Pasco County Tangible Tax Form 2015-2026

What is the Pasco County Tangible Tax Form

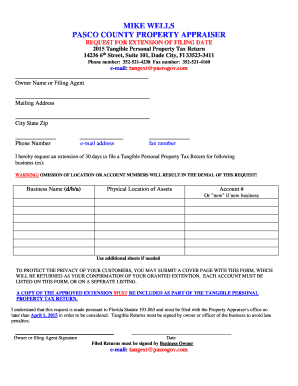

The Pasco County Tangible Tax Form is a document used to report tangible personal property owned by businesses and individuals in Pasco County, Florida. This form is essential for assessing the value of personal property, which may include items like machinery, equipment, and furniture. The information provided on this form helps the Pasco County Property Appraiser determine the appropriate tax assessment for the property. Accurate completion of the form is crucial for compliance with local tax regulations.

How to use the Pasco County Tangible Tax Form

Using the Pasco County Tangible Tax Form involves several key steps. First, gather all necessary information about the tangible personal property, including descriptions, purchase dates, and values. Next, accurately fill out the form with this information, ensuring that all details are complete and correct. Once completed, the form must be submitted to the Pasco County Property Appraiser's office by the specified deadline. Utilizing digital tools can streamline this process, allowing for easier completion and submission.

Steps to complete the Pasco County Tangible Tax Form

Completing the Pasco County Tangible Tax Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather documentation regarding all tangible personal property owned.

- List each item, including its description, purchase date, and estimated value.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where required.

- Submit the form by mail, in person, or electronically, as per the guidelines provided by the Pasco County Property Appraiser.

Legal use of the Pasco County Tangible Tax Form

The Pasco County Tangible Tax Form is legally binding when completed and submitted correctly. It serves as a formal declaration of personal property ownership and value, which is necessary for tax assessment purposes. Compliance with local tax laws is essential to avoid penalties. The form must be filled out truthfully, as any misrepresentation can lead to legal consequences, including fines or additional taxes owed.

Filing Deadlines / Important Dates

Filing deadlines for the Pasco County Tangible Tax Form are crucial for compliance. Typically, the form must be submitted by April first each year to ensure timely assessment for the upcoming tax year. It is important to stay informed about any changes to deadlines, as late submissions may result in penalties or loss of eligibility for certain exemptions. Checking the Pasco County Property Appraiser's website or contacting their office can provide the most current information on important dates.

Required Documents

When completing the Pasco County Tangible Tax Form, certain documents may be required to support the information provided. These documents can include:

- Purchase invoices or receipts for tangible personal property.

- Previous tax returns that include personal property schedules.

- Any relevant financial statements or asset valuations.

Having these documents ready can facilitate the completion of the form and help ensure accuracy in reporting.

Quick guide on how to complete pasco county tangible tax form

Complete Pasco County Tangible Tax Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Pasco County Tangible Tax Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-centered process today.

The easiest way to modify and eSign Pasco County Tangible Tax Form with ease

- Find Pasco County Tangible Tax Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign Pasco County Tangible Tax Form and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pasco county tangible tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Pasco County tangible tax?

Pasco County tangible tax is a property tax assessed on tangible personal property owned by businesses, including equipment and machinery. This tax is essential for local funding and is calculated based on the assessed value of the property. Understanding how this tax applies can help business owners plan their finances more effectively.

-

How can airSlate SignNow assist with Pasco County tangible tax documents?

airSlate SignNow streamlines the process of sending and signing documents related to Pasco County tangible tax. With our electronic signature solution, businesses can quickly get tax forms, applications, and payment authorizations signed, reducing turnaround times. This efficiency helps ensure compliance with local tax requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs. Depending on the features and level of usage required for handling activities like Pasco County tangible tax documentation, businesses can select a plan that fits their budget. Our competitive pricing ensures that affordability doesn't compromise functionality.

-

What features does airSlate SignNow offer for managing tangible tax documentation?

Our platform provides features such as customizable templates, automated reminders, and audit trails specifically beneficial for handling Pasco County tangible tax documents. These tools make it easier for businesses to manage their tax-related paperwork and ensure timely submissions. Plus, our user-friendly interface makes document management simple and efficient.

-

Are there any benefits to using airSlate SignNow for tangible tax filing in Pasco County?

By using airSlate SignNow for Pasco County tangible tax filing, businesses enjoy enhanced efficiency, reduced errors, and improved compliance. Our platform helps eliminate paperwork hassles, allowing users to focus on their core operations. Many clients find that this leads to faster processing of tax forms and improved organizational productivity.

-

Can airSlate SignNow integrate with other accounting software for tangible tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting and financial software, aiding in the management of Pasco County tangible tax documents. This integration streamlines data sharing and allows for efficient handling of financial records. Users can connect their existing systems to ensure comprehensive oversight of their tax obligations.

-

Is it secure to use airSlate SignNow for signing Pasco County tangible tax documents?

Absolutely. airSlate SignNow prioritizes security and compliance, ensuring that all documents related to Pasco County tangible tax are protected. We utilize advanced encryption protocols and adhere to stringent guidelines, giving users peace of mind while managing sensitive tax documentation online.

Get more for Pasco County Tangible Tax Form

- Language access national center for state courts form

- Case transfer form

- Frequently asked questions for attorneysnebraska judicial branch form

- 27 rev form

- Master forms list nebraska judicial branch nebraskagov

- Dc 1941 new 0817 form

- Protective orderwelcome to legal aid services of oklahomas guide form

- Instructions for completing the protection order praecipe form

Find out other Pasco County Tangible Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors