Nj 1040 Schedule a Form

What is the NJ 1040 Schedule A

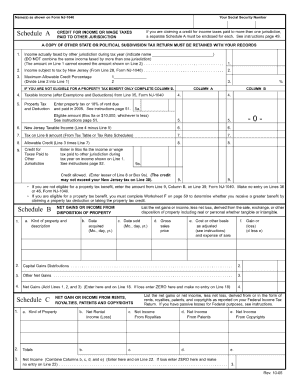

The NJ 1040 Schedule A is a form used by residents of New Jersey to report itemized deductions on their state income tax return. This form allows taxpayers to detail specific expenses that can reduce their taxable income, potentially resulting in a lower tax liability. Common deductions reported on this schedule include medical expenses, mortgage interest, property taxes, and charitable contributions. Understanding the NJ 1040 Schedule A is essential for maximizing tax benefits and ensuring compliance with state tax regulations.

Steps to complete the NJ 1040 Schedule A

Completing the NJ 1040 Schedule A involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and statements related to deductible expenses. Next, fill out the form by entering your total itemized deductions in the appropriate sections. It is important to provide accurate figures and to include any required supporting documentation. After completing the form, review it carefully for errors before submitting it with your NJ 1040 tax return. This thorough approach helps to avoid delays and potential issues with your tax filing.

State-specific rules for the NJ 1040 Schedule A

New Jersey has specific rules that govern the use of the NJ 1040 Schedule A. Unlike federal tax laws, New Jersey may have different eligibility criteria for certain deductions. For instance, some expenses that are deductible on federal returns may not be allowed at the state level. Additionally, New Jersey has its own limits and thresholds for various deductions, which can affect the total amount you can claim. Familiarizing yourself with these state-specific rules is crucial for accurate reporting and to take full advantage of available deductions.

Legal use of the NJ 1040 Schedule A

The legal use of the NJ 1040 Schedule A requires compliance with state tax laws and regulations. To ensure that the form is legally valid, taxpayers must accurately report all itemized deductions and maintain supporting documentation. This documentation should be retained for at least four years, as the state may request it during an audit. Utilizing a reliable eSignature solution can further enhance the legal standing of your completed form, ensuring that it is securely signed and submitted in accordance with New Jersey's eSignature laws.

Examples of using the NJ 1040 Schedule A

Examples of using the NJ 1040 Schedule A can help clarify its application in various situations. For instance, a homeowner may use this form to deduct mortgage interest and property taxes, significantly lowering their taxable income. Similarly, a taxpayer who has incurred substantial medical expenses may find it beneficial to itemize these costs on the NJ 1040 Schedule A. Each individual's financial situation can vary, making it important to assess which deductions apply to you and how they can be leveraged for tax savings.

Filing Deadlines / Important Dates

Filing deadlines for the NJ 1040 Schedule A align with the overall New Jersey state income tax return deadlines. Typically, the due date for filing your state tax return is April fifteenth, unless it falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. It is essential to be aware of these deadlines to avoid penalties and interest on any unpaid taxes. Taxpayers should also consider any extensions that may apply, which can provide additional time to file the NJ 1040 Schedule A and the accompanying return.

Quick guide on how to complete nj 1040 schedule a 262737

Complete Nj 1040 Schedule A effortlessly on any device

Online document management has become widely adopted by both businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Nj 1040 Schedule A on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Nj 1040 Schedule A seamlessly

- Obtain Nj 1040 Schedule A and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Nj 1040 Schedule A and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 schedule a 262737

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nj 1040 schedule a used for?

The nj 1040 schedule a is used to report itemized deductions for New Jersey state income tax. It allows taxpayers to detail various deductions related to property taxes, medical expenses, and charitable contributions, potentially lowering their taxable income. Understanding how to properly fill out this schedule can signNowly impact your tax refund.

-

How can airSlate SignNow help me with my nj 1040 schedule a?

airSlate SignNow simplifies the document signing process, allowing you to easily eSign your nj 1040 schedule a and keep track of relevant tax documents in one place. Our platform is user-friendly and ensures that all necessary parties can review and sign your forms securely. This streamlines your tax filing experience.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers several features for managing tax documents, including cloud storage, real-time collaboration, and eSignature capabilities. You can easily create, edit, and send your nj 1040 schedule a and other tax forms. These features make document management more efficient and effective during tax season.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing tax documents like the nj 1040 schedule a. We offer flexible pricing plans that cater to various business sizes and needs, ensuring you get high-quality services without breaking the bank. This affordability allows you to focus on maximizing your tax benefits.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software solutions, making it easier for you to manage your nj 1040 schedule a alongside your financial data. This integration helps streamline your processes and minimizes the risk of errors when filing your taxes or creating financial statements.

-

How does airSlate SignNow ensure the security of my nj 1040 schedule a?

airSlate SignNow prioritizes security through advanced encryption and compliance with industry standards. All your documents, including the nj 1040 schedule a, are securely stored and can only be accessed by authorized users. This security measure gives you peace of mind when handling sensitive tax information.

-

What benefits does eSigning my nj 1040 schedule a offer?

eSigning your nj 1040 schedule a via airSlate SignNow streamlines the signing process, making it faster and more convenient. You won't need to print, sign, and scan documents anymore; everything is done electronically. This saves time, reduces paper waste, and allows for a more efficient tax filing experience.

Get more for Nj 1040 Schedule A

- Badge application form

- Za effingham secondary school optima tuition saturdays form

- Ma dana farber cancer institute medical information request form

- Tomorrows scholar 165720 form

- Babbel model withdrawal form

- Pg air niugini international air passenger travel form i aptf

- Quinebaug valley community college refund appeal form

- Quinebaug valley community college authorization to release information ferpa

Find out other Nj 1040 Schedule A

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter