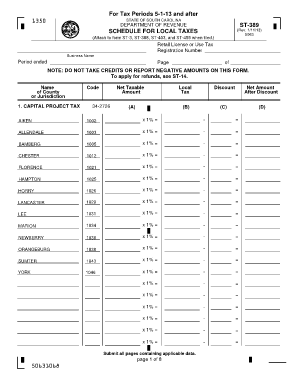

For Tax Periods 5 1 13 and After STATE of SOUTH CAROLINA 1350 DEPARTMENT of REVENUE ST 389 SCHEDULE for LOCAL TAXES Rev Sctax Form

What is the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax

The For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax is a specific form used by taxpayers in South Carolina to report local taxes. This form is essential for ensuring compliance with state tax regulations and accurately reflecting local tax obligations. It is particularly relevant for businesses and individuals who need to detail their local tax contributions for the specified tax periods.

Steps to complete the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax

Completing the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out the form with accurate information regarding your local tax liabilities.

- Review the completed form for any errors or omissions.

- Sign the form electronically or physically, ensuring compliance with eSignature regulations.

- Submit the form by the designated deadline through the appropriate channels.

Legal use of the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax

The legal use of the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax is governed by state tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted within the required timeframe. Utilizing a reliable eSignature solution can enhance the legal validity of the document, as it provides a digital certificate that verifies the signer's identity and intent.

Key elements of the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax

Several key elements are crucial for understanding the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax:

- Tax Periods: Specifies the time frame for which local taxes are being reported.

- Taxpayer Information: Requires accurate details about the individual or business filing the form.

- Local Tax Calculations: Involves calculations for various local taxes owed based on income and other factors.

- Signature Section: Must be signed to validate the form, either electronically or by hand.

How to obtain the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax

To obtain the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax, taxpayers can visit the official South Carolina Department of Revenue website. The form is typically available for download in PDF format, allowing users to fill it out digitally or print it for manual completion. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax are critical to avoid penalties. Typically, forms must be submitted by the end of the tax year or as specified by the South Carolina Department of Revenue. Keeping track of these dates helps ensure timely submission and compliance with state tax laws.

Quick guide on how to complete for tax periods 5 1 13 and after state of south carolina 1350 department of revenue st 389 schedule for local taxes rev sctax

Effortlessly Prepare For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without hold-ups. Handle For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Edit and eSign For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax Effortlessly

- Obtain For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal significance as a traditional wet ink signature.

- Review the information and click the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for tax periods 5 1 13 and after state of south carolina 1350 department of revenue st 389 schedule for local taxes rev sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax?

The STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax is designed to report local taxes for businesses. For Tax Periods 5 1 13 And After, it is essential for ensuring compliance with local tax obligations and streamlined processing for tax filings.

-

How can airSlate SignNow assist with the completion of the STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax?

airSlate SignNow provides tools that simplify the process of completing and eSigning the STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax. With a user-friendly interface, businesses can efficiently manage their documents, ensuring a hassle-free experience for Tax Periods 5 1 13 And After.

-

What are the pricing options for airSlate SignNow for businesses dealing with tax documents?

airSlate SignNow offers various pricing plans that cater to different business needs, especially for those dealing with tax documents. Each plan provides access to features crucial for managing tax filings, like the STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax, thereby supporting businesses for Tax Periods 5 1 13 And After.

-

What features does airSlate SignNow offer that are beneficial for tax compliance?

airSlate SignNow includes eSignature capabilities, document management, and templates tailored for compliance purposes. These features facilitate quick completion of forms such as the STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax, making the process more efficient for Tax Periods 5 1 13 And After.

-

Are there any integrations available with airSlate SignNow for accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software systems. This capability is particularly useful for preparing the STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax in alignment with reporting requirements for Tax Periods 5 1 13 And After.

-

How does airSlate SignNow enhance the efficiency of document workflows?

airSlate SignNow enhances efficiency by automating workflows related to document processing and eSigning. This is particularly advantageous when handling tax-related documents like the STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax, ensuring timely submissions for Tax Periods 5 1 13 And After.

-

Can airSlate SignNow help in tracking the status of my tax documents?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of all your tax documents, including the STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax. This ensures you remain informed about submissions and approvals, particularly signNow for Tax Periods 5 1 13 And After.

Get more for For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax

- Ohio quitclaim deed form

- Time share deed form

- Advance care directive form

- Michigan designation form

- Michigan quitclaim deed from individual to individual form

- Living will form 481369855

- Kansas general durable power of attorney for property and finances or financial effective immediately form

- Kansas summary administration or simplified estate package for small estates form

Find out other For Tax Periods 5 1 13 And After STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE ST 389 SCHEDULE FOR LOCAL TAXES Rev Sctax

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF