Hsa Deferral Form

What is the HSA Deferral Form

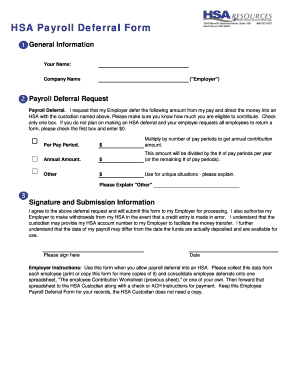

The HSA Deferral Form is a crucial document used by individuals to manage contributions to their Health Savings Account (HSA). This form allows account holders to specify the amount they wish to defer from their taxable income into their HSA, which can be used for qualified medical expenses. By utilizing this form, individuals can maximize their tax benefits while ensuring they have funds available for healthcare costs. Understanding the purpose and function of the HSA Deferral Form is essential for effective financial planning and healthcare expenditure management.

How to use the HSA Deferral Form

Using the HSA Deferral Form involves several straightforward steps. First, individuals need to gather their personal information, including Social Security numbers and account details. Next, they should accurately fill out the form, indicating the desired deferral amount. Once completed, the form must be submitted to the appropriate payroll or benefits department at the individual's workplace or financial institution. It is important to keep a copy of the submitted form for personal records and future reference.

Steps to complete the HSA Deferral Form

Completing the HSA Deferral Form requires attention to detail to ensure accuracy. Follow these steps:

- Obtain the latest version of the HSA Deferral Form from your employer or financial institution.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the amount you wish to defer for the tax year, ensuring it does not exceed the IRS limits.

- Sign and date the form to validate your request.

- Submit the form to your employer's HR or payroll department, or your financial institution.

Key elements of the HSA Deferral Form

Several key elements are essential for the HSA Deferral Form to be valid and effective. These include:

- Personal Information: Accurate details about the account holder, including name and Social Security number.

- Deferral Amount: The specific dollar amount the individual wishes to contribute to their HSA.

- Signature: The account holder's signature is necessary to authorize the deferral.

- Date: The date of submission is critical for record-keeping and compliance.

Legal use of the HSA Deferral Form

The legal use of the HSA Deferral Form is governed by IRS regulations and guidelines. To ensure compliance, individuals must adhere to contribution limits set by the IRS, which may change annually. Additionally, the form must be filled out accurately and submitted within the designated timeframes to avoid penalties. Proper use of this form not only facilitates tax benefits but also ensures that individuals can utilize their HSA funds for qualified medical expenses without legal complications.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the HSA Deferral Form is crucial for effective tax planning. Generally, the form should be submitted before the start of the tax year to ensure that contributions are deducted from taxable income for that year. Additionally, individuals should be aware of the IRS deadlines for HSA contributions, which typically align with the tax filing deadline in April. Keeping track of these dates helps individuals maximize their HSA contributions and avoid missing out on potential tax savings.

Quick guide on how to complete hsa deferral form

Complete Hsa Deferral Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Hsa Deferral Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The easiest method to modify and eSign Hsa Deferral Form without hassle

- Obtain Hsa Deferral Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to store your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Hsa Deferral Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hsa deferral form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hsa Deferral Form and why is it important?

The Hsa Deferral Form allows employees to defer a portion of their salary into a Health Savings Account (HSA) for tax savings. It's essential for managing healthcare costs effectively while maximizing tax benefits. Understanding the Hsa Deferral Form is crucial for both employers and employees to ensure compliance and optimal use of HSA funds.

-

How does airSlate SignNow simplify the Hsa Deferral Form process?

airSlate SignNow streamlines the process of completing and submitting the Hsa Deferral Form by providing an intuitive interface for digital signatures. This eliminates paper-based workflows and speeds up the approval process. With features like templates and automated reminders, managing your Hsa Deferral Form has never been easier.

-

Is there a cost associated with using airSlate SignNow for the Hsa Deferral Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. By providing a cost-effective solution for managing the Hsa Deferral Form, companies can save on administrative costs while ensuring secure and efficient document handling. Check our pricing page for details on the best plan for your team.

-

What key features should I look for in an Hsa Deferral Form solution?

When selecting a solution for the Hsa Deferral Form, key features to consider include ease of use, digital signing capability, templates for quick setup, and robust security measures. airSlate SignNow offers these features and more, ensuring a smooth experience for both employers and employees. These capabilities help ensure compliance and mitigate errors in the submission process.

-

Can I integrate airSlate SignNow with other software for managing Hsa Deferral Forms?

Yes, airSlate SignNow seamlessly integrates with various HR and payroll systems, which makes managing the Hsa Deferral Form even more convenient. This integration streamlines data flow between platforms and reduces manual entry errors. You can easily link your existing tools to enhance your workflow further.

-

What are the benefits of using airSlate SignNow for my Hsa Deferral Form?

The benefits of using airSlate SignNow for your Hsa Deferral Form include improved efficiency, reduced turnaround time, and enhanced security. By digitizing the process, you can easily track submissions and have a secure repository for all your documents. This ensures quick access and helps maintain compliance with federal regulations.

-

Is it easy for employees to fill out the Hsa Deferral Form using airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive platform that makes it easy for employees to fill out the Hsa Deferral Form. With digital signature capabilities and user-friendly navigation, employees can complete their forms quickly and without confusion. This contributes to a hassle-free experience for all parties involved.

Get more for Hsa Deferral Form

- Control number ne p067 pkg form

- Nebraska contract for deed forms us legal forms

- New hampshire legal formslegal documentsus legal

- Power of attorney financialnebraska judicial branch form

- Control number ne p077 pkg form

- Control number ne p078 pkg form

- Control number ne p080 pkg form

- Control number ne p082 pkg form

Find out other Hsa Deferral Form

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later