Illinois Withholding Allowance Worksheet Example Form

What is the Illinois Withholding Allowance Worksheet Example

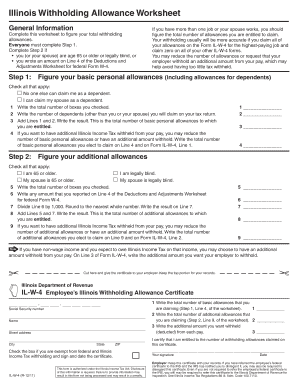

The Illinois Withholding Allowance Worksheet is a crucial document used by employees to determine the number of allowances they can claim for state income tax withholding purposes. This worksheet helps ensure that the correct amount of tax is withheld from an employee's paycheck, reflecting their personal financial situation. By accurately completing this form, employees can avoid overpaying or underpaying their state taxes throughout the year.

Steps to Complete the Illinois Withholding Allowance Worksheet Example

Completing the Illinois Withholding Allowance Worksheet involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Next, assess your filing status. This may include options such as single, married, or head of household.

- Determine the number of allowances you qualify for based on your personal circumstances, such as dependents and other tax credits.

- Finally, review your entries for accuracy before submitting the worksheet to your employer.

Legal Use of the Illinois Withholding Allowance Worksheet Example

The Illinois Withholding Allowance Worksheet is legally binding when filled out correctly and submitted to your employer. It serves as a formal request for the appropriate amount of state income tax withholding. Employers are required to use this information to calculate the correct withholding amount, ensuring compliance with state tax laws. Failure to provide accurate information can lead to tax liabilities or penalties.

State-Specific Rules for the Illinois Withholding Allowance Worksheet Example

Each state has its own regulations regarding withholding allowances. In Illinois, specific rules dictate how to fill out the worksheet, including the number of allowances based on marital status and the number of dependents. It is essential to stay informed about any changes in state tax laws that may affect your withholding allowances, as these can impact your overall tax liability.

How to Obtain the Illinois Withholding Allowance Worksheet Example

The Illinois Withholding Allowance Worksheet can be obtained from the Illinois Department of Revenue's website or through your employer. Many employers provide this form during the onboarding process for new employees. Additionally, it may be available in various formats, including printable PDFs, making it easy to access and complete.

Examples of Using the Illinois Withholding Allowance Worksheet Example

Consider a scenario where an employee is married with two children. By filling out the Illinois Withholding Allowance Worksheet, they may determine that they are eligible for four allowances—two for themselves and one for each dependent. This can lead to a lower amount of state tax being withheld from their paycheck, providing more take-home pay. Conversely, a single employee with no dependents might only claim one allowance, resulting in higher withholding.

Quick guide on how to complete illinois withholding allowance worksheet example 5502000

Complete Illinois Withholding Allowance Worksheet Example effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and physically signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly and without delay. Handle Illinois Withholding Allowance Worksheet Example on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to edit and electronically sign Illinois Withholding Allowance Worksheet Example with ease

- Find Illinois Withholding Allowance Worksheet Example and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new versions. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and electronically sign Illinois Withholding Allowance Worksheet Example and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois withholding allowance worksheet example 5502000

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a withholding allowance and how does it affect my taxes?

A withholding allowance is an exemption you can claim on your W-4 form and it impacts how much tax is withheld from your paycheck. The more allowances you claim, the less tax is deducted, which can provide more take-home pay but may lead to tax liabilities at year-end if not managed appropriately.

-

How can airSlate SignNow help me manage documents related to withholding allowances?

With airSlate SignNow, you can easily send and eSign documents related to your withholding allowance, such as W-4 forms and other tax-related documents. Our platform streamlines the process, ensuring you and your employees can quickly complete and return necessary paperwork without hassle.

-

Are there any costs associated with using airSlate SignNow for withholding allowance documentation?

airSlate SignNow offers a cost-effective solution for managing all your document needs, including withholding allowance forms. Our pricing plans are designed to fit businesses of all sizes, providing a variety of features without breaking the bank.

-

What features does airSlate SignNow provide for handling withholding allowance documents?

With airSlate SignNow, you can leverage features like customizable templates, automatic reminders, and real-time tracking for all documents related to withholding allowance. These features not only simplify the signing process but also enhance productivity and compliance.

-

Can I integrate airSlate SignNow with other software to manage withholding allowances?

Yes, airSlate SignNow offers seamless integrations with a variety of software applications, making it easy to manage data related to withholding allowances. This can help automate data entry and improve overall efficiency within your organization.

-

What are the benefits of using airSlate SignNow for withholding allowances compared to traditional methods?

Using airSlate SignNow for withholding allowances offers numerous benefits over traditional methods, including faster turnaround times, reduced paper usage, and enhanced security. Additionally, our user-friendly interface makes it easy for all users to navigate the signing process.

-

Is airSlate SignNow compliant with tax regulations regarding withholding allowance?

Absolutely! airSlate SignNow is designed to be fully compliant with relevant tax regulations, ensuring that all documents related to withholding allowances are handled appropriately. We prioritize security and legal compliance, so you can trust our platform for all your document needs.

Get more for Illinois Withholding Allowance Worksheet Example

- Lease purchase vs lease option a potential solution for form

- Adopted by the state of north dakota and form

- Of the state of north dakota form

- Financial disclosure required with prenuptial agreements form

- By the laws of the state of north dakota and any other agreements the parties may enter into form

- Control number nd006d form

- Control number nd008d form

- 8 us code1502 certificate of nationality issued by form

Find out other Illinois Withholding Allowance Worksheet Example

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure