Nh 1120 Es Form

What is the NH 1120 ES?

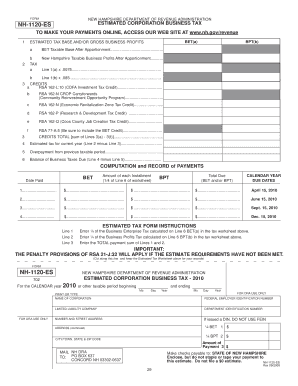

The NH 1120 ES is a form used by businesses in New Hampshire to make estimated tax payments. This form is essential for corporations that expect to owe tax of $1,000 or more during the tax year. It allows businesses to pay their estimated tax liabilities in four installments throughout the year, helping to manage cash flow and avoid penalties for underpayment.

How to use the NH 1120 ES

To effectively use the NH 1120 ES, businesses must first calculate their estimated tax liability based on the previous year’s income or projected income for the current year. The form requires specific financial information, including gross receipts and allowable deductions. Once the estimated tax amount is determined, the business can fill out the form and submit it along with the payment to the New Hampshire Department of Revenue Administration.

Steps to complete the NH 1120 ES

Completing the NH 1120 ES involves several key steps:

- Gather financial records, including income statements and expense reports.

- Calculate the estimated tax liability based on projected income.

- Fill out the NH 1120 ES form accurately, ensuring all required information is included.

- Determine the payment amount for the current installment.

- Submit the form and payment by the due date to avoid penalties.

Legal use of the NH 1120 ES

The NH 1120 ES is legally binding when completed and submitted according to state regulations. It is crucial for businesses to adhere to the guidelines set forth by the New Hampshire Department of Revenue Administration to ensure compliance. Using electronic signatures through a reliable platform can enhance the legal standing of the form, provided all electronic signature laws are followed.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines for the NH 1120 ES to avoid penalties. Typically, the estimated tax payments are due on the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year. It is advisable to check the New Hampshire Department of Revenue Administration’s website for any updates or changes to these dates.

Required Documents

When preparing to file the NH 1120 ES, businesses should have the following documents ready:

- Previous year’s tax return for reference.

- Current year’s financial projections.

- Records of any prior estimated payments made.

Form Submission Methods

The NH 1120 ES can be submitted through various methods to accommodate different preferences. Businesses may choose to file the form online through the New Hampshire Department of Revenue Administration’s website, or they can mail a paper copy of the form along with the payment. In-person submissions may also be available at designated state offices.

Quick guide on how to complete nh 1120 es

Complete Nh 1120 Es effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Nh 1120 Es on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Nh 1120 Es with ease

- Obtain Nh 1120 Es and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important portions of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Decide how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Nh 1120 Es and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nh 1120 es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nh 1120 es form used for?

The nh 1120 es form is primarily used for making estimated tax payments in New Hampshire. By utilizing this form, businesses ensure they comply with state tax requirements while conveniently managing their estimated taxes throughout the year.

-

How does airSlate SignNow facilitate the signing of the nh 1120 es form?

With airSlate SignNow, signing the nh 1120 es form becomes effortless. Users can easily upload the form, add necessary signatures, and send it for eSignature, streamlining the process and ensuring timely submissions.

-

What are the pricing options for airSlate SignNow when using the nh 1120 es?

airSlate SignNow offers various pricing plans that cater to different business needs, starting with a free trial. When dealing with the nh 1120 es form, businesses can choose the plan that best fits their budget while enjoying full access to essential features.

-

Can I integrate airSlate SignNow with my accounting software for the nh 1120 es process?

Yes, airSlate SignNow integrates seamlessly with popular accounting software. This feature allows users to streamline the handling of the nh 1120 es form, ensuring that all data is accurately reflected in both their documents and financial reports.

-

What benefits does airSlate SignNow provide for managing the nh 1120 es form?

By using airSlate SignNow for the nh 1120 es form, businesses enjoy increased efficiency, reduced errors, and enhanced compliance with tax regulations. The platform simplifies document management, making it easier to access and sign vital tax documents.

-

Is airSlate SignNow legally compliant for eSigning the nh 1120 es form?

Absolutely, airSlate SignNow is legally compliant with eSignature laws, ensuring that your signed nh 1120 es form is valid and enforceable. Users can confidently eSign documents knowing they meet all necessary legal requirements.

-

How secure is my information when using airSlate SignNow for the nh 1120 es?

airSlate SignNow prioritizes the security of user information with advanced encryption and data protection measures. When submitting the nh 1120 es form, businesses can trust that their sensitive data remains confidential and well-guarded.

Get more for Nh 1120 Es

- The foregoing instrument was acknowledged before me this date by name of form

- Control number ne p003 pkg form

- Estate planning checklist us legal forms power of

- Control number ne p004 pkg form

- Control number ne p006 pkg form

- Records and to consent to the disclosure of such records in circumstances the attorney s infact may deem appropriate to file form

- Business litigationcommercial contract disputes form

- Where can i find nebraska legalbusiness forms

Find out other Nh 1120 Es

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document