Loan and Guaranty Agreement SEC Gov Form

Understanding the Loan Guaranty Agreement

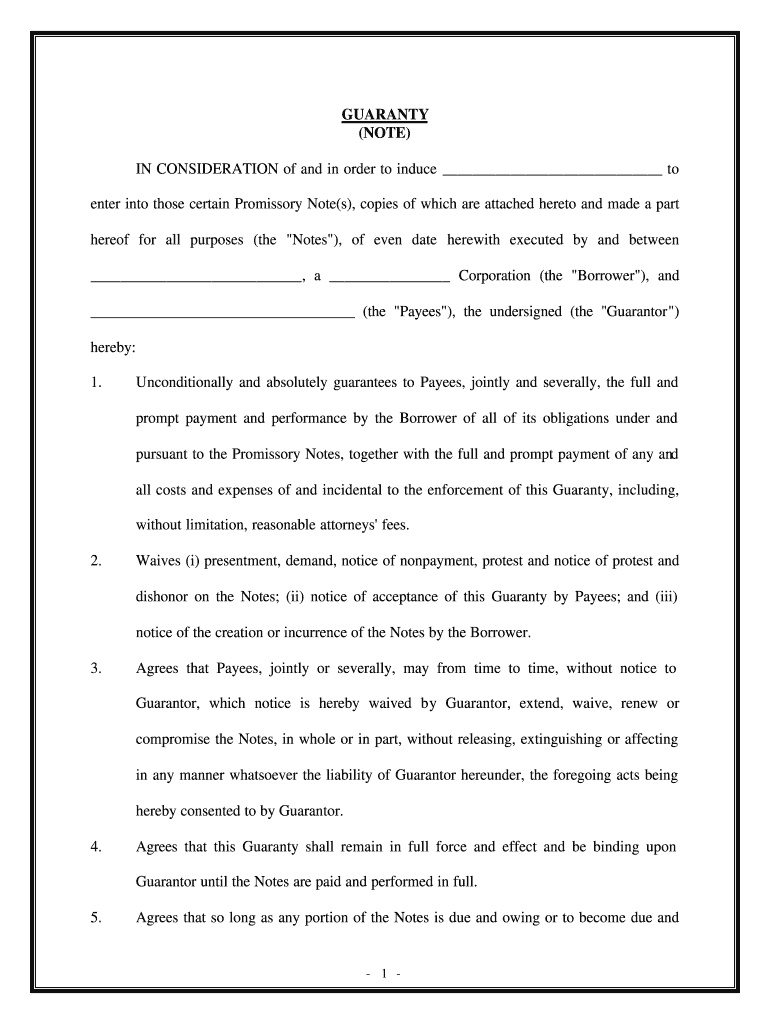

The loan guaranty agreement is a legally binding document that outlines the terms under which a guarantor agrees to assume responsibility for a borrower's debt if the borrower defaults. This agreement is crucial in lending scenarios, as it provides lenders with an additional layer of security. It typically includes details such as the amount guaranteed, the terms of the loan, and the obligations of the guarantor. Understanding these components is essential for both borrowers and guarantors to ensure clarity and compliance with the agreement.

Key Elements of the Loan Guaranty Agreement

Several critical elements define a loan guaranty agreement. These include:

- Identification of Parties: Clearly states the borrower, lender, and guarantor involved in the agreement.

- Loan Details: Specifies the loan amount, interest rate, repayment terms, and any collateral involved.

- Guarantor's Obligations: Outlines the responsibilities of the guarantor, including the conditions under which they must fulfill their obligations.

- Default Terms: Defines what constitutes a default and the procedures that will follow if a default occurs.

- Governing Law: Indicates which state’s laws will govern the agreement, which is particularly important for legal enforcement.

Steps to Complete the Loan Guaranty Agreement

Completing a loan guaranty agreement involves several key steps to ensure accuracy and legal compliance:

- Gather Necessary Information: Collect all relevant details about the borrower, lender, and guarantor, including financial information and identification.

- Draft the Agreement: Use a loan guarantor agreement template to create a draft that includes all required elements.

- Review Terms: Ensure that all parties understand the terms outlined in the agreement and that they are acceptable.

- Sign the Document: All parties should sign the agreement, preferably in the presence of a notary to enhance its legal standing.

- Distribute Copies: Provide each party with a copy of the signed agreement for their records.

Legal Use of the Loan Guaranty Agreement

The legal use of a loan guaranty agreement is governed by various laws and regulations. In the United States, it must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), which validate electronic signatures and documents. Ensuring that the agreement meets these legal requirements is essential for its enforceability in court. Additionally, it is advisable to consult with a legal professional to confirm that the agreement adheres to state-specific regulations.

Examples of Using the Loan Guaranty Agreement

Loan guaranty agreements are commonly used in various scenarios, including:

- Personal Loans: A family member may guarantee a loan for a relative, ensuring the lender that the loan will be repaid.

- Business Loans: A business owner might have a partner or investor act as a guarantor to secure financing for expansion.

- Student Loans: Parents often sign as guarantors for their children's education loans, providing assurance to lenders.

Obtaining the Loan Guaranty Agreement

To obtain a loan guaranty agreement, individuals can access templates through legal document providers or financial institutions. Many banks and credit unions offer standardized forms that can be customized to meet specific needs. It is important to ensure that any template used complies with state laws and includes all necessary elements to protect all parties involved. Consulting with a legal expert can also provide guidance on the most appropriate form to use in a given situation.

Quick guide on how to complete loan and guaranty agreement secgov

Effortlessly Prepare Loan And Guaranty Agreement SEC gov on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Loan And Guaranty Agreement SEC gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Loan And Guaranty Agreement SEC gov effortlessly

- Locate Loan And Guaranty Agreement SEC gov and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method of sending your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign Loan And Guaranty Agreement SEC gov and ensure excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do I fill out a Form 10BA if I lived in two rented homes during the previous year as per the rent agreement? Which address and landlord should I mention in the form?

you should fill out the FORM 10BA, with detail of the rented house, for which you are paying more rent than other.To claim Section 80GG deduction, the following conditions must be fulfilled by the taxpayer:HRA Not Received from Employer:- The taxpayer must not have received any house rent allowance (HRA) from the employer.Not a Home Owner:- The taxpayer or spouse or minor child must not own a house property. In case of a Hindu Undivided Family (HUF), the HUF must not own a house property where the taxpayer resides.Form 10BA Declaration:- The taxpayer must file a declaration in Form 10BA that he/she has taken a residence on rent in the previous year and that he/she has no other residence.format of form-10BA:-https://www.webtel.in/Image/Form...Amount of Deduction under Section 80GG:-Maximum deduction under Section 80GG is capped at Rs.60,000. Normally, the deduction under Section 80GG is the lower of the following three amounts :-25% of Adjusted Total IncomeRent Paid minus 10% of Adjusted Total IncomeRs.5000 per Month

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

Create this form in 5 minutes!

How to create an eSignature for the loan and guaranty agreement secgov

How to make an electronic signature for your Loan And Guaranty Agreement Secgov online

How to make an eSignature for the Loan And Guaranty Agreement Secgov in Google Chrome

How to generate an electronic signature for signing the Loan And Guaranty Agreement Secgov in Gmail

How to create an electronic signature for the Loan And Guaranty Agreement Secgov straight from your smartphone

How to create an electronic signature for the Loan And Guaranty Agreement Secgov on iOS devices

How to create an eSignature for the Loan And Guaranty Agreement Secgov on Android devices

People also ask

-

What is a loan guaranty agreement?

A loan guaranty agreement is a legal document that details the responsibilities of the guarantor in ensuring that the borrower repays the loan. This agreement provides lenders with additional security, decreasing their risk in lending. With airSlate SignNow, creating and signing a loan guaranty agreement is quick and straightforward.

-

How can I create a loan guaranty agreement using airSlate SignNow?

Creating a loan guaranty agreement with airSlate SignNow is simple. You can either start from a customizable template or upload your own document. The platform allows you to easily add fields for signatures and other required information, ensuring that your agreement is complete and legally binding.

-

What features does airSlate SignNow offer for loan guaranty agreements?

airSlate SignNow offers a range of features for handling loan guaranty agreements, including eSigning, document sharing, and real-time tracking of signature status. Users can also automate reminders for signers and integrate the platform with other tools to streamline the process. These features enhance efficiency and help ensure timely agreement execution.

-

Is airSlate SignNow cost-effective for managing loan guaranty agreements?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing loan guaranty agreements. With affordable pricing plans, businesses can digitize their agreement processes without breaking the bank. This leads to signNow cost savings on paper, printing, and storage, while also reducing the time spent on administrative tasks.

-

How secure are the loan guaranty agreements signed through airSlate SignNow?

Security is a top priority for airSlate SignNow. All loan guaranty agreements signed through the platform are protected by advanced encryption protocols. Additionally, airSlate SignNow complies with industry standards, ensuring that your sensitive financial information remains confidential and secure throughout the signing process.

-

Can I store my loan guaranty agreements on airSlate SignNow?

Yes, you can store your loan guaranty agreements and all other signed documents on airSlate SignNow. The platform provides a secure document management system that allows users to access and organize their agreements easily. This ensures that you can retrieve critical documents when needed without any hassle.

-

What integrations does airSlate SignNow support for loan guaranty agreements?

airSlate SignNow supports various integrations that enhance its functionality for managing loan guaranty agreements. You can connect it with CRMs, cloud storage services, and other essential business applications to streamline workflows and improve productivity. These integrations allow for a seamless experience when handling important financial documents.

Get more for Loan And Guaranty Agreement SEC gov

Find out other Loan And Guaranty Agreement SEC gov

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy