Citi Group Bank Loan Documents to Companies Form

What is the Citi Group Bank Loan Documents To Companies

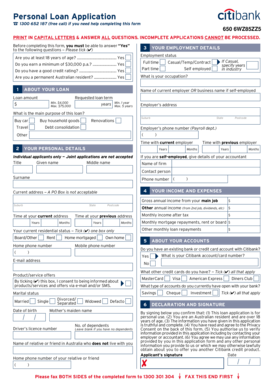

The Citi Group Bank Loan Documents to Companies are essential legal forms required for businesses seeking financing from Citi Group. These documents outline the terms and conditions of the loan agreement, detailing the responsibilities of both the lender and the borrower. They typically include information about loan amounts, interest rates, repayment schedules, and any collateral involved. Understanding these documents is crucial for companies to ensure compliance and to protect their financial interests.

How to use the Citi Group Bank Loan Documents To Companies

Using the Citi Group Bank Loan Documents to Companies involves several steps. First, businesses must gather relevant financial information and documentation required by Citi Group. Next, they should carefully review the loan documents to ensure all terms are understood. Once the documents are completed, companies can submit them through the designated channels, whether online or in person. It is advisable to keep copies of all submitted documents for future reference.

Steps to complete the Citi Group Bank Loan Documents To Companies

Completing the Citi Group Bank Loan Documents to Companies requires attention to detail. The following steps can guide businesses through the process:

- Gather necessary financial information, including business income statements and tax returns.

- Fill out the loan application form accurately, ensuring all fields are completed.

- Review the terms and conditions outlined in the documents.

- Provide any required signatures, ensuring compliance with eSignature regulations.

- Submit the completed forms as instructed by Citi Group.

Key elements of the Citi Group Bank Loan Documents To Companies

Key elements of the Citi Group Bank Loan Documents to Companies include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The cost of borrowing, expressed as a percentage.

- Repayment Terms: The schedule and conditions under which the loan must be repaid.

- Collateral: Any assets pledged to secure the loan.

- Default Clauses: Conditions under which the lender may demand repayment.

Legal use of the Citi Group Bank Loan Documents To Companies

The legal use of the Citi Group Bank Loan Documents to Companies is governed by various regulations. To be legally binding, these documents must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This ensures that electronic signatures and documents hold the same legal weight as traditional paper documents. Businesses should ensure that all parties involved in the loan agreement understand their rights and obligations as outlined in these documents.

Who Issues the Form

The Citi Group Bank Loan Documents to Companies are issued by Citi Group, a prominent financial institution in the United States. The bank provides these documents as part of its loan application process, ensuring that all necessary legal and financial information is captured for the loan agreement. Companies seeking financing must obtain these forms directly from Citi Group, either through their website or by contacting a representative.

Quick guide on how to complete citi group bank loan documents to companies

Complete Citi Group Bank Loan Documents To Companies easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Citi Group Bank Loan Documents To Companies on any device with airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

How to modify and eSign Citi Group Bank Loan Documents To Companies effortlessly

- Find Citi Group Bank Loan Documents To Companies and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form: via email, SMS, invite link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Citi Group Bank Loan Documents To Companies and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the citi group bank loan documents to companies

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Citi Group bank loan documents to companies?

Citi Group bank loan documents to companies refer to the required paperwork that businesses must provide to obtain a loan from Citi Group. These documents typically include financial statements, business plans, and legal agreements that demonstrate the company's ability to repay the loan.

-

How can airSlate SignNow help with Citi Group bank loan documents to companies?

airSlate SignNow streamlines the process of managing Citi Group bank loan documents to companies by providing an easy-to-use platform for sending, signing, and storing documents securely. This ensures that all loan-related documents are handled efficiently and are accessible at any time.

-

What features does airSlate SignNow offer for handling loan documents?

airSlate SignNow offers features such as eSigning, document templates, and real-time tracking, specifically designed for managing loan documents like Citi Group bank loan documents to companies. These capabilities help simplify the document workflow and enhance collaboration among stakeholders.

-

Is airSlate SignNow cost-effective for businesses dealing with loan documents?

Yes, airSlate SignNow provides a cost-effective solution for businesses managing Citi Group bank loan documents to companies. With flexible pricing plans and no hidden fees, you can access powerful tools without breaking the bank.

-

What are the benefits of using airSlate SignNow for loan documentation?

Using airSlate SignNow for Citi Group bank loan documents to companies offers numerous benefits, including faster processing times, improved accuracy, and enhanced security for sensitive information. This can signNowly reduce delays in obtaining loans, allowing businesses to access funds more quickly.

-

Can airSlate SignNow integrate with other financial software for loan management?

Absolutely! airSlate SignNow can seamlessly integrate with various financial software solutions, ensuring a smooth workflow for managing Citi Group bank loan documents to companies. Integrations with tools like CRM and accounting software enhance efficiency and data accuracy.

-

How secure is airSlate SignNow for handling loan documents?

airSlate SignNow prioritizes security, utilizing advanced encryption and compliance with industry standards to protect Citi Group bank loan documents to companies. This ensures that sensitive information remains confidential and secure throughout the document lifecycle.

Get more for Citi Group Bank Loan Documents To Companies

Find out other Citi Group Bank Loan Documents To Companies

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy