Ca Form 3539 Instructions

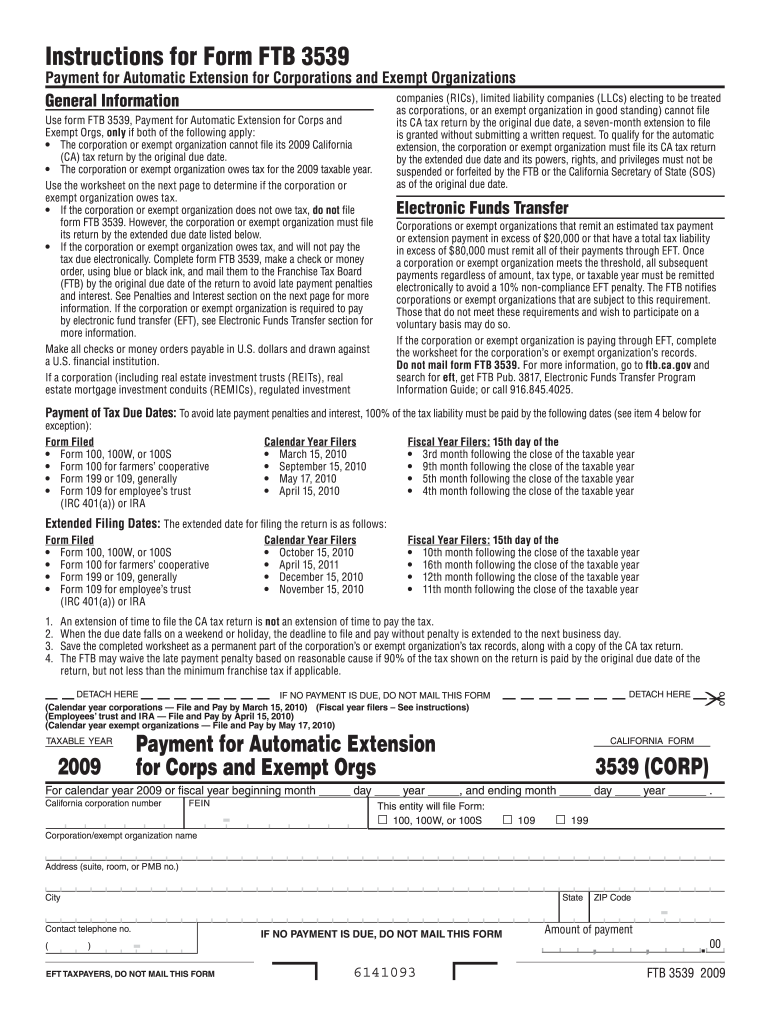

What is the California Form 3539?

The California Form 3539, also known as the FTB Form 3539, is a tax form used by businesses and individuals in California to request an extension for filing their state income tax return. This form is particularly important for those who may not be able to meet the standard filing deadline. By submitting Form 3539, taxpayers can avoid penalties associated with late filing while ensuring they have adequate time to prepare their returns accurately.

Steps to Complete the California Form 3539

Completing the California Form 3539 involves several straightforward steps:

- Gather Required Information: Collect all necessary financial documents, including income statements and previous tax returns.

- Fill Out the Form: Provide your personal details, including your name, address, and Social Security number or Employer Identification Number.

- Calculate the Estimated Tax: Estimate your tax liability for the year to ensure you submit the correct payment with the form.

- Review the Form: Double-check all entries for accuracy to avoid delays or issues.

- Submit the Form: Send the completed Form 3539 to the appropriate address provided in the instructions.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the California Form 3539. Typically, the form must be submitted by the original due date of your tax return. For most individual taxpayers, this date is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates helps prevent penalties and ensures compliance with state tax laws.

Legal Use of the California Form 3539

The California Form 3539 is legally binding when filled out and submitted correctly. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the California Franchise Tax Board (FTB). This includes providing accurate information and submitting the form on time. Additionally, using a secure electronic signature solution, like signNow, can enhance the legitimacy of the submission, ensuring compliance with eSignature laws.

Key Elements of the California Form 3539

Several key elements are essential when completing the California Form 3539:

- Taxpayer Identification: Accurate identification of the taxpayer is crucial, including Social Security numbers or Employer Identification Numbers.

- Estimated Tax Payment: Taxpayers must calculate and include their estimated tax payment to avoid penalties.

- Signature: A signature, whether electronic or handwritten, is necessary to validate the form.

- Submission Method: Understanding how to submit the form, whether electronically or by mail, is essential for compliance.

Who Issues the Form?

The California Form 3539 is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering the state's personal income tax and corporate tax programs. Taxpayers can find the form and its instructions on the FTB's official website, ensuring they have the most current version and guidelines for completion.

Quick guide on how to complete ca form 3539 instructions

Effortlessly prepare Ca Form 3539 Instructions on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and electronically sign your documents quickly without waiting. Manage Ca Form 3539 Instructions on any gadget using airSlate SignNow apps for Android or iOS and streamline any document-related operations today.

Steps to adjust and eSign Ca Form 3539 Instructions effortlessly

- Obtain Ca Form 3539 Instructions and click on Get Form to commence.

- Utilize the features we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to store your modifications.

- Choose your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred gadget. Adjust and eSign Ca Form 3539 Instructions and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 3539 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3539 and why is it important?

Form 3539 is a critical document used for specific tax-related purposes. It is essential for businesses to understand its requirements to ensure compliance with tax regulations. Using airSlate SignNow to eSign and send form 3539 simplifies the process and helps avoid delays in submissions.

-

How does airSlate SignNow facilitate the completion of form 3539?

airSlate SignNow provides an intuitive interface that allows users to easily fill out and eSign form 3539. Features such as templates and document tracking ensure that you can handle this important form efficiently. The digital solution minimizes errors and speeds up the paperwork process.

-

Can I integrate airSlate SignNow with other applications for managing form 3539?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow for managing form 3539. You can connect it with platforms like Google Drive, Salesforce, and more to streamline document management. This connectivity allows for seamless document sharing and processing.

-

What is the pricing structure for airSlate SignNow when using it for form 3539?

airSlate SignNow offers several pricing plans tailored to fit the needs of different businesses. Whether you are a small business or a larger enterprise, you can find a cost-effective plan that allows you to eSign and manage form 3539 efficiently. Explore the various options to find the perfect fit for your needs.

-

What are the benefits of using airSlate SignNow for form 3539?

Using airSlate SignNow for form 3539 provides numerous benefits, including faster processing, reduced paper usage, and enhanced security. The platform ensures that all data is encrypted and compliant with regulations, giving you peace of mind. Plus, the user-friendly interface makes it easy for everyone on your team to adopt.

-

Is there customer support available for using airSlate SignNow with form 3539?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions related to form 3539. You can access resources such as tutorials, FAQs, and live support to ensure you have all the help you need. This support is key to making your document management process smooth.

-

Can multiple users collaborate on form 3539 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 3539 easily. This feature enables teams to work together in real-time, ensuring that everyone is on the same page. Collaboration features such as comments and notifications streamline the eSigning process.

Get more for Ca Form 3539 Instructions

- A silent partner is an form

- Office of the pardon attorney form

- Uslegal pamphlet on homestead filingus legal forms

- Trespass to land legal definition of trespass to land form

- Uslegal pamphlet on modus operandius legal forms

- Five ready to use news release templates prco news form

- Press releases investor relationsblue apron holdings inc form

- Sample new employee press release form

Find out other Ca Form 3539 Instructions

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online