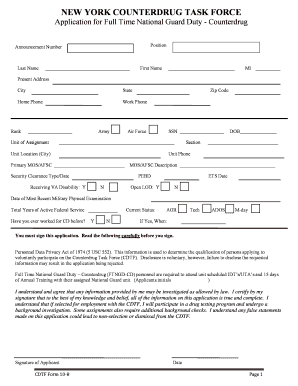

Cdtf Form

What is the Cdtf Form

The Cdtf Form is a specific document used primarily for tax reporting purposes in the United States. It serves as a means for individuals and businesses to report certain types of income or transactions to the appropriate tax authorities. Understanding the purpose and requirements of the Cdtf Form is essential for compliance with federal and state tax regulations. This form may be required under various circumstances, such as when reporting specific deductions or credits.

How to use the Cdtf Form

Using the Cdtf Form involves several key steps to ensure accurate completion and compliance. First, gather all necessary information and documentation related to the income or transactions being reported. This may include receipts, invoices, or other financial records. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to review the form for any errors before submission. Finally, submit the completed Cdtf Form to the appropriate tax authority, either electronically or via mail, depending on the requirements.

Steps to complete the Cdtf Form

Completing the Cdtf Form requires attention to detail and adherence to specific guidelines. Follow these steps:

- Gather all relevant financial documents.

- Obtain the latest version of the Cdtf Form from the official source.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Report the relevant income or transaction details accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the form by the designated deadline.

Legal use of the Cdtf Form

The legal use of the Cdtf Form is governed by federal and state tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with established deadlines. Additionally, the form must comply with regulations regarding electronic signatures if submitted digitally. Understanding the legal implications of the Cdtf Form is crucial for avoiding potential penalties or issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Cdtf Form vary depending on the specific purpose of the form and the taxpayer's situation. Generally, forms must be submitted by a certain date each year, often coinciding with the overall tax filing deadline. It is important to stay informed about any changes to deadlines, as late submissions can result in penalties or interest charges. Taxpayers should mark important dates on their calendars to ensure timely filing.

Required Documents

When completing the Cdtf Form, certain documents are typically required to support the information provided. These may include:

- Proof of income, such as pay stubs or 1099 forms.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any relevant contracts or agreements related to reported transactions.

Gathering these documents in advance can streamline the completion process and help ensure accuracy.

Quick guide on how to complete cdtf form

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely store it digitally. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents swiftly and without interruptions. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to Edit and Electronically Sign [SKS] Without Strain

- Locate [SKS] and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important parts of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Edit and electronically sign [SKS] to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Cdtf Form

Create this form in 5 minutes!

How to create an eSignature for the cdtf form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Cdtf Form and how is it used?

A Cdtf Form is a document specifically designed for electronic signing and processing within various business applications. It simplifies the workflow by enabling users to fill out and sign forms digitally, reducing paper usage and enhancing efficiency. With airSlate SignNow, completing a Cdtf Form becomes easy and straightforward, allowing businesses to streamline their processes.

-

How much does airSlate SignNow cost for Cdtf Form usage?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The cost for using Cdtf Form functionalities is designed to be budget-friendly and comes with various options based on the features you need. Check the pricing page on our website for details and choose the plan that best fits your needs.

-

What features does airSlate SignNow provide for Cdtf Form processing?

airSlate SignNow provides a range of features for efficient Cdtf Form processing, including customizable templates, advanced signing options, and real-time tracking. Users can easily create, distribute, and manage Cdtf Forms all in one platform. This comprehensive tool also offers integrations with other business applications to enhance workflow efficiency.

-

Can I integrate Cdtf Form with other software?

Yes, airSlate SignNOW allows for easy integrations with various software applications, including CRM and project management tools. This means you can seamlessly incorporate the Cdtf Form into your existing workflows, enhancing productivity and consistency. Our open API supports further customization to meet specific business needs.

-

Is it safe to use Cdtf Form with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, ensuring that all Cdtf Form submissions are encrypted and compliant with industry standards. We implement strict security protocols to protect your data and provide a secure environment for electronic signing. You can trust airSlate SignNow for your document management needs.

-

What are the benefits of using Cdtf Form for my business?

Using Cdtf Form can signNowly reduce document turnaround times and improve overall efficiency in your business operations. With features like electronic signing and real-time tracking, the Cdtf Form process eliminates the hassles of traditional paperwork. This not only saves time but also minimizes errors and increases customer satisfaction.

-

How do I get started with creating a Cdtf Form?

Getting started with creating a Cdtf Form is simple with airSlate SignNow. Once you sign up, you can access our user-friendly interface to design and customize your forms according to your needs. A variety of templates and tools are available to help you create professional Cdtf Forms in no time.

Get more for Cdtf Form

- Nm landlord tenant 497320244 form

- Name change instructions and forms package for a family new mexico

- Hearing court form

- Nm name change 497320250 form

- Nm name 497320251 form

- Proof of publication for name change new mexico form

- Petition for change of name new mexico form

- Request for hearing for name change new mexico form

Find out other Cdtf Form

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF