Baltimore Tax Sale Property List Form

What is the Baltimore Tax Sale Property List

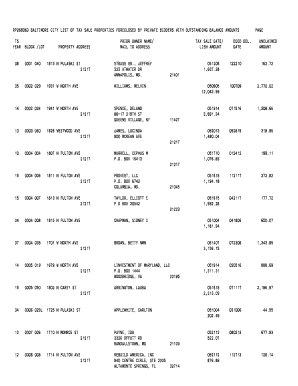

The Baltimore Tax Sale Property List is a comprehensive document that details properties in Baltimore City that are subject to tax sale due to unpaid property taxes. This list is crucial for potential investors and buyers who are interested in acquiring properties at tax sales. The properties listed often include residential, commercial, and vacant land that have delinquent taxes. Understanding the contents of this list is essential for making informed decisions in property investment.

How to obtain the Baltimore Tax Sale Property List

To obtain the Baltimore Tax Sale Property List, individuals can access it through the official Baltimore City government website or the local tax office. The list is typically updated annually and may be available in both digital and printed formats. Interested parties should ensure they are looking at the most current version, which may include details about the properties, outstanding tax amounts, and any relevant legal notices.

Steps to complete the Baltimore Tax Sale Property List

Completing the Baltimore Tax Sale Property List involves several key steps. First, identify the properties of interest from the list. Next, gather necessary information such as property descriptions, tax amounts, and any liens or encumbrances. It is also important to verify the legal status of each property. Finally, any required documentation should be prepared and submitted according to the guidelines provided by the Baltimore City tax authority.

Legal use of the Baltimore Tax Sale Property List

The legal use of the Baltimore Tax Sale Property List is governed by local laws and regulations. Buyers must ensure they comply with all legal requirements when participating in tax sales. This includes understanding the bidding process, payment deadlines, and the implications of purchasing properties with outstanding taxes. Utilizing the list legally helps protect buyers from potential disputes or liabilities associated with the properties.

Key elements of the Baltimore Tax Sale Property List

Key elements of the Baltimore Tax Sale Property List include the property address, owner information, tax amounts owed, and any applicable legal descriptions. Additionally, the list may indicate the status of the property, such as whether it is residential or commercial, and any other relevant details that could affect the sale. Understanding these elements is vital for making informed investment decisions.

Examples of using the Baltimore Tax Sale Property List

Examples of using the Baltimore Tax Sale Property List include identifying investment opportunities in distressed properties, conducting due diligence before bidding, and assessing the potential return on investment. Investors may also use the list to research property histories and evaluate market conditions. These examples highlight the practical applications of the list in real estate investment strategies.

Quick guide on how to complete baltimore tax sale property list

Prepare Baltimore Tax Sale Property List effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers a fantastic eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Baltimore Tax Sale Property List on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Baltimore Tax Sale Property List effortlessly

- Find Baltimore Tax Sale Property List and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you prefer to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, inconvenient form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Baltimore Tax Sale Property List and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the baltimore tax sale property list

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is included in the Baltimore tax sale 2022 property list?

The Baltimore tax sale 2022 property list contains all properties eligible for tax lien sale in Baltimore. This includes properties with outstanding taxes that are available for bidding. Understanding this list is crucial for potential investors looking to acquire real estate through tax sales.

-

How can I access the Baltimore tax sale 2022 property list?

You can access the Baltimore tax sale 2022 property list through the official Baltimore city government website or trusted real estate websites. This will provide you with the latest updates and comprehensive details on the properties available. Always ensure to verify the source for accuracy and reliability.

-

Are there any fees associated with purchasing from the Baltimore tax sale 2022 property list?

Yes, there are fees associated with purchasing properties from the Baltimore tax sale 2022 property list. These fees can include registration fees, buyer premiums, and any outstanding back taxes. Be sure to factor in these costs when planning your investment.

-

What are the benefits of investing in properties from the Baltimore tax sale 2022 property list?

Investing in properties from the Baltimore tax sale 2022 property list can provide signNow returns. Buyers often acquire properties below market value, allowing for potential profit through resale or rental. Moreover, paying off delinquent taxes can lead to property ownership in a straightforward manner.

-

Can I use airSlate SignNow for documentation related to the Baltimore tax sale 2022 property list?

Absolutely! airSlate SignNow offers an easy-to-use solution for signing and sending documents related to the Baltimore tax sale 2022 property list. This includes contracts and agreements, simplifying the paperwork process in your property transactions.

-

Is the Baltimore tax sale 2022 property list updated regularly?

Yes, the Baltimore tax sale 2022 property list is updated regularly to reflect new information and changes in property status. It's essential to check frequently for the latest properties eligible for tax sale. Staying informed will aid in making timely investment decisions.

-

What features does airSlate SignNow offer for eSigning documents related to the tax sale?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure eSigning capabilities for documents related to the tax sale. These features streamline the process, ensuring that your documentation associated with the Baltimore tax sale 2022 property list is efficient and compliant.

Get more for Baltimore Tax Sale Property List

- Discover student loanspo box 30947salt lake city ut form

- The foregoing instrument was acknowledged before me on by form

- City county and state of residence form

- Control number nh p004 pkg form

- Control number nh p005 pkg form

- Control number nh p006 pkg form

- Power of attorney for sale of motor vehicle generic poa form

- Special marriage licenses nhsos nh secretary of state form

Find out other Baltimore Tax Sale Property List

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word