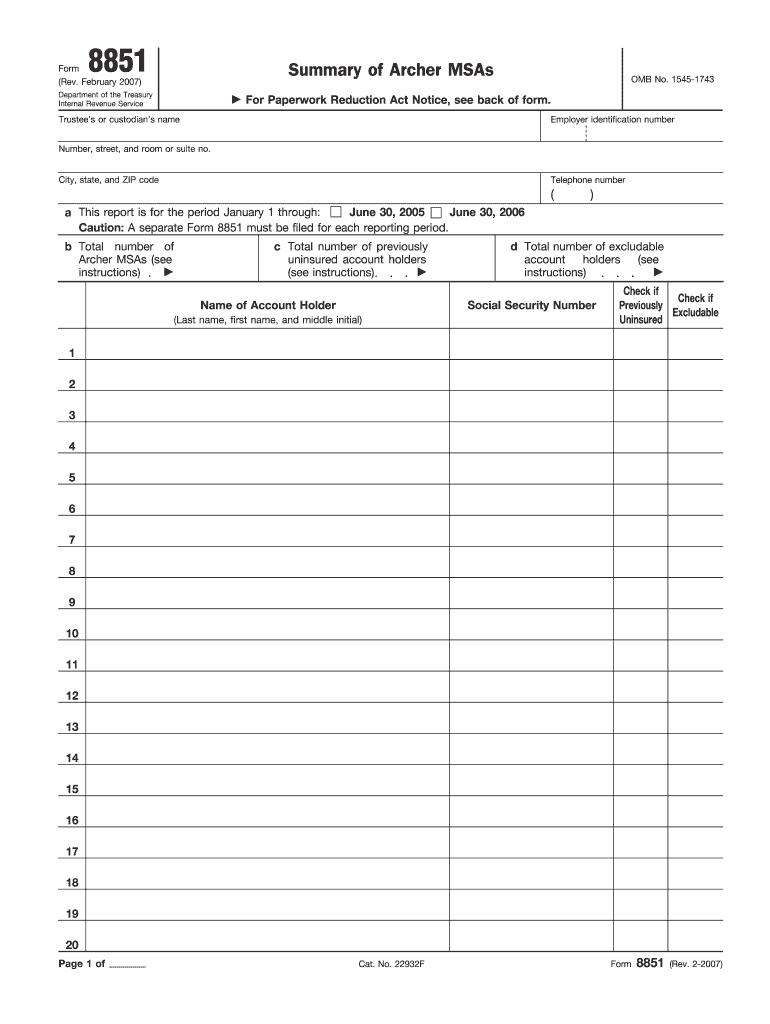

1545 1743 Department of the Treasury Internal Revenue Service Trustee's or Custodian's Name Number, Street, and Room or Suite No Form

Understanding Form 8851

Form 8851, also known as the "A Request for a Taxpayer Identification Number (TIN) for Certain Entities," is a crucial document used in the United States tax system. It is primarily utilized by certain entities to request a TIN from the Internal Revenue Service (IRS). This form is essential for businesses and organizations that need to comply with federal tax regulations and ensure they can properly report income and pay taxes.

Steps to Complete Form 8851

Completing Form 8851 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the legal name of the entity, the type of entity, and the reason for requesting a TIN. Next, fill out the form carefully, ensuring that all fields are completed accurately. It is important to double-check the information for any errors that could delay processing. Once completed, the form should be signed and dated by an authorized individual within the organization. Finally, submit the form to the IRS according to the instructions provided, either electronically or via mail.

Legal Use of Form 8851

Form 8851 serves a vital legal purpose in the tax filing process. It is used to establish a taxpayer identification number, which is necessary for entities to report income, file tax returns, and comply with other federal tax obligations. The information provided on this form must be truthful and accurate, as any discrepancies can lead to penalties or delays in processing. Understanding the legal implications of submitting Form 8851 is essential for maintaining compliance with IRS regulations.

Filing Deadlines for Form 8851

Filing deadlines for Form 8851 can vary depending on the type of entity and the specific tax year. Generally, it is advisable to submit the form as soon as the need for a TIN arises to avoid any potential delays in tax reporting. Entities should be aware of the IRS deadlines for tax filings and ensure that Form 8851 is submitted in a timely manner to facilitate compliance with federal tax laws.

Who Issues Form 8851

The Internal Revenue Service (IRS) is the issuing authority for Form 8851. As the federal agency responsible for tax collection and enforcement, the IRS provides this form to assist entities in obtaining a taxpayer identification number. Understanding the role of the IRS in this process is crucial for entities seeking to navigate the complexities of tax compliance effectively.

Required Documents for Form 8851

When completing Form 8851, certain documents may be required to support the request for a taxpayer identification number. Commonly required documents include proof of the entity's legal formation, such as articles of incorporation or organization, and any relevant identification documents for the individuals authorized to sign the form. Ensuring that all necessary documentation is included can help streamline the processing of Form 8851 and reduce the likelihood of delays.

Quick guide on how to complete form 8851

Effortlessly Set Up form 8851 on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Handle form 8851 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign form 8851 with Ease

- Locate form 8851 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign tool, a process that takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign form 8851 to ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 8851

Create this form in 5 minutes!

How to create an eSignature for the form 8851

How to generate an electronic signature for your 1545 1743 Department Of The Treasury Internal Revenue Service Trustees Or Custodians Name Number Street And Room Or Suite No online

How to create an eSignature for the 1545 1743 Department Of The Treasury Internal Revenue Service Trustees Or Custodians Name Number Street And Room Or Suite No in Chrome

How to make an eSignature for putting it on the 1545 1743 Department Of The Treasury Internal Revenue Service Trustees Or Custodians Name Number Street And Room Or Suite No in Gmail

How to create an eSignature for the 1545 1743 Department Of The Treasury Internal Revenue Service Trustees Or Custodians Name Number Street And Room Or Suite No right from your smartphone

How to generate an eSignature for the 1545 1743 Department Of The Treasury Internal Revenue Service Trustees Or Custodians Name Number Street And Room Or Suite No on iOS

How to generate an electronic signature for the 1545 1743 Department Of The Treasury Internal Revenue Service Trustees Or Custodians Name Number Street And Room Or Suite No on Android OS

People also ask form 8851

-

What is Form 8851 and how is it used?

Form 8851 is a crucial document used by businesses to apply for certain tax benefits, particularly in relation to the Employer's Credit for Paid Family and Medical Leave. With airSlate SignNow, you can easily fill out and eSign Form 8851, ensuring compliance and accuracy, making the filing process much smoother.

-

How can airSlate SignNow help streamline the Form 8851 process?

airSlate SignNow simplifies the Form 8851 submission process by providing an intuitive platform to complete and eSign the document online. Our solution reduces paperwork, eliminates manual errors, and accelerates your submission time, making it ideal for businesses looking to optimize tax form handling.

-

Is there a cost associated with using airSlate SignNow for Form 8851?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can enjoy a cost-effective solution for processing Form 8851 and other documents, with flexible subscription options that fit your budget and requirements.

-

What features does airSlate SignNow offer for managing Form 8851?

airSlate SignNow provides features such as electronic signatures, templates, and team collaboration tools specifically designed for managing Form 8851. These features enhance your workflow efficiency, allowing multiple users to collaborate seamlessly on tax document preparation and signing.

-

Can I integrate airSlate SignNow with other software when handling Form 8851?

Absolutely! airSlate SignNow offers integration with various platforms such as CRMs, cloud storage services, and accounting software. This means you can easily link your Form 8851 workflows with your existing tools, further optimizing your document management process.

-

How secure is the data when using airSlate SignNow for Form 8851?

The security of your data is a top priority at airSlate SignNow. We employ robust encryption measures and secure access protocols to ensure that your Form 8851 and any accompanying documents are protected throughout the eSigning process.

-

Are there any tutorials available for using airSlate SignNow with Form 8851?

Yes, airSlate SignNow provides comprehensive tutorials and resources to help you navigate the process of completing Form 8851. Our user-friendly guides and support team are available to assist you in maximizing the benefits of our platform for all your document needs.

Get more for form 8851

Find out other form 8851

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template