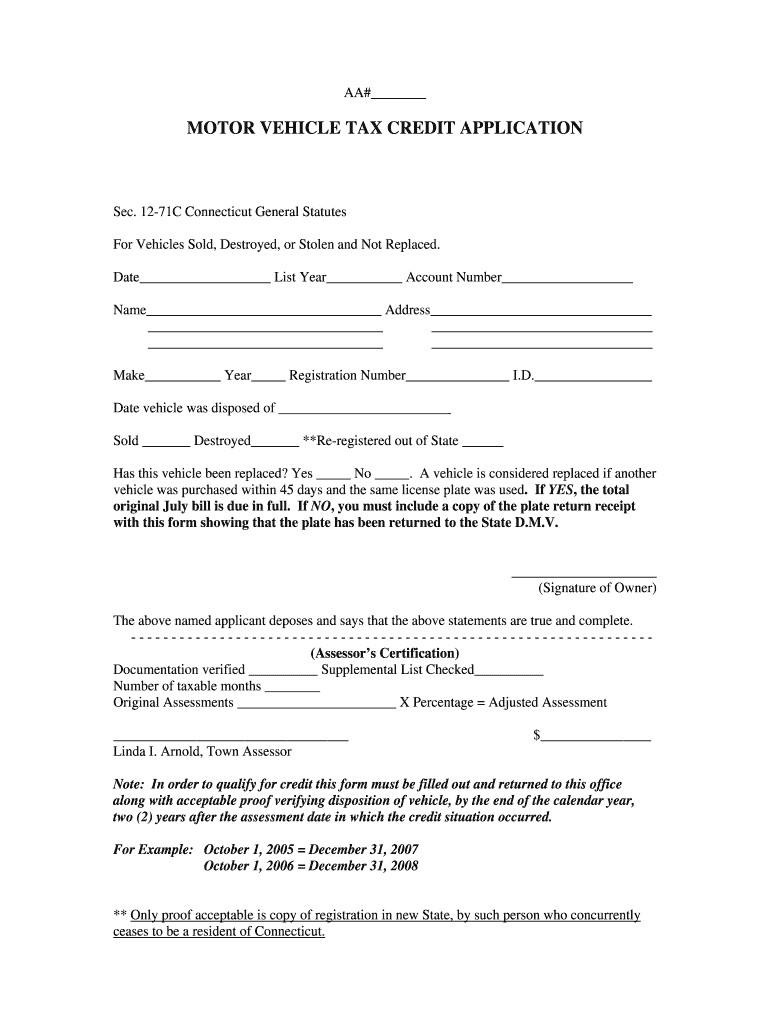

MOTOR VEHICLE TAX CREDIT APPLICATION Town of Farmington Farmington Ct Form

What is the CT vehicle gift form?

The CT vehicle gift form is a legal document used in Connecticut to transfer ownership of a motor vehicle as a gift. This form is essential for ensuring that the transaction is documented properly and that the recipient can register the vehicle in their name. It serves as proof of the gift, which may be required for tax purposes and to avoid any misunderstandings regarding ownership.

Steps to complete the CT vehicle gift form

Completing the CT vehicle gift form involves several straightforward steps:

- Obtain the CT vehicle gift form from the appropriate state agency or online resources.

- Fill in the required information, including the donor's and recipient's names, addresses, and the vehicle's details such as make, model, year, and VIN.

- Indicate that the vehicle is being given as a gift, ensuring to check any relevant boxes on the form.

- Both the donor and recipient must sign the form to validate the transfer.

- Submit the completed form to the local Department of Motor Vehicles (DMV) along with any required documentation.

Legal use of the CT vehicle gift form

The legal use of the CT vehicle gift form is crucial for ensuring that the transfer of ownership is recognized by the state. This form must be signed by both parties to confirm the gift transaction. By completing this form, the donor relinquishes all rights to the vehicle, and the recipient accepts ownership. This legal framework helps prevent disputes regarding ownership and ensures compliance with state regulations.

Eligibility criteria for using the CT vehicle gift form

To use the CT vehicle gift form, certain eligibility criteria must be met:

- The donor must be the legal owner of the vehicle.

- The recipient must be a person or entity eligible to receive the vehicle as a gift.

- Both parties must be willing to complete the form and provide accurate information.

Required documents for the CT vehicle gift form

When submitting the CT vehicle gift form, several documents may be required to complete the process:

- The original title of the vehicle, signed over to the recipient.

- Proof of identity for both the donor and recipient, such as a driver's license.

- Any additional forms required by the local DMV, depending on the specific circumstances of the gift.

Form submission methods for the CT vehicle gift form

The CT vehicle gift form can typically be submitted through various methods:

- In-person at the local Department of Motor Vehicles (DMV) office.

- By mail, if allowed by the local DMV, ensuring all required documents are included.

- Online submission, if the state offers electronic filing options for vehicle registration.

Quick guide on how to complete motor vehicle tax credit application town of farmington farmington ct

Complete MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct on any platform with airSlate SignNow's Android or iOS apps and enhance any document-based procedure today.

How to modify and eSign MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct without breaking a sweat

- Find MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the motor vehicle tax credit application town of farmington farmington ct

How to make an electronic signature for your Motor Vehicle Tax Credit Application Town Of Farmington Farmington Ct online

How to create an electronic signature for the Motor Vehicle Tax Credit Application Town Of Farmington Farmington Ct in Google Chrome

How to create an electronic signature for putting it on the Motor Vehicle Tax Credit Application Town Of Farmington Farmington Ct in Gmail

How to create an eSignature for the Motor Vehicle Tax Credit Application Town Of Farmington Farmington Ct from your mobile device

How to create an eSignature for the Motor Vehicle Tax Credit Application Town Of Farmington Farmington Ct on iOS devices

How to make an electronic signature for the Motor Vehicle Tax Credit Application Town Of Farmington Farmington Ct on Android OS

People also ask

-

What is the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct?

The MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct is a formal request that residents can file to receive tax credits on their vehicles. This application helps taxpayers reduce their overall vehicle tax burden and is essential for eligible residents looking to benefit from local tax incentives.

-

How do I submit the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct?

To submit the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct, you can complete the application online or download a printable version from the Town of Farmington's official website. Once filled out, you can submit it electronically or mail it to the appropriate tax office.

-

Is there a fee associated with the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct?

No, there is no fee to submit the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct. This application is designed to help residents save on their vehicle taxes, so there are no costs involved in applying for the credit.

-

What documents do I need to provide for the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct?

When applying for the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct, you typically need to provide proof of residency, vehicle registration details, and any other documentation that verifies your eligibility for the tax credit. Check the application guidelines for specific requirements.

-

How long does it take to process the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct?

Processing times for the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct can vary, but typically you can expect a response within a few weeks. It's advisable to check with the local tax office for the most current processing times and updates.

-

Can I track the status of my MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct?

Yes, you can track the status of your MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct by contacting the local tax office or checking online if the town offers a tracking system. Keeping your application confirmation handy can help expedite the inquiry.

-

What are the benefits of the MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct?

The MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct provides signNow financial relief by reducing the amount of vehicle tax you owe. This tax credit is beneficial for residents looking to lower their monthly expenses and enhance their overall financial well-being.

Get more for MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct

Find out other MOTOR VEHICLE TAX CREDIT APPLICATION Town Of Farmington Farmington ct

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement