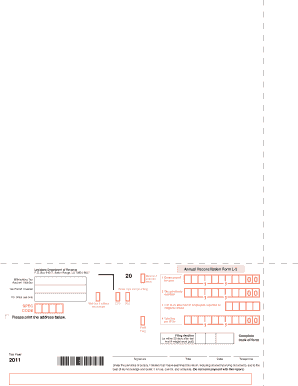

Form L 3

What is the Form L 3

The Louisiana Form L 3 is a state-specific document used primarily for tax purposes. It is essential for individuals and businesses operating within Louisiana to report their income accurately. This form captures various financial details and is crucial for ensuring compliance with state tax regulations. Understanding its purpose is vital for taxpayers to avoid penalties and ensure proper filing.

How to use the Form L 3

Using the Louisiana Form L 3 involves several steps. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form accurately, ensuring that all information is complete and correct. It is important to review the form for any errors before submission. Once completed, the form can be submitted online, by mail, or in person, depending on the preferred filing method.

Steps to complete the Form L 3

Completing the Louisiana Form L 3 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts.

- Begin filling out the form, starting with personal identification information.

- Report income from all sources, ensuring to include any deductions or credits applicable.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate it.

Legal use of the Form L 3

The Louisiana Form L 3 must be used in compliance with state tax laws to be considered legally valid. This includes ensuring that all information reported is truthful and accurate. Failure to comply with these regulations can lead to penalties, including fines or legal action. Utilizing a reliable electronic signature service can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Louisiana Form L 3. Typically, forms must be submitted by April 15 for individual taxpayers. Businesses may have different deadlines depending on their fiscal year. Staying informed about these dates helps avoid late fees and ensures compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Louisiana Form L 3 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Louisiana Department of Revenue website.

- Mailing the completed form to the appropriate tax office.

- Submitting the form in person at designated tax offices.

Key elements of the Form L 3

Understanding the key elements of the Louisiana Form L 3 is essential for accurate completion. Important sections include:

- Personal identification information, such as name and address.

- Income details from various sources.

- Deductions and credits that apply to the taxpayer.

- Signature section to validate the form.

Quick guide on how to complete form l 3

Complete Form L 3 seamlessly on any device

Digital document management has gained traction among enterprises and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents promptly without delays. Manage Form L 3 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The most efficient method to modify and eSign Form L 3 effortlessly

- Find Form L 3 and then click Get Form to begin.

- Make use of the tools we provide to finish your form.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form L 3 and assure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form l 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana Form L 3?

The Louisiana Form L 3 is a tax form used for reporting and payment purposes within the state of Louisiana. It is essential for businesses that need to comply with state tax regulations. Completing the Louisiana Form L 3 accurately ensures that your business stays compliant with state laws.

-

How can airSlate SignNow assist with filling out the Louisiana Form L 3?

airSlate SignNow provides an intuitive platform that simplifies the process of completing the Louisiana Form L 3. Our electronic signing and document management tools enable you to fill out, sign, and send the form seamlessly. This not only saves time but also ensures that you meet all necessary compliance requirements.

-

Is there a cost associated with using airSlate SignNow for the Louisiana Form L 3?

While airSlate SignNow offers various pricing plans, our basic features suitable for filling out the Louisiana Form L 3 are available at a competitive rate. Depending on your business needs, you can choose a plan that provides the necessary tools while optimizing costs. Visit our pricing page to explore the available options.

-

What features does airSlate SignNow provide for eSigning the Louisiana Form L 3?

With airSlate SignNow, users can enjoy features like customizable templates, secure cloud storage, and an intuitive eSigning process for the Louisiana Form L 3. Our platform allows multiple signers to electronically sign the document, ensuring that your form is completed promptly without hassles.

-

Can I integrate airSlate SignNow with other software for managing the Louisiana Form L 3?

Yes, airSlate SignNow offers various integrations with popular business tools, making it easier to manage the Louisiana Form L 3 alongside your other applications. By integrating with accounting and document management software, you can streamline your workflow and enhance operational efficiency.

-

What are the benefits of using airSlate SignNow for Louisiana Form L 3 submissions?

Using airSlate SignNow for Louisiana Form L 3 submissions provides numerous benefits, including improved accuracy, time savings, and enhanced security. Our platform minimizes the chances of errors during form completion and ensures that your documents are securely stored and accessible. This enables smoother and more efficient tax submissions.

-

Is airSlate SignNow compliant with Louisiana state regulations for Form L 3?

Absolutely, airSlate SignNow is designed to meet compliance standards dictated by Louisiana state regulations. We ensure that all document management processes adhere to legal requirements, including the handling of the Louisiana Form L 3. Using our platform provides confidence that your submissions are compliant and secure.

Get more for Form L 3

- Descriptionemployment agreement thomas obenhuber form

- Employee leasing company address city state zip attention form

- Matt stepovich president ampamp chief executive officer linkedin form

- Employment agreement regina wiedemann form

- David t craig 941 calle mejia 509 santa fe canon cat form

- Employmentagreement 2 employment agreement this form

- Employment agreement between the company and merouane bencherif form

- Form of stock option agreement early exercise

Find out other Form L 3

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed