Pulaski County Lodging Tax Form Pulaski County Tourism Bureau Visitpulaskicounty

What is the Pulaski County Lodging Tax Form?

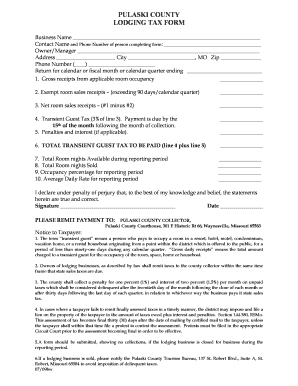

The Pulaski County Lodging Tax Form is a document required by the Pulaski County Tourism Bureau for the collection of lodging taxes from accommodations within the county. This form is essential for lodging providers, such as hotels and motels, to report their taxable income and remit the appropriate taxes to the county. The funds collected from this tax are typically used to promote tourism and support local attractions, benefiting the community as a whole.

How to Obtain the Pulaski County Lodging Tax Form

To obtain the Pulaski County Lodging Tax Form, lodging providers can visit the Pulaski County Tourism Bureau's official website or contact their office directly. The form may be available for download in a digital format, allowing for easy access and completion. Additionally, physical copies of the form may be available at local government offices or tourism information centers.

Steps to Complete the Pulaski County Lodging Tax Form

Completing the Pulaski County Lodging Tax Form involves several key steps:

- Gather necessary financial records, including total lodging revenue and tax-exempt sales.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Calculate the total lodging tax owed based on the applicable tax rate.

- Review the form for accuracy and completeness before submission.

Legal Use of the Pulaski County Lodging Tax Form

The Pulaski County Lodging Tax Form is legally binding when completed correctly and submitted to the appropriate authorities. Compliance with local tax laws is crucial, as failure to file or remit the correct taxes can result in penalties. It is important for lodging providers to understand their obligations under local regulations to avoid legal issues.

Key Elements of the Pulaski County Lodging Tax Form

Key elements of the Pulaski County Lodging Tax Form typically include:

- Identification of the lodging provider, including name and address.

- Reporting period for the lodging tax.

- Total gross receipts from lodging services.

- Calculation of the lodging tax due.

- Signature of the authorized representative of the lodging provider.

Form Submission Methods

The Pulaski County Lodging Tax Form can generally be submitted through various methods, including:

- Online submission through the Pulaski County Tourism Bureau's website, if available.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local government offices or tourism bureau locations.

Quick guide on how to complete pulaski county lodging tax form pulaski county tourism bureau visitpulaskicounty

Complete Pulaski County Lodging Tax Form Pulaski County Tourism Bureau Visitpulaskicounty effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Pulaski County Lodging Tax Form Pulaski County Tourism Bureau Visitpulaskicounty on any platform using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and eSign Pulaski County Lodging Tax Form Pulaski County Tourism Bureau Visitpulaskicounty without breaking a sweat

- Find Pulaski County Lodging Tax Form Pulaski County Tourism Bureau Visitpulaskicounty and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Pulaski County Lodging Tax Form Pulaski County Tourism Bureau Visitpulaskicounty and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pulaski county lodging tax form pulaski county tourism bureau visitpulaskicounty

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pulaski County Lodging Tax Form?

The Pulaski County Lodging Tax Form is a document that lodging providers must complete to report and remit lodging taxes collected in Pulaski County. This form is essential for compliance with local regulations, helping businesses contribute to the Pulaski County Tourism Bureau initiatives. By properly managing your lodging tax obligations, you support the marketing and promotion of tourism in the area.

-

How do I obtain the Pulaski County Lodging Tax Form?

You can easily obtain the Pulaski County Lodging Tax Form through the Pulaski County Tourism Bureau's website, VisitPulaskiCounty. They provide downloadable versions of the form along with guidelines for filling it out. This ensures that all lodging providers have access to the most current information and resources.

-

What are the benefits of using airSlate SignNow for submitting the Pulaski County Lodging Tax Form?

Using airSlate SignNow to submit your Pulaski County Lodging Tax Form streamlines the e-signature process, making it faster and more secure. Our solution eliminates paperwork inefficiencies, allowing you to manage your tax documents from anywhere. Ultimately, this helps you stay compliant with the Pulaski County Tourism Bureau requirements without the hassle.

-

Are there any fees associated with filing the Pulaski County Lodging Tax Form?

While the Pulaski County Lodging Tax Form itself may not have a filing fee, lodging providers must pay the lodging tax based on their collected revenue. It's essential to review the guidelines provided by the Pulaski County Tourism Bureau to understand any potential costs associated with the submission process. AirSlate SignNow offers cost-effective solutions to manage your documentation efficiently.

-

How often do I need to submit the Pulaski County Lodging Tax Form?

The Pulaski County Lodging Tax Form typically needs to be submitted quarterly, although this may vary based on specific regulations from the Pulaski County Tourism Bureau. Ensure you check the guidelines to keep track of important deadlines. Regular submission helps maintain compliance and supports the growth of local tourism.

-

Can I integrate airSlate SignNow with other tools to manage my lodging tax forms?

Yes, airSlate SignNow can easily integrate with various tools and platforms to help you manage your lodging tax forms more efficiently. This integration facilitates data sharing and ensures that you can track submissions related to the Pulaski County Lodging Tax Form. By coordinating these efforts with the Pulaski County Tourism Bureau, you streamline tax compliance.

-

What features does airSlate SignNow offer for e-signing documents like the Pulaski County Lodging Tax Form?

AirSlate SignNow offers a range of features such as customizable templates, real-time tracking, and secure cloud storage for documents. These features enable you to efficiently e-sign and manage the Pulaski County Lodging Tax Form within a user-friendly platform. Plus, our solution enhances security and ensures compliance with the standards set by the Pulaski County Tourism Bureau.

Get more for Pulaski County Lodging Tax Form Pulaski County Tourism Bureau Visitpulaskicounty

Find out other Pulaski County Lodging Tax Form Pulaski County Tourism Bureau Visitpulaskicounty

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter