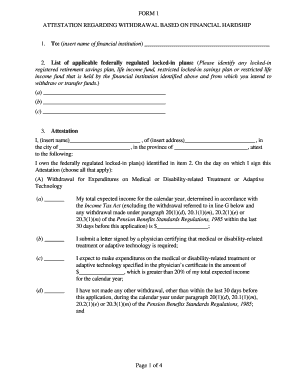

Attestation Regarding Withdrawal Based on Financial Hardship Form

What is the attestation regarding withdrawal based on financial hardship

The attestation regarding withdrawal based on financial hardship is a formal document that allows individuals to withdraw from certain financial obligations due to significant economic difficulties. This form is particularly relevant for students who may need to withdraw from educational programs or loans when facing unexpected financial challenges. By submitting this attestation, individuals can demonstrate their situation and potentially receive relief from their financial commitments.

Steps to complete the attestation regarding withdrawal based on financial hardship

Completing the attestation regarding withdrawal based on financial hardship involves several clear steps:

- Gather necessary documentation that supports your claim of financial hardship, such as income statements, bills, or other financial records.

- Fill out the form accurately, ensuring that all personal information is correct and that the details of your financial hardship are clearly articulated.

- Review the completed form for any errors or omissions before submission.

- Sign the form electronically or in print, depending on the submission method you choose.

- Submit the form through the appropriate channel, whether online, by mail, or in person.

Legal use of the attestation regarding withdrawal based on financial hardship

The legal use of the attestation regarding withdrawal based on financial hardship is significant. It serves as a formal declaration that can protect individuals from penalties associated with withdrawal from financial agreements. When properly completed and submitted, this document can be used in legal contexts to demonstrate that the individual acted in good faith during a time of financial distress. It is essential to ensure compliance with all relevant laws and regulations when using this attestation.

Eligibility criteria for the attestation regarding withdrawal based on financial hardship

To qualify for the attestation regarding withdrawal based on financial hardship, individuals typically need to meet specific eligibility criteria. These may include:

- Demonstrating a significant reduction in income or unexpected expenses.

- Providing evidence of financial difficulties, such as unemployment or medical bills.

- Being enrolled in a program or holding financial obligations that allow for withdrawal based on hardship.

Each institution may have its own specific requirements, so it is important to check the guidelines provided by the relevant authority.

Examples of using the attestation regarding withdrawal based on financial hardship

There are various scenarios in which the attestation regarding withdrawal based on financial hardship can be utilized. For instance:

- A student may use the form to withdraw from a college course due to unexpected medical expenses that hinder their ability to pay tuition.

- An individual may submit the attestation to a loan servicer to request a temporary suspension of payments due to job loss.

- A parent may use the form when withdrawing a child from a private school due to financial strain caused by unforeseen circumstances.

These examples illustrate how the attestation can provide necessary relief in challenging financial situations.

Required documents for the attestation regarding withdrawal based on financial hardship

When preparing to submit the attestation regarding withdrawal based on financial hardship, certain documents may be required to support your claim. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns.

- Bank statements that show financial transactions and account balances.

- Invoices or bills that demonstrate outstanding financial obligations.

- Any correspondence from employers or financial institutions regarding changes in financial status.

Having these documents ready can facilitate a smoother submission process and strengthen your case.

Quick guide on how to complete attestation regarding withdrawal based on financial hardship

Complete Attestation Regarding Withdrawal Based On Financial Hardship easily on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Attestation Regarding Withdrawal Based On Financial Hardship on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Attestation Regarding Withdrawal Based On Financial Hardship effortlessly

- Locate Attestation Regarding Withdrawal Based On Financial Hardship and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Attestation Regarding Withdrawal Based On Financial Hardship and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the attestation regarding withdrawal based on financial hardship

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an attestation regarding withdrawal based on financial hardship?

An attestation regarding withdrawal based on financial hardship is a formal declaration that allows individuals to withdraw from certain financial commitments or agreements due to unforeseen financial difficulties. This document provides evidence of the claim and assists in the clear documentation of the reason for the withdrawal.

-

How can airSlate SignNow help with creating an attestation regarding withdrawal based on financial hardship?

airSlate SignNow offers an efficient platform for drafting and eSigning important documents, including an attestation regarding withdrawal based on financial hardship. With an intuitive interface, users can easily customize templates and ensure legal compliance while streamlining the signing process.

-

Is there a cost associated with using airSlate SignNow for my attestation regarding withdrawal based on financial hardship?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan provides access to features that facilitate the creation and management of documents like the attestation regarding withdrawal based on financial hardship, making it a cost-effective choice for organizations.

-

What are the benefits of using airSlate SignNow for eSigning my documents?

Using airSlate SignNow for eSigning documents like the attestation regarding withdrawal based on financial hardship provides numerous benefits, including speed, security, and convenience. The platform ensures that your documents are signed quickly while maintaining the integrity and confidentiality of sensitive information.

-

Can I integrate airSlate SignNow with other applications for better document management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your document management capabilities. This means you can easily link your workflow tools and securely share the attestation regarding withdrawal based on financial hardship and other important documents across platforms.

-

Is the attestation regarding withdrawal based on financial hardship legally binding?

Yes, when properly completed and eSigned using airSlate SignNow, the attestation regarding withdrawal based on financial hardship is legally binding. The platform ensures compliance with electronic signature laws, giving users confidence that their documents are valid and enforceable.

-

How can I ensure my attestation regarding withdrawal based on financial hardship is processed quickly?

To ensure quick processing of your attestation regarding withdrawal based on financial hardship, utilize airSlate SignNow's automated workflows and notifications. By streamlining the sending and signing process, you can signNowly reduce waiting times and improve overall efficiency.

Get more for Attestation Regarding Withdrawal Based On Financial Hardship

- Special proceedings action cover form

- Apply for a marriage license courtsingov form

- Notice of hearing onincompetencemotion in the cause form

- Order of assignment or denial of counsel state of north carolina form

- To sell motor vehicle form

- Fillable online order directing transfer of motor vehicle title form

- Summary of civil commitment proceedingsmental health form

- Respondent found not guilty form

Find out other Attestation Regarding Withdrawal Based On Financial Hardship

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement