RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form

What is the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form

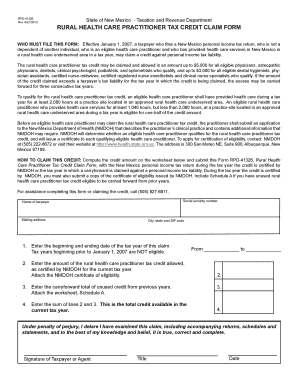

The RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form is a specific document utilized by health care practitioners in rural areas to claim tax credits. This form is essential for those who provide medical services in designated rural locations, allowing them to receive financial benefits aimed at encouraging health care provision in underserved areas. The form requires detailed information about the practitioner’s qualifications, the services provided, and the rural area served, ensuring that the tax credit is allocated appropriately.

How to use the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form

Using the RPD 41326 form involves several steps to ensure proper completion and submission. Practitioners should first gather all necessary information, including their professional credentials and details about their practice location. Once the form is filled out, it can be submitted electronically or via traditional mail. It is important to ensure that all sections are accurately completed to avoid delays in processing. Utilizing digital tools can streamline this process, making it easier to fill out, sign, and submit the form securely.

Steps to complete the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form

Completing the RPD 41326 form involves a series of clear steps:

- Gather relevant information, including your professional license number, practice address, and details about the services provided.

- Access the form through the appropriate channels, ensuring you have the latest version.

- Fill in all required fields accurately, paying attention to any specific instructions provided on the form.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or by mail, ensuring you keep a copy for your records.

Eligibility Criteria

To qualify for the tax credit using the RPD 41326 form, practitioners must meet certain eligibility criteria. This typically includes being a licensed health care provider, offering services in a rural area as defined by state guidelines, and fulfilling a minimum service requirement. Practitioners should verify their eligibility by consulting the specific regulations applicable in their state, as these can vary. Ensuring compliance with these criteria is crucial for successful claims.

Required Documents

When completing the RPD 41326 form, several documents may be required to support the claim. These typically include:

- A copy of your professional license.

- Proof of practice location, such as a utility bill or lease agreement.

- Documentation of the services provided, which may include patient records or billing statements.

- Any additional forms or documentation specified by state tax authorities.

Form Submission Methods

The RPD 41326 form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through a secure portal designated by the state tax authority.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if available.

It is advisable to check the specific submission guidelines for your state to ensure compliance and timely processing of your claim.

Quick guide on how to complete rpd 41326 rural health care practitioner tax credit claim form

Complete RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the features you require to create, modify, and eSign your documents swiftly without delays. Manage RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form seamlessly

- Locate RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd 41326 rural health care practitioner tax credit claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form?

The RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form is an official document that healthcare practitioners use to claim tax credits for providing services in rural areas. This form enables eligible professionals to receive financial benefits, encouraging them to continue their services in underserved communities.

-

How can airSlate SignNow help with the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form?

airSlate SignNow simplifies the process of preparing and eSigning the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form. Users can create, edit, and securely sign the form online, ensuring that all submissions are timely and compliant with tax regulations.

-

Are there any costs associated with using airSlate SignNow for the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form?

Yes, airSlate SignNow offers several pricing plans to fit different organizational needs, with cost-effective solutions for users needing to submit the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form. You can choose a plan that aligns with your usage, providing flexibility and affordability.

-

What features does airSlate SignNow offer for managing the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form?

airSlate SignNow provides features such as document templates, automated workflows, and secure eSigning, specifically for the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form. These tools enhance efficiency, making it simple to manage all necessary paperwork involved in the tax credit claim process.

-

How does airSlate SignNow ensure the security of the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form?

Security is a top priority at airSlate SignNow. We implement advanced encryption, secure cloud storage, and strict access controls to protect your RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form and all other documents, ensuring your sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other software for the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form?

Yes, airSlate SignNow integrates with a variety of third-party applications including CRM and accounting software. These integrations facilitate seamless management of the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form, streamlining your workflow and improving productivity.

-

What benefits can I expect from using airSlate SignNow for the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form?

By using airSlate SignNow for the RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form, you can expect faster processing times, reduced paperwork, and increased compliance. Our platform enhances your ability to efficiently manage claims while ensuring that you don't miss out on valuable tax credits.

Get more for RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form

Find out other RPD 41326, Rural Health Care Practitioner Tax Credit Claim Form

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document