both organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without delays. Manage 2220 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to Edit and eSign 2220 with Ease

- Locate 2220 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign 2220 to ensure excellent communication at any point during your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2220

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable form 2220?

A fillable form 2220 is a specific IRS form used to report estimated tax liability for corporate entities. This digital format allows users to easily input their data directly onto the form, making the process more efficient.

-

How can airSlate SignNow help with fillable form 2220?

airSlate SignNow provides an intuitive platform to create, send, and eSign fillable form 2220. With its user-friendly features, businesses can streamline their tax reporting process, ensuring accuracy and timely submissions.

-

Is there a cost associated with using fillable form 2220 on airSlate SignNow?

Yes, while airSlate SignNow offers various pricing plans, users have access to features specifically designed for handling fillable form 2220. The subscription costs are structured to accommodate businesses of all sizes, offering flexibility and value.

-

Can I integrate fillable form 2220 with other software?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to seamlessly manage your fillable form 2220 alongside other business tools. This interoperability enhances your workflow and increases productivity.

-

What are the benefits of using airSlate SignNow for fillable form 2220?

Using airSlate SignNow for your fillable form 2220 offers multiple benefits, including enhanced accuracy, easy tracking, and secure storage of your documents. Its eSigning feature reduces turnaround time and improves overall efficiency.

-

How does airSlate SignNow ensure the security of my fillable form 2220?

airSlate SignNow employs robust security measures, including encryption and secure access protocols, to protect your fillable form 2220. This means your sensitive tax information remains confidential and is only accessible to authorized users.

-

Is it easy to create a fillable form 2220 with airSlate SignNow?

Yes, creating a fillable form 2220 with airSlate SignNow is straightforward. The platform provides templates and a user-friendly interface, enabling even those with minimal technical skills to generate and customize their forms quickly.

Get more for 2220

Find out other 2220

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF