Md Tax Form 510 Fillable

What is the Md Tax Form 510 Fillable

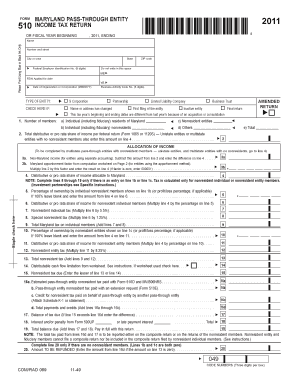

The Md Tax Form 510 Fillable is a tax form used by businesses and individuals in Maryland to report income, calculate taxes owed, and claim any applicable credits. This form is essential for ensuring compliance with state tax regulations. It is designed to be filled out electronically, allowing for easier submission and record-keeping. The fillable version enhances accessibility and efficiency, enabling users to complete the form accurately and conveniently.

How to use the Md Tax Form 510 Fillable

Using the Md Tax Form 510 Fillable involves several straightforward steps. First, download the form from a reliable source. Once you have the form, open it in a compatible PDF reader that supports fillable fields. Enter the required information, such as your personal details, income sources, and deductions. Review the form for accuracy before saving it. After completing the form, you can sign it electronically, ensuring that your submission meets legal standards.

Steps to complete the Md Tax Form 510 Fillable

Completing the Md Tax Form 510 Fillable requires careful attention to detail. Follow these steps:

- Download the form from a trusted source.

- Open the form in a fillable PDF reader.

- Fill in your personal information, including name, address, and Social Security number.

- Report your income and any deductions you qualify for.

- Review all entries for accuracy.

- Sign the form electronically to validate it.

- Save the completed form for your records.

Legal use of the Md Tax Form 510 Fillable

The Md Tax Form 510 Fillable is legally valid when completed according to state regulations. To ensure that your electronic submission is recognized, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). By using a reliable eSignature solution, you can add a layer of security and authenticity to your submission, making it legally binding.

Filing Deadlines / Important Dates

Timely filing of the Md Tax Form 510 Fillable is crucial to avoid penalties. The typical deadline for submission aligns with the federal tax deadline, which is usually April fifteenth. However, specific circumstances, such as extensions or special provisions, may alter this date. It is important to stay informed about any changes to filing deadlines to ensure compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Md Tax Form 510 Fillable can be submitted through various methods to accommodate different preferences. You can file the form online using the Maryland state tax website, which often provides a streamlined process. Alternatively, you can print the completed form and mail it to the appropriate tax office. In-person submissions may also be possible at designated tax offices, providing another option for those who prefer face-to-face interactions.

Quick guide on how to complete md tax form 510 fillable

Complete Md Tax Form 510 Fillable effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Md Tax Form 510 Fillable on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Md Tax Form 510 Fillable with ease

- Locate Md Tax Form 510 Fillable and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Md Tax Form 510 Fillable and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the md tax form 510 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Md Tax Form 510 Fillable?

The Md Tax Form 510 Fillable is a state tax form used by businesses in Maryland to report income and claim credits. Designed to be user-friendly, this fillable form simplifies the tax filing process for businesses. With airSlate SignNow, you can easily fill out and eSign the Md Tax Form 510, ensuring accuracy and efficiency.

-

How can I fill out the Md Tax Form 510 Fillable using airSlate SignNow?

Filling out the Md Tax Form 510 Fillable with airSlate SignNow is straightforward. Simply upload the form, enter your information in the designated fields, and the platform allows you to eSign it seamlessly. This ensures that your submission is not only complete but also legally binding.

-

Is there a cost associated with using the Md Tax Form 510 Fillable on airSlate SignNow?

Yes, there is a subscription fee for using airSlate SignNow, which includes access to the Md Tax Form 510 Fillable and other document management features. The pricing models are designed to be cost-effective for businesses of all sizes. Explore our pricing plans to find one that suits your needs and budget.

-

What are the benefits of using airSlate SignNow for the Md Tax Form 510 Fillable?

Using airSlate SignNow for the Md Tax Form 510 Fillable offers numerous benefits, including ease of use, quick turnaround times, and enhanced security. The platform allows you to fill out, sign, and share the form digitally, minimizing paperwork and reducing the risk of errors. This streamlined process saves time and improves efficiency for businesses.

-

Can I integrate airSlate SignNow with other software for processing the Md Tax Form 510 Fillable?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow when processing the Md Tax Form 510 Fillable. Whether you use accounting software or customer relationship management (CRM) tools, our integrations ensure a seamless experience, improving productivity and collaboration.

-

How does airSlate SignNow ensure the security of my Md Tax Form 510 Fillable?

Security is a top priority for airSlate SignNow. When handling the Md Tax Form 510 Fillable, the platform utilizes encryption and secure cloud storage to protect your sensitive information. Additionally, comprehensive audit trails provide transparency and compliance for all transactions.

-

Can I save a partially filled Md Tax Form 510 Fillable for later completion?

Yes, airSlate SignNow allows you to save a partially filled Md Tax Form 510 Fillable, so you can return to it at your convenience. This feature is incredibly useful for businesses that require time to gather necessary information. Simply save your progress and login later to complete and eSign the form.

Get more for Md Tax Form 510 Fillable

- Request for temporary assignment polk county public schools polk fl form

- Brevard public schools bullying reporting form

- Musical instrument rental agreement current horncraft music horncraft form

- Cooling log form

- Commsec additional authority form

- Wwwuslegalformscomform library289254 commseccommsec additional authority form fill and sign printable

- Refocus form

- Fillable online instructions for form i 800 department of

Find out other Md Tax Form 510 Fillable

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document