Sba Form Cap 1050 What is it

What is the SBA Form CAP 1050?

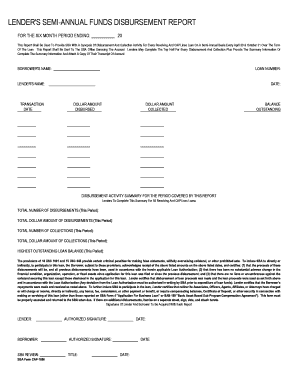

The SBA Form CAP 1050 is a document utilized by the Small Business Administration (SBA) for the purpose of reporting and evaluating the performance of businesses that have received financial assistance through SBA programs. This form is essential for both the SBA and the businesses involved, as it helps track the impact of funding on business growth and job creation. Understanding the purpose and requirements of the CAP 1050 is crucial for compliance and effective reporting.

Steps to Complete the SBA Form CAP 1050

Completing the SBA Form CAP 1050 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including business financials, employment data, and project descriptions. Next, follow these steps:

- Fill out the identification section with the business name, address, and contact information.

- Provide detailed financial information, including revenue, expenses, and net profit.

- Document the number of jobs created or retained as a result of the funding.

- Include any additional information required by the SBA, such as project outcomes or future plans.

- Review the completed form for accuracy before submission.

Legal Use of the SBA Form CAP 1050

The SBA Form CAP 1050 serves a legal purpose by ensuring that businesses receiving federal funds comply with reporting requirements. This form is legally binding, and the information provided must be accurate and truthful. Misrepresentation or failure to submit the form can lead to penalties, including the potential for financial repercussions or loss of funding. Understanding the legal implications of this form is vital for businesses to maintain compliance with SBA regulations.

How to Obtain the SBA Form CAP 1050

The SBA Form CAP 1050 can be obtained directly from the Small Business Administration’s official website or through local SBA offices. Additionally, many business advisory organizations and financial institutions may provide access to the form. It is important to ensure that you are using the most current version of the form to avoid any issues with submission.

Key Elements of the SBA Form CAP 1050

Several key elements must be included in the SBA Form CAP 1050 for it to be considered complete. These elements include:

- Business identification details, such as name and address.

- Financial performance metrics, including revenue and expenses.

- Job creation or retention statistics linked to the funding.

- Project descriptions that outline the purpose and outcomes of the funding.

- Signature of an authorized representative to certify the information provided.

Form Submission Methods

The SBA Form CAP 1050 can be submitted through various methods, depending on the requirements set by the SBA. Common submission methods include:

- Online submission through the SBA’s designated portal.

- Mailing a printed copy of the form to the appropriate SBA office.

- In-person submission at local SBA offices for direct assistance.

Quick guide on how to complete sba form cap 1050 what is it

Effortlessly Prepare Sba Form Cap 1050 What Is It on Any Device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Sba Form Cap 1050 What Is It on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and eSign Sba Form Cap 1050 What Is It with Ease

- Obtain Sba Form Cap 1050 What Is It and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools offered by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Sba Form Cap 1050 What Is It to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba form cap 1050 what is it

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sba form cap 1050?

The sba form cap 1050 is a document required by the Small Business Administration for specific loan applications. It provides essential information about the business's financial status, helping the SBA assess eligibility. Understanding what the sba form cap 1050 is can streamline your loan process.

-

How can airSlate SignNow help with the sba form cap 1050?

airSlate SignNow allows you to easily prepare, sign, and send the sba form cap 1050 electronically. This efficient eSigning process ensures your documents are securely transmitted and saved. With airSlate SignNow, managing the sba form cap 1050 becomes hassle-free.

-

Is there a cost associated with using airSlate SignNow for the sba form cap 1050?

Yes, while airSlate SignNow offers various pricing plans, using it to complete the sba form cap 1050 is cost-effective. The platform's features are priced to fit different business needs, allowing you to choose a plan that optimizes your budget. Affordable solutions make handling the sba form cap 1050 efficient.

-

What are the features of airSlate SignNow when dealing with the sba form cap 1050?

airSlate SignNow provides numerous features for managing the sba form cap 1050, including templates, eSignatures, and document tracking. The intuitive interface helps users create and manage documents effortlessly. With airSlate SignNow's advanced features, dealing with the sba form cap 1050 is simplified and efficient.

-

What are the benefits of using airSlate SignNow for the sba form cap 1050?

Using airSlate SignNow for the sba form cap 1050 streamlines your document workflow, saving time and resources. The electronic signing process enhances security and reduces paper waste, which can be beneficial for environmentally conscious businesses. Overall, the benefits of airSlate SignNow can signNowly ease the burden of handling the sba form cap 1050.

-

Can airSlate SignNow integrate with other platforms for managing the sba form cap 1050?

Yes, airSlate SignNow offers integrations with various popular platforms, enhancing its functionality when handling the sba form cap 1050. These integrations allow for seamless data sharing and document management across different services. This capability makes it easier to manage your sba form cap 1050 as part of your broader business processes.

-

Is airSlate SignNow user-friendly for completing the sba form cap 1050?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to complete the sba form cap 1050. Its straightforward interface guides users through the document preparation and eSigning process, ensuring a smooth experience for everyone, regardless of technical proficiency.

Get more for Sba Form Cap 1050 What Is It

Find out other Sba Form Cap 1050 What Is It

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate