1040wh Form

What is the 1040wh Form

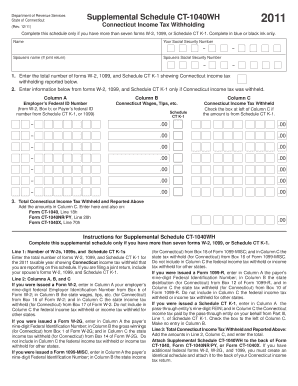

The 1040wh form, officially known as the Connecticut Tax Withholding Certificate, is a crucial document used by employees and employers in Connecticut to determine the appropriate amount of state income tax to withhold from employee wages. This form helps ensure compliance with state tax regulations and enables employees to manage their tax liabilities effectively. By providing accurate information on this form, employees can avoid over-withholding or under-withholding, which can lead to unexpected tax bills or reduced take-home pay.

How to use the 1040wh Form

Using the 1040wh form involves several straightforward steps. First, employees must fill out their personal information, including name, address, and Social Security number. Next, they should indicate their filing status and any allowances they are claiming, which can affect the withholding amount. It is essential to review the instructions carefully to ensure all relevant sections are completed accurately. Once filled out, the form should be submitted to the employer, who will use this information to calculate the correct withholding amount from the employee's paycheck.

Steps to complete the 1040wh Form

Completing the 1040wh form requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including your Social Security number.

- Choose your filing status, which can be single, married, or head of household.

- Determine the number of allowances you wish to claim based on your personal and financial situation.

- Complete any additional sections, such as specifying additional withholding if desired.

- Review the form for accuracy before submitting it to your employer.

Legal use of the 1040wh Form

The legal use of the 1040wh form is governed by state tax laws in Connecticut. This form must be completed accurately to ensure compliance with state withholding requirements. Employers are required to maintain records of the forms submitted by their employees, as these documents can be audited by state tax authorities. Failure to submit a properly completed 1040wh form may result in incorrect withholding, leading to potential penalties for both the employee and employer.

Filing Deadlines / Important Dates

Filing deadlines for the 1040wh form typically align with the start of employment or any changes in an employee's tax situation. Employees should submit the form to their employer as soon as they start a new job or if they experience a significant life event that affects their tax status, such as marriage or the birth of a child. It is advisable to review the form annually, especially before the start of a new tax year, to ensure that withholding amounts remain accurate.

Form Submission Methods (Online / Mail / In-Person)

The 1040wh form can be submitted to employers in various ways, depending on their policies. Many employers accept electronic submissions, allowing employees to fill out and submit the form online. Alternatively, employees may choose to print the form and submit it in person or via mail. It is important to confirm with your employer which submission methods are acceptable to ensure timely processing.

Quick guide on how to complete 1040wh form

Effortlessly Prepare 1040wh Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage 1040wh Form on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The Simplest Way to Edit and eSign 1040wh Form with Ease

- Locate 1040wh Form and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mismanaged files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device of your preference. Edit and eSign 1040wh Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040wh form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CT 1040WH and how is it used?

CT 1040WH is a withholding certificate used by Connecticut residents to claim exemptions from state income taxes. Businesses can utilize this form to ensure accurate tax withholding for employees. Understanding CT 1040WH is essential for compliance and effective payroll management.

-

How can airSlate SignNow assist with submitting CT 1040WH?

AirSlate SignNow offers a seamless platform for electronically signing and submitting the CT 1040WH. With our easy-to-use interface, businesses can efficiently manage their tax documentation. This ensures timely submission of required forms, reducing the likelihood of penalties.

-

What are the features of airSlate SignNow that benefit CT 1040WH processing?

AirSlate SignNow provides features like document templates, automated workflows, and real-time tracking which streamline the CT 1040WH processing. These functionalities enhance efficiency and accuracy in handling tax documents. Additionally, you can store and retrieve forms easily for future reference.

-

Is airSlate SignNow a cost-effective solution for managing CT 1040WH?

Yes, airSlate SignNow is a cost-effective solution for managing CT 1040WH and other documents. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you only pay for what you need. This makes it an affordable option for streamlining your tax documentation process.

-

How does airSlate SignNow integrate with other tools for handling CT 1040WH?

AirSlate SignNow offers integrations with popular business tools such as CRM systems and accounting software to facilitate the management of CT 1040WH. This ensures all your documents are readily accessible within your existing workflows. Such integrations enhance collaboration and efficiency across teams.

-

What benefits does airSlate SignNow provide for eSigning CT 1040WH forms?

Using airSlate SignNow for eSigning CT 1040WH forms offers enhanced security and convenience. Our platform ensures that all electronic signatures are legally binding and compliant with state regulations. This accelerates the signing process, allowing for quicker tax form submission.

-

Can businesses track the status of their CT 1040WH submissions with airSlate SignNow?

Absolutely! AirSlate SignNow allows businesses to track the submission status of CT 1040WH forms in real-time. This feature helps users keep an eye on the progress of their tax documentation, ensuring that they never miss important deadlines.

Get more for 1040wh Form

- How to answer a motion new york state unified court form

- Fillable online preclusion order fax email print pdffiller form

- It is hereby ordered that visitation between form

- Decision after trial 1 form

- Fillable online fca 433 531 a 580 316 drl 75 j form 4 24

- Notice of electronic filing new york state unified court form

- Ny do 2 form

- Llc article 7 the new york state senate form

Find out other 1040wh Form

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter