Form 945

What is the Form 945

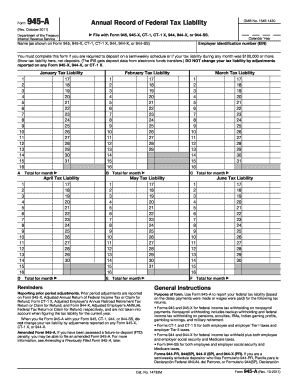

The Form 945 is an IRS document used by businesses to report nonpayroll federal income tax withheld. This form is essential for employers who have withheld taxes from payments made to non-employees, such as independent contractors or certain payments to corporations. Understanding the purpose of Form 945 is crucial for compliance with federal tax regulations.

How to use the Form 945

Using Form 945 involves accurately reporting the total amount of federal income tax withheld during the year. Businesses must complete the form with details such as the name and address of the payer, the Employer Identification Number (EIN), and the total amount withheld. Once completed, the form must be submitted to the IRS by the specified deadline to ensure compliance and avoid penalties.

Steps to complete the Form 945

Completing Form 945 requires careful attention to detail. Follow these steps:

- Gather necessary information, including your EIN and details of payments made.

- Fill out the form, ensuring all fields are completed accurately.

- Calculate the total federal income tax withheld for the year.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for Form 945 to avoid late penalties. Typically, Form 945 must be filed by January 31 of the following year for the previous tax year. If you are submitting the form electronically, you may have until March 31. Keeping track of these dates is essential for maintaining compliance with IRS regulations.

Legal use of the Form 945

The legal use of Form 945 is governed by IRS regulations. It is vital for businesses to ensure that they are reporting the correct amounts withheld to avoid issues with the IRS. Proper use of the form not only fulfills legal obligations but also helps in maintaining accurate financial records for the business.

Penalties for Non-Compliance

Failure to file Form 945 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions or errors in the reported amounts. Understanding these penalties can motivate businesses to ensure timely and accurate filings, thus avoiding unnecessary financial burdens.

Quick guide on how to complete form 945 100021203

Set up Form 945 effortlessly on any gadget

Web-based document handling has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and digitally sign your documents rapidly without delays. Handle Form 945 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to alter and digitally sign Form 945 with ease

- Locate Form 945 and then click Obtain Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that function.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Finished button to save your changes.

- Decide how you wish to send your form, either via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, burdensome form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any gadget you prefer. Edit and digitally sign Form 945 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 945 100021203

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 945 and why is it important?

Form 945 is an IRS form used to report withheld federal income tax from non-payroll payments. It is essential for businesses to accurately file this form to avoid penalties and ensure compliance with tax regulations.

-

Can airSlate SignNow help with the electronic signing of Form 945?

Yes, airSlate SignNow offers a seamless platform to electronically sign Form 945. This feature simplifies the signing process, allowing businesses to execute the form efficiently while maintaining compliance.

-

What are the pricing options for using airSlate SignNow for Form 945?

airSlate SignNow provides various pricing plans to suit different business needs. These plans are cost-effective, especially for companies that regularly manage forms like Form 945, ensuring you get great value for your investment.

-

Does airSlate SignNow integrate with other accounting software for handling Form 945?

Absolutely! airSlate SignNow integrates with popular accounting software, making it easier to manage Form 945 alongside your other financial documents. This integration facilitates streamlined workflows and reduces the chances of errors.

-

What features does airSlate SignNow offer for managing Form 945?

airSlate SignNow offers features like document templates, real-time tracking, and secure cloud storage specifically for forms like Form 945. These tools enhance the efficiency of your document management process and ensure your forms are always accessible.

-

Is airSlate SignNow compliant with federal regulations for Form 945?

Yes, airSlate SignNow is designed to be compliant with federal regulations regarding electronic signatures, ensuring that your Form 945 submissions meet legal standards. This compliance gives businesses peace of mind when filing important tax documents.

-

How does airSlate SignNow ensure the security of my Form 945 documents?

airSlate SignNow prioritizes document security by using advanced encryption protocols and secure data storage. This means your Form 945 and other sensitive documents are protected from unauthorized access and bsignNowes.

Get more for Form 945

- Notice of excusal facts requiring recusal form

- Rule 1 0881 peremptory excusal of a district judge recusal form

- 4 103 notice of excusal for use with magistrate court rule 2 form

- Part 1 basic support form

- Matters to be heard form

- Wv code 1 west virginia legislature form

- New mexico rules of civil procedure process serving rules form

- New mexico district court self help guide nm courts form

Find out other Form 945

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple