Wisconsin Self Employment Income Report Form

What is the Wisconsin Self Employment Income Report Form

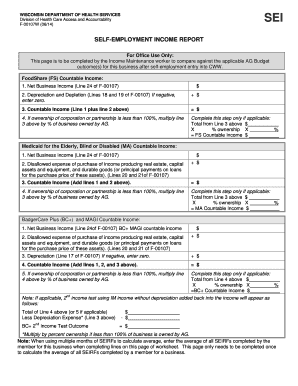

The Wisconsin Self Employment Income Report Form, commonly referred to as F-00107, is a crucial document for individuals who are self-employed in Wisconsin. This form is used to report income earned from self-employment activities, ensuring compliance with state tax regulations. It provides the necessary information to determine eligibility for various state programs and benefits. Understanding this form is essential for maintaining accurate financial records and fulfilling legal obligations as a self-employed individual.

How to use the Wisconsin Self Employment Income Report Form

Using the Wisconsin Self Employment Income Report Form involves several straightforward steps. First, gather all relevant financial documents, including income statements, receipts, and expense records. Next, accurately fill out the form by entering your total income from self-employment and detailing any allowable deductions. It is important to ensure that all information is complete and accurate to avoid potential issues with state authorities. After completing the form, you can submit it through the appropriate channels, either online or by mail, depending on your preference.

Steps to complete the Wisconsin Self Employment Income Report Form

Completing the Wisconsin Self Employment Income Report Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary financial documents, including income and expense records.

- Download or obtain the F-00107 form from the Wisconsin Department of Revenue.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total self-employment income and any applicable deductions.

- Review the form for accuracy and completeness.

- Submit the completed form online or by mailing it to the designated address.

Legal use of the Wisconsin Self Employment Income Report Form

The Wisconsin Self Employment Income Report Form is legally recognized for reporting self-employment income. To ensure its validity, it must be completed accurately and submitted within the designated timeframes set by the Wisconsin Department of Revenue. The information provided on this form is used to assess tax liabilities and determine eligibility for state benefits. Therefore, it is essential to adhere to all legal requirements when using this form to avoid penalties or compliance issues.

Key elements of the Wisconsin Self Employment Income Report Form

Several key elements must be included when filling out the Wisconsin Self Employment Income Report Form. These include:

- Your full name and contact information.

- Your Social Security number or Employer Identification Number (EIN).

- Total income earned from self-employment activities.

- Detailed breakdown of allowable deductions, such as business expenses.

- Signature and date to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Self Employment Income Report Form are critical to ensure compliance with state tax laws. Typically, the form must be submitted by the same deadline as your federal tax return. For most taxpayers, this is April 15 of each year. However, if you are unable to meet this deadline, it is advisable to file for an extension to avoid penalties. Staying informed about these important dates helps maintain good standing with tax authorities.

Quick guide on how to complete wisconsin self employment income report form

Manage Wisconsin Self Employment Income Report Form seamlessly on any device

Digital document management has become a favored choice for businesses and individuals alike. It offers an ideal sustainable substitute to traditional printed and signed documents, enabling you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Administer Wisconsin Self Employment Income Report Form on any platform using airSlate SignNow's Android or iOS applications and improve any document-related process today.

The easiest way to modify and eSign Wisconsin Self Employment Income Report Form effortlessly

- Find Wisconsin Self Employment Income Report Form and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Wisconsin Self Employment Income Report Form while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin self employment income report form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self employment income report form?

A self employment income report form is a document used by self-employed individuals to report their income to tax authorities. This form typically includes details about earnings, expenses, and net profit. Using airSlate SignNow, you can easily create and sign this form, making compliance with tax regulations simple.

-

How does airSlate SignNow help with the self employment income report form?

airSlate SignNow streamlines the process of creating and signing self employment income report forms. With our user-friendly interface, you can quickly fill out the necessary information and send the form for eSignature. This eliminates the hassle of printing and scanning, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for self employment income report forms?

Yes, airSlate SignNow offers several pricing plans tailored to meet the needs of different users. Our plans are designed to be budget-friendly while providing robust features for managing self employment income report forms and other documents. You can choose a plan that aligns with your specific requirements.

-

What features does airSlate SignNow offer for self employment income report forms?

airSlate SignNow provides a variety of features for managing self employment income report forms, including customizable templates, automatic reminders for signers, and secure storage. Our platform ensures your documents are protected and easily accessible whenever needed. Additionally, you can track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and Dropbox, allowing you to manage your self employment income report forms efficiently. This integration helps streamline workflows and keeps all your documents organized in one place.

-

Is airSlate SignNow compliant with legal standards for self employment income report forms?

Yes, airSlate SignNow is compliant with essential legal standards for electronic signatures, ensuring that your self employment income report forms are legally binding. Our platform adheres to regulations like the ESIGN Act and UETA, giving you peace of mind when handling sensitive documents.

-

How secure is airSlate SignNow when dealing with self employment income report forms?

Security is a top priority for airSlate SignNow. We implement robust encryption and data protection measures to ensure your self employment income report forms and personal information are safe. Regular audits and compliance with industry standards further guarantee the integrity of your documents.

Get more for Wisconsin Self Employment Income Report Form

Find out other Wisconsin Self Employment Income Report Form

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast