Request for Copy of Tax Statement PDF Research Research Binghamton Form

What is the Request For Copy Of Tax Statement Pdf Research Research Binghamton

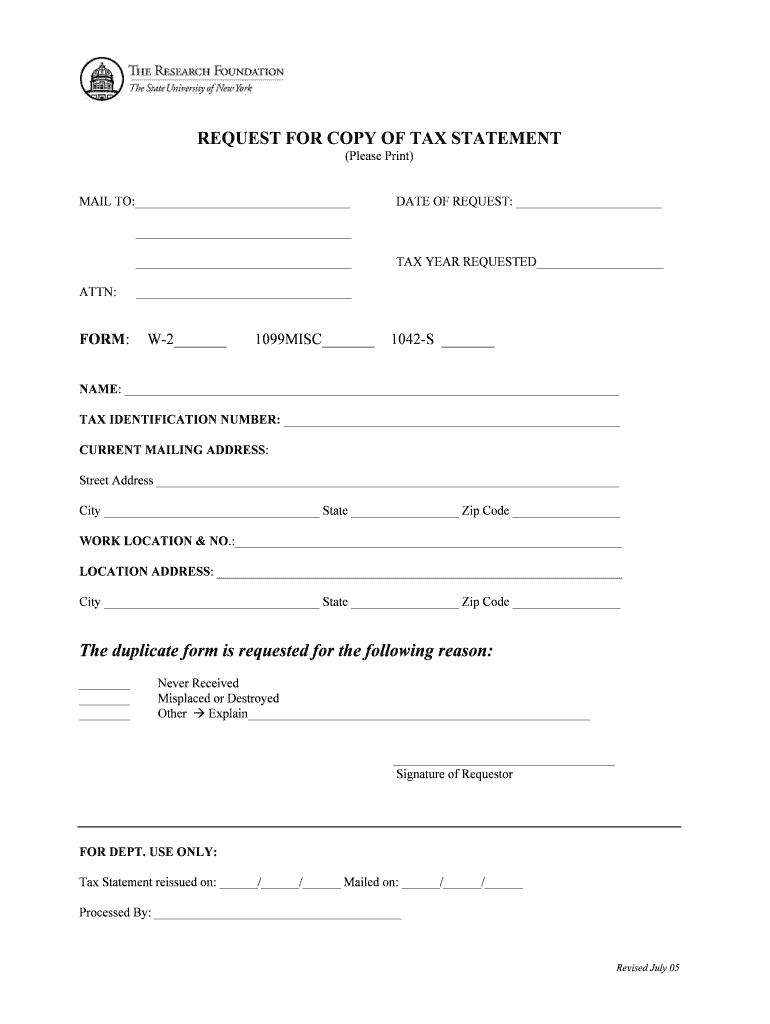

The Request For Copy Of Tax Statement Pdf Research Research Binghamton is a formal document used to obtain copies of tax statements from the relevant authorities in Binghamton, New York. This form is essential for individuals or businesses needing to access their tax records for various purposes, including financial planning, loan applications, or personal record-keeping. The document typically includes personal identification information, specific tax years requested, and the purpose for which the records are needed.

How to obtain the Request For Copy Of Tax Statement Pdf Research Research Binghamton

To obtain the Request For Copy Of Tax Statement Pdf Research Research Binghamton, individuals can visit the official website of the local tax authority or the state department of revenue. The form is often available for download in PDF format, allowing users to fill it out digitally or print it for manual completion. It is crucial to ensure that the latest version of the form is used to avoid any processing delays.

Steps to complete the Request For Copy Of Tax Statement Pdf Research Research Binghamton

Completing the Request For Copy Of Tax Statement Pdf Research Research Binghamton involves several key steps:

- Download the form from the official website.

- Fill in your personal information, including name, address, and Social Security number.

- Specify the tax years for which you are requesting copies.

- Indicate the purpose of the request, such as for financial records or loan applications.

- Sign and date the form to validate your request.

- Submit the completed form via the designated method, whether online, by mail, or in person.

Legal use of the Request For Copy Of Tax Statement Pdf Research Research Binghamton

The Request For Copy Of Tax Statement Pdf Research Research Binghamton is legally recognized as a valid means of obtaining tax records. To ensure compliance with legal standards, it is important to provide accurate information and complete all required sections of the form. Additionally, the use of electronic signatures is permissible under U.S. law, provided that the signing process meets the necessary legal requirements.

Key elements of the Request For Copy Of Tax Statement Pdf Research Research Binghamton

Key elements of the Request For Copy Of Tax Statement Pdf Research Research Binghamton include:

- Personal Information: Full name, address, and contact details.

- Tax Years: Specific years for which the tax statements are requested.

- Purpose: A brief explanation of why the records are needed.

- Signature: The requester's signature to authenticate the request.

IRS Guidelines

According to IRS guidelines, individuals are entitled to request copies of their tax statements. The IRS provides specific instructions on how to obtain these records, including the necessary forms and identification requirements. It is advisable to follow these guidelines closely to ensure that the request is processed without issues.

Quick guide on how to complete request for copy of tax statement pdf research research binghamton

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to retain your modifications.

- Choose your preferred method to submit your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

It seems like DNA is a way to figure out how myriads of neurons form a system and consciousness, e.g. for AI. Is there any research in that direction, or are there roadblocks to that yet?

DNA is not a blueprint for neural circuits. It encodes the rules of development, but as in most life processes simple rules create emergent complexity. This is the great folly applying the methods and logic of mineral science to Biology. For minerals, Occam’s Razor holds and nearly all the world can be expressed in equations with a few independent variables.OTOH life thrives on un-imaginable complexity from thousands of interactive variables. For example, the permutations of a fraction of a gene are hyper-astronomical, larger than the number of particles in the known Universe and therefore innumerable. Consider further that Nature has been trying sextillions of genetic experiments per second for the last 4 billion years, so we won’t live long enough as a species to understand the knowledge of that database.AGI research is more productively based on synthesis from higher mathematics, novel engines and software than analysis of how chemical computers work.AI as practiced today does not lead towards consciousness, which is a different modality far beyond our Turing computation engines.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Related searches to Request For Copy Of Tax Statement Pdf Research Research Binghamton

Create this form in 5 minutes!

How to create an eSignature for the request for copy of tax statement pdf research research binghamton

How to make an electronic signature for the Request For Copy Of Tax Statement Pdf Research Research Binghamton in the online mode

How to create an eSignature for the Request For Copy Of Tax Statement Pdf Research Research Binghamton in Chrome

How to create an eSignature for putting it on the Request For Copy Of Tax Statement Pdf Research Research Binghamton in Gmail

How to create an eSignature for the Request For Copy Of Tax Statement Pdf Research Research Binghamton right from your mobile device

How to create an electronic signature for the Request For Copy Of Tax Statement Pdf Research Research Binghamton on iOS

How to create an eSignature for the Request For Copy Of Tax Statement Pdf Research Research Binghamton on Android

People also ask

-

What is the process to Request For Copy Of Tax Statement Pdf Research Research Binghamton?

To Request For Copy Of Tax Statement Pdf Research Research Binghamton, you can utilize airSlate SignNow's user-friendly interface. Simply upload the necessary documents, create your request, and send it electronically for signatures. This process saves time and ensures that your request is processed efficiently.

-

Are there any costs associated with requesting a tax statement through airSlate SignNow?

Using airSlate SignNow for your Request For Copy Of Tax Statement Pdf Research Research Binghamton is cost-effective. Our pricing plans are designed to accommodate businesses of all sizes, offering various features that ensure you get the best value for your investment. You can check our pricing page for more details.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a range of features that enhance your document signing experience. With options for electronic signatures, templates, and audit trails, your Request For Copy Of Tax Statement Pdf Research Research Binghamton is handled smoothly and securely. Our platform also supports various file formats, ensuring compatibility.

-

How can I track the status of my Request For Copy Of Tax Statement Pdf Research Research Binghamton?

You can easily track your Request For Copy Of Tax Statement Pdf Research Research Binghamton through airSlate SignNow's dashboard. Our system provides real-time updates on document status, so you’ll always know when it’s been viewed, signed, or completed. This feature helps maintain transparency and accountability.

-

Is airSlate SignNow compliant with legal regulations for document signing?

Yes, airSlate SignNow is compliant with all legal regulations pertaining to electronic signatures and document handling. When you Request For Copy Of Tax Statement Pdf Research Research Binghamton, you can rest assured that your documents are treated with the highest level of security and legal validation, adhering to industry standards.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers various integrations with popular applications and platforms, which can enhance your workflow when you Request For Copy Of Tax Statement Pdf Research Research Binghamton. Connect with tools like Google Workspace, Salesforce, and more to streamline your document management processes.

-

What are the advantages of using airSlate SignNow for tax statement requests?

Using airSlate SignNow for your Request For Copy Of Tax Statement Pdf Research Research Binghamton has multiple advantages such as speed, security, and cost savings. Our platform simplifies the entire process, allowing you to focus on your core business activities while ensuring your document requests are efficiently handled.

Get more for Request For Copy Of Tax Statement Pdf Research Research Binghamton

- Plat act affidavit for logan county illinois form

- Nj waiver of first appearance form

- Cdc head circumference boy form

- Completed west virginia dep waste characterization form

- Cargo declaration form 28169793

- The school for sympathy pdf form

- Change address belastingdienst form

- Coonhound litter registration application note rush form

Find out other Request For Copy Of Tax Statement Pdf Research Research Binghamton

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template