Firs Tax Clearance Slip Form

What is the Firs Tax Clearance Slip

The Firs Tax Clearance Slip serves as an official document that confirms an individual or business has settled all tax obligations with the state. This slip is essential for various transactions, such as securing loans, applying for permits, or completing business registrations. It demonstrates compliance with tax regulations, ensuring that the taxpayer is in good standing with the tax authority.

How to Obtain the Firs Tax Clearance Slip

To obtain the Firs Tax Clearance Slip, individuals or businesses must follow a series of steps. Generally, this involves submitting a request to the state tax authority, which may require specific information such as identification details, tax identification numbers, and proof of tax payments. It is advisable to check the state’s tax authority website for any specific forms or online services available to expedite the process.

Steps to Complete the Firs Tax Clearance Slip

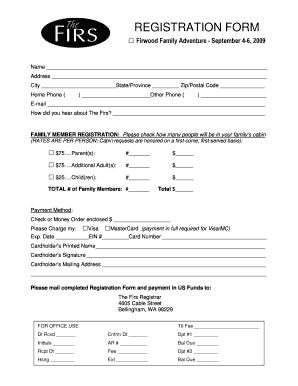

Completing the Firs Tax Clearance Slip involves several key steps:

- Gather necessary documentation, including previous tax returns and payment receipts.

- Fill out the slip accurately, ensuring all fields are completed as required.

- Review the information for accuracy to avoid delays.

- Submit the completed slip to the appropriate tax authority, either online or via mail.

Legal Use of the Firs Tax Clearance Slip

The Firs Tax Clearance Slip is legally binding and can be used in various legal contexts. It is often required for business transactions, such as applying for loans or permits. The slip serves as proof of compliance with tax laws, which can protect individuals and businesses from potential legal issues related to tax evasion or non-compliance.

Key Elements of the Firs Tax Clearance Slip

The Firs Tax Clearance Slip typically includes several key elements:

- Taxpayer Information: Name, address, and tax identification number.

- Tax Status: Confirmation of tax payments and compliance.

- Issuing Authority: Name of the state tax authority issuing the slip.

- Date of Issue: The date when the clearance slip was issued.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for obtaining the Firs Tax Clearance Slip. Each state may have different deadlines for tax filings and clearance requests. It is important to consult the state tax authority's calendar to ensure timely submission and avoid penalties. Marking these dates on a calendar can help taxpayers stay organized and compliant.

Quick guide on how to complete firs tax clearance certificate sample

Effortlessly prepare firs tax clearance certificate sample on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle tax clearance sample on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign firs tax clearance certificate with ease

- Find sample of tax clearance and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obfuscate sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form—via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign fiscal clearance sample and maintain exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to tax clearance sample

Create this form in 5 minutes!

How to create an eSignature for the firs tax clearance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask fiscal clearance sample

-

What is a tax clearance sample?

A tax clearance sample is a document that demonstrates your compliance with tax obligations. It is often required by government agencies or other organizations as proof that you have settled your taxes. Using airSlate SignNow, you can easily create and eSign your tax clearance sample, simplifying the process.

-

How can airSlate SignNow help me create a tax clearance sample?

With airSlate SignNow, you can quickly generate a tax clearance sample by using our customizable templates. Our platform allows you to input necessary information effortlessly and ensure your document meets all requirements. Plus, you can eSign the document and send it digitally, saving you time.

-

Is it easy to eSign a tax clearance sample with airSlate SignNow?

Yes, eSigning a tax clearance sample with airSlate SignNow is straightforward. Our user-friendly interface guides you through the eSigning process step-by-step. You can eSign from any device, making it convenient to finalize your tax clearance sample wherever you are.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are competitively priced, allowing you to choose the one that best suits your requirements, whether you need a basic plan for a single user or an advanced plan for an entire team. All prices provide access to features that help streamline the creation of documents like tax clearance samples.

-

Can airSlate SignNow integrate with other software I use?

Absolutely! airSlate SignNow integrates with a wide range of applications and software tools, enhancing your workflow. This means you can easily pull information into your tax clearance sample from other platforms, ensuring your documentation process is seamless and efficient.

-

What benefits do I gain from using airSlate SignNow for tax clearance documents?

Utilizing airSlate SignNow for your tax clearance documents brings numerous benefits, such as faster processing times and enhanced accuracy. Since it's an electronic solution, you can reduce paper waste and improve your overall workflow efficiency. Our security features also ensure that your tax clearance sample is handled safely.

-

How secure is my information when I create a tax clearance sample?

Security is a top priority at airSlate SignNow. When you create a tax clearance sample with our platform, you can trust that your information is encrypted and stored securely. Our compliance with industry standards means your data remains protected throughout the eSigning process.

Get more for firs tax clearance certificate sample

Find out other firs form

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document