Guidelines for Filing a Group Form 540NR California Ftb Ca

What is the Guidelines For Filing A Group Form 540NR California Ftb Ca

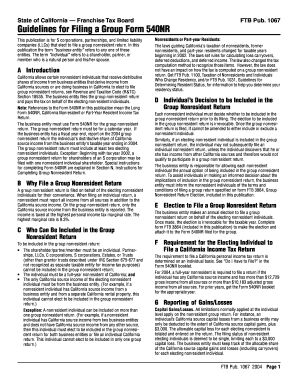

The Guidelines for Filing a Group Form 540NR California FTB CA is a comprehensive set of instructions designed for individuals and entities filing a non-resident tax return in California. This form is particularly relevant for those who earn income in California but reside in another state. The guidelines outline eligibility criteria, required documentation, and specific procedures to ensure compliance with state tax regulations.

Steps to complete the Guidelines For Filing A Group Form 540NR California Ftb Ca

Completing the Group Form 540NR involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Determine your filing status and eligibility based on your residency and income sources.

- Fill out the Group Form 540NR accurately, ensuring all income and deductions are reported.

- Review the form for accuracy, checking calculations and ensuring all required signatures are included.

- Submit the completed form either online through the California Franchise Tax Board's website or by mailing it to the appropriate address.

Required Documents

When filing the Group Form 540NR, certain documents are essential to support your income claims and deductions. These include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits you plan to claim.

- Identification numbers, such as Social Security numbers for all individuals included in the group filing.

Legal use of the Guidelines For Filing A Group Form 540NR California Ftb Ca

The legal use of the Guidelines for Filing a Group Form 540NR is critical for ensuring that the filing meets California tax laws. Compliance with these guidelines helps avoid penalties and legal issues. The form must be signed by all parties involved, and electronic signatures are acceptable if they meet the requirements set forth by the state. Understanding the legal implications of the information provided is essential to maintain the integrity of the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Group Form 540NR are crucial for compliance. Typically, the deadline aligns with the federal tax filing date, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

There are various methods for submitting the Group Form 540NR:

- Online: Filers can submit the form electronically through the California Franchise Tax Board's e-file system.

- Mail: Completed forms can be mailed to the designated address provided in the filing instructions.

- In-Person: Some taxpayers may choose to file in person at local tax offices, though this option may be limited.

Quick guide on how to complete guidelines for filing a group form 540nr california ftb ca

Effortlessly Prepare Guidelines For Filing A Group Form 540NR California Ftb Ca on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly option compared to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your paperwork quickly without delays. Handle Guidelines For Filing A Group Form 540NR California Ftb Ca on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Guidelines For Filing A Group Form 540NR California Ftb Ca with Ease

- Find Guidelines For Filing A Group Form 540NR California Ftb Ca and click on Access Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of the documents or obscure sensitive information with tools offered by airSlate SignNow specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes only moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Finish button to preserve your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Guidelines For Filing A Group Form 540NR California Ftb Ca and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the guidelines for filing a group form 540nr california ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Guidelines For Filing A Group Form 540NR California Ftb Ca?

The Guidelines For Filing A Group Form 540NR California Ftb Ca provide crucial information about the requirements and procedures for submitting a Group Form 540NR. This includes eligibility criteria, necessary documentation, and specific instructions for different types of filers. It's essential to follow these guidelines to ensure compliance and avoid potential penalties.

-

What features does airSlate SignNow offer for signing Group Form 540NR?

airSlate SignNow offers a variety of features that streamline the signing process for Group Form 540NR. You'll benefit from easy document upload, customizable signing workflows, and robust eSignature capabilities. These features help ensure that your Group Form 540NR is signed and submitted efficiently.

-

How can I efficiently collaborate on my Group Form 540NR using airSlate SignNow?

With airSlate SignNow, you can easily collaborate on your Group Form 540NR by inviting team members to review and sign the document. The platform allows for real-time tracking of document statuses and automatic notifications, ensuring that everyone stays informed. This collaborative approach simplifies the overall filing process.

-

Is airSlate SignNow a cost-effective solution for filing Group Form 540NR?

Yes, airSlate SignNow is designed to be a cost-effective solution for filing Group Form 540NR. With different pricing plans tailored to your needs, you can choose the one that best fits your budget. The savings from reduced paper use and faster processing times further enhance the value of using airSlate SignNow.

-

Are there any integrations available for processing Group Form 540NR with airSlate SignNow?

airSlate SignNow offers a range of integrations with popular platforms and tools that can assist in processing Group Form 540NR. These integrations make it easier to import data and manage documents directly from your existing workflows. By streamlining these processes, you can save time and improve efficiency.

-

What are the benefits of using airSlate SignNow for filing Group Form 540NR?

Using airSlate SignNow for filing Group Form 540NR provides several benefits, including faster turnaround times, enhanced security through encrypted signatures, and easy access to signed documents. Furthermore, the intuitive interface ensures that users of all expertise levels can navigate the platform with ease. This efficiency is particularly valuable during tax season.

-

Can airSlate SignNow help me keep track of my Group Form 540NR filings?

Yes, airSlate SignNow includes features that enable you to keep track of your Group Form 540NR filings effectively. You can monitor who has signed the document, view timestamps, and access an audit trail for compliance purposes. This comprehensive tracking helps to ensure transparency and accountability throughout the filing process.

Get more for Guidelines For Filing A Group Form 540NR California Ftb Ca

- Printable funeral pre planning worksheet form

- Mnp form

- Form ct 12fpdffillercom

- Canada child passport application form

- Electrical license renewal cayman islands planning department form

- Gannon university affidavit of support 40850765 form

- Supports intensity scale interview and profile form

- Euro trck simulator 2 full p2p form

Find out other Guidelines For Filing A Group Form 540NR California Ftb Ca

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document