Form 05 177

What is the Form 05 177

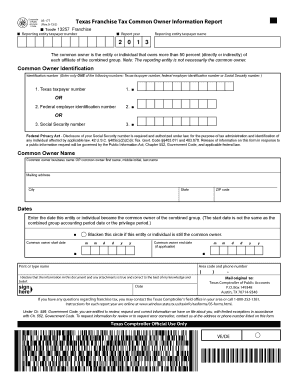

The Texas Form 05 177, also known as the Common Owner Report, is a document required for reporting ownership information related to entities subject to the Texas franchise tax. This form is essential for ensuring compliance with state regulations and provides transparency regarding the ownership structure of businesses operating in Texas. It is particularly relevant for entities that have multiple owners or partners, as it helps the state assess tax obligations accurately.

Steps to complete the Form 05 177

Completing the Texas Form 05 177 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the owners of the entity, including names, addresses, and ownership percentages. Next, accurately fill in the form, ensuring that all fields are completed as required. It is important to review the form for any errors or omissions before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Legal use of the Form 05 177

The Texas Form 05 177 is legally binding when completed accurately and submitted in accordance with state regulations. It must be signed by an authorized representative of the entity, affirming that the information provided is true and correct. Compliance with the legal requirements surrounding this form is crucial, as failure to submit it or providing false information can result in penalties or legal repercussions.

How to obtain the Form 05 177

The Texas Form 05 177 can be obtained through the Texas Comptroller's website or directly from authorized business registration offices. It is available in both digital and paper formats, allowing businesses to choose the method that best suits their needs. For digital access, users can download the form and fill it out electronically, which can streamline the submission process.

Form Submission Methods

The completed Texas Form 05 177 can be submitted through various methods. Businesses have the option to file online through the Texas Comptroller's e-filing system, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate state office or delivered in person. It is important to check the latest guidelines for submission methods to ensure compliance with any updates in the process.

Key elements of the Form 05 177

Understanding the key elements of the Texas Form 05 177 is essential for accurate completion. The form typically includes sections for listing the names and addresses of all owners, their ownership percentages, and any relevant identifying information. Additionally, it may require details about the entity itself, such as its legal structure and tax identification number. Ensuring that all required information is provided will help facilitate a smooth filing process.

Penalties for Non-Compliance

Failure to comply with the requirements of the Texas Form 05 177 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action against the entity. It is crucial for businesses to adhere to submission deadlines and ensure that all information is accurate to avoid these consequences. Regularly reviewing compliance requirements can help mitigate risks associated with non-compliance.

Quick guide on how to complete form 05 177

Complete Form 05 177 effortlessly on any device

The management of documents online has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any hold-ups. Manage Form 05 177 on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Form 05 177 with ease

- Find Form 05 177 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically developed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in a few clicks from any device of your choosing. Modify and eSign Form 05 177 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 05 177

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 05 177 and how does it work with airSlate SignNow?

The form 05 177 is a specific document required for various administrative tasks. With airSlate SignNow, you can easily create, send, and eSign the form 05 177, streamlining your workflow. Our solution ensures that the document is completed efficiently while maintaining security and compliance.

-

How much does it cost to use airSlate SignNow for the form 05 177?

airSlate SignNow offers competitive pricing plans that include access to features for managing the form 05 177. Depending on your needs, you can choose a plan that suits your budget while ensuring you have all the necessary tools for document management. Consider starting with our free trial to explore the benefits.

-

What features does airSlate SignNow offer for managing the form 05 177?

airSlate SignNow provides a range of features to effectively manage the form 05 177, including customizable templates, electronic signatures, and secure cloud storage. Our user-friendly interface allows you to track the status of your document and ensure all stakeholders can sign easily. Additionally, you can integrate it with other tools to enhance productivity.

-

Can I integrate airSlate SignNow with other software for managing the form 05 177?

Yes, airSlate SignNow seamlessly integrates with various software solutions, allowing you to enhance your workflow when managing the form 05 177. Popular integrations include CRM systems, project management tools, and cloud storage services. This flexibility ensures that you can streamline your processes and maintain organization.

-

What are the benefits of using airSlate SignNow for the form 05 177?

Using airSlate SignNow for the form 05 177 provides numerous benefits, such as increased efficiency, reduced errors, and improved document tracking. Our platform enables faster turnaround times for signatures and approvals. By digitizing your workflow, you can save time and resources while ensuring compliance with regulations.

-

Is airSlate SignNow secure for signing the form 05 177?

Absolutely! airSlate SignNow prioritizes security, ensuring that your form 05 177 is signed in a safe environment. We employ industry-standard encryption and robust authentication measures to protect your sensitive data. You can confidently use our platform knowing that your documents are secure.

-

How can I track the status of the form 05 177 in airSlate SignNow?

Tracking the status of your form 05 177 is easy with airSlate SignNow. Our platform provides real-time notifications and status updates, so you can see who has viewed or signed the document. Additionally, you can access a comprehensive audit trail for complete transparency.

Get more for Form 05 177

Find out other Form 05 177

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple