Bir Form 2550m Sample

What is the Bir Form 2550m Sample

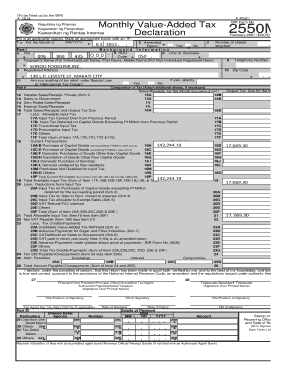

The Bir Form 2550m sample is a tax declaration form used in the Philippines for the reporting of monthly value-added tax (VAT) and other percentage taxes. This form is essential for businesses that are registered for VAT and must report their sales and output tax on a monthly basis. The sample serves as a template that taxpayers can use to understand the structure and required information needed for accurate completion. It includes sections for reporting sales, tax due, and any applicable deductions, ensuring compliance with tax regulations.

How to Use the Bir Form 2550m Sample

To effectively use the Bir Form 2550m sample, start by downloading the form from a reliable source or creating a template based on the sample. Carefully review each section of the form to understand the information required. Fill in your business details, including your Tax Identification Number (TIN), and report your gross sales or receipts. Ensure that you calculate the VAT correctly and include any adjustments or exemptions that apply. After completing the form, double-check for accuracy before submission to avoid penalties.

Steps to Complete the Bir Form 2550m Sample

Completing the Bir Form 2550m sample involves several key steps:

- Gather necessary documents, including sales records and previous tax returns.

- Download or access the sample form to use as a guide.

- Fill in your business information, including your TIN and business name.

- Report your total sales and calculate the VAT based on the applicable rate.

- Include any deductions or exemptions that may apply to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form by the due date, either electronically or by mail.

Legal Use of the Bir Form 2550m Sample

The legal use of the Bir Form 2550m sample is crucial for compliance with tax laws. This form must be filled out accurately and submitted on time to avoid legal repercussions, including fines or audits. The information provided on the form is used by tax authorities to assess tax liabilities. It is important to ensure that the sample form adheres to the guidelines set forth by the Bureau of Internal Revenue (BIR) to maintain its validity and legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Bir Form 2550m sample are typically set by the Bureau of Internal Revenue (BIR). Generally, the form must be submitted on or before the 20th day of the month following the reporting period. It is essential to stay updated on any changes to these deadlines, as late submissions can result in penalties. Mark your calendar with important dates to ensure timely compliance with tax obligations.

Required Documents

When completing the Bir Form 2550m sample, certain documents are required to provide accurate information. These may include:

- Sales invoices and receipts for the reporting period.

- Previous tax returns for reference.

- Any relevant financial statements that support your reported figures.

- Documentation for exemptions or deductions claimed.

Having these documents on hand will facilitate a smoother completion process and help ensure compliance with tax regulations.

Quick guide on how to complete bir form 2550m sample 359394389

Conveniently Prepare Bir Form 2550m Sample on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Bir Form 2550m Sample on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Effortlessly Modify and Electronically Sign Bir Form 2550m Sample

- Find Bir Form 2550m Sample and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Bir Form 2550m Sample to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form 2550m sample 359394389

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax declaration sample, and why is it important?

A tax declaration sample is a template that outlines the necessary information required for filing taxes. It is important as it helps businesses ensure compliance and accuracy when reporting their financial status. Utilizing a tax declaration sample can simplify the filing process, making it easier for businesses to manage their tax obligations.

-

How can airSlate SignNow assist with creating a tax declaration sample?

airSlate SignNow provides tools that enable users to easily create and customize a tax declaration sample. With our intuitive interface, businesses can add specific fields and data necessary for their tax declarations. This ensures that the sample meets all requirements and can be quickly eSigned and shared.

-

Is airSlate SignNow cost-effective for managing tax declaration samples?

Yes, airSlate SignNow offers a cost-effective solution for managing tax declaration samples. Our pricing plans are designed to fit the needs of various businesses, allowing you to streamline your document processes without breaking the bank. Plus, with the time you save, you'll be able to allocate resources more efficiently.

-

What features does airSlate SignNow offer for tax declaration samples?

airSlate SignNow includes features such as customizable templates, eSigning capabilities, and automated workflows that are essential for managing your tax declaration samples. You can easily track the status of your samples and ensure that all necessary parties are included in the signing process. This enhances efficiency and reduces the potential for errors.

-

Can I integrate airSlate SignNow with other tools for tax filing?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easy to manage documents and streamline the filing process for your tax declaration samples. This integration helps maintain consistency in your data and reduces the manual effort required for submitting tax paperwork.

-

What benefits can I expect from using a tax declaration sample with airSlate SignNow?

Using a tax declaration sample with airSlate SignNow provides numerous benefits, including improved accuracy, reduced processing time, and enhanced collaboration among team members. Our solution allows for quick edits and easy distribution of samples, ensuring you meet deadlines without hassle. Plus, with secure eSigning, your documents are always protected.

-

How does airSlate SignNow ensure the security of tax declaration samples?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and secure storage practices to ensure that your tax declaration samples are protected from unauthorized access. Additionally, our eSigning process complies with legal standards to guarantee the integrity of your documents.

Get more for Bir Form 2550m Sample

- Control number nm p082 pkg form

- Report fraud nm motor vehicle division form

- Control number nm p085 pkg form

- Control number nm p086 pkg form

- Paperwork to give someone emergency permission while on form

- Application requirements ampamp deadlines school of lawthe form

- State of iowa v martha aracely martinezfindlaw form

- Power of attorney low cost lawyers and law firms pro form

Find out other Bir Form 2550m Sample

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed