Arizona Form 285b

What is the Arizona Form 285b

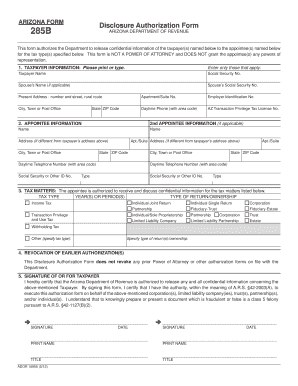

The Arizona Form 285b is a specific document used for various official purposes within the state. This form is typically associated with the Arizona Department of Revenue and is essential for individuals and businesses to report specific information or request certain actions. It is crucial for ensuring compliance with state regulations and maintaining accurate records.

How to use the Arizona Form 285b

Using the Arizona Form 285b involves several steps to ensure proper completion and submission. First, gather all necessary information and documents required to fill out the form accurately. Next, complete the form by entering the required details, ensuring that all information is correct and up to date. Once completed, the form can be submitted either electronically or by mail, depending on the specific requirements set forth by the Arizona Department of Revenue.

Steps to complete the Arizona Form 285b

Completing the Arizona Form 285b requires careful attention to detail. Here are the steps to follow:

- Download the form from the official Arizona Department of Revenue website or access it through an authorized platform.

- Fill in your personal information, including your name, address, and any identification numbers required.

- Provide the necessary details specific to the purpose of the form, such as financial information or transaction details.

- Review the completed form for accuracy and completeness before submission.

- Submit the form through the designated method, ensuring you retain a copy for your records.

Legal use of the Arizona Form 285b

The Arizona Form 285b holds legal significance as it is used to comply with state laws and regulations. Properly completing and submitting this form ensures that individuals and businesses adhere to legal requirements, which can help avoid penalties or legal issues. It is essential to understand the implications of the information provided on the form and to ensure that it is filled out honestly and accurately.

Key elements of the Arizona Form 285b

Several key elements are essential to the Arizona Form 285b. These include:

- Personal Information: Accurate details about the individual or business submitting the form.

- Purpose of the Form: A clear indication of why the form is being submitted, such as for tax reporting or compliance.

- Signature: A required signature that validates the information provided and confirms its accuracy.

- Date of Submission: The date when the form is completed and submitted, which may be important for compliance deadlines.

Form Submission Methods

The Arizona Form 285b can be submitted through various methods to accommodate different preferences and situations. Options typically include:

- Online Submission: Many users can submit the form electronically through the Arizona Department of Revenue's online portal.

- Mail: The form can be printed and mailed to the appropriate department, ensuring it is sent to the correct address.

- In-Person: Some individuals may choose to deliver the form in person at designated offices for immediate processing.

Quick guide on how to complete arizona form 285b

Complete Arizona Form 285b effortlessly on any gadget

Web-based document management has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to locate the necessary form and securely keep it online. airSlate SignNow supplies all the resources required to create, modify, and electronically sign your documents quickly and without complications. Manage Arizona Form 285b on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Arizona Form 285b with ease

- Obtain Arizona Form 285b and click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the paperwork or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere moments and holds the same legal validity as a standard handwritten signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Arizona Form 285b to ensure smooth communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 285b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 285B and why is it important?

The Arizona Form 285B is a crucial document used for various legal and administrative purposes within the state. Understanding this form is essential for fulfilling your compliance obligations, especially for businesses operating in Arizona. Utilizing airSlate SignNow can simplify the process of preparing and signing the Arizona Form 285B.

-

How does airSlate SignNow facilitate eSigning the Arizona Form 285B?

With airSlate SignNow, you can easily eSign the Arizona Form 285B through a user-friendly interface. The platform allows you to upload, edit, and send this form for signatures, making the entire process faster and more efficient. This eliminates the need for physical paperwork and enhances your workflow.

-

What are the pricing options for using airSlate SignNow to manage Arizona Form 285B?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes that need to manage documents like the Arizona Form 285B. You can choose from various subscription tiers which provide access to essential features needed for document management and electronic signatures. Each plan is designed to deliver value while ensuring you stay compliant.

-

Can I integrate airSlate SignNow with other tools to manage the Arizona Form 285B?

Yes, airSlate SignNow offers seamless integrations with popular business applications like Google Drive and Salesforce. This allows you to import and manage the Arizona Form 285B alongside your existing workflows effortlessly. Integrating these tools enhances collaboration and ensures that your documents are always up-to-date.

-

What features does airSlate SignNow provide for the Arizona Form 285B?

airSlate SignNow includes robust features such as customized templates, real-time tracking, and secure storage specifically for the Arizona Form 285B. These features help streamline your document management process and enhance the overall efficiency of handling legally important forms. Such capabilities ensure that you can manage your documents effectively.

-

Is it secure to eSign the Arizona Form 285B with airSlate SignNow?

Absolutely, airSlate SignNow employs advanced security measures to protect sensitive information when you eSign the Arizona Form 285B. The platform is compliant with industry standards and uses encryption to safeguard your data during transmission and storage. You can trust that your documents are secure and confidential.

-

How can airSlate SignNow benefit my business when dealing with Arizona Form 285B?

Using airSlate SignNow can signNowly boost your operational efficiency when dealing with the Arizona Form 285B. The platform not only streamlines the signing process but also helps reduce turnaround times and related costs. This ultimately allows your business to operate more smoothly while ensuring compliance with state requirements.

Get more for Arizona Form 285b

- Ceu tracker template form

- After school registration form

- Jdf 1000 case information sheetdoc

- Credit card authorization form 59102069

- Form 0060 fall protection equipment inspection employers report of injury or occupational disease

- Test correction template form

- Statutory declaration of payment distribution form albertaparksca

- International hip outcome tool ihot 12 pdf form

Find out other Arizona Form 285b

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure