Ca Form 5806 Instructions

What is the CA Form 5806 Instructions?

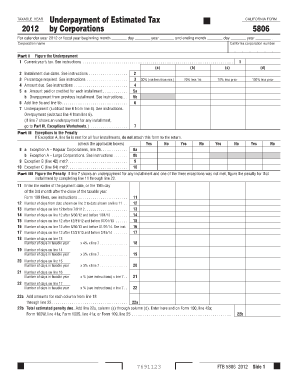

The CA Form 5806, also known as the California Form 5806 Instructions, is a document that provides guidelines for completing the California tax form related to various tax situations. This form is specifically designed for taxpayers who need to report certain types of income or claim specific deductions. The instructions detail the necessary steps to fill out the form accurately, ensuring compliance with California tax laws.

Steps to Complete the CA Form 5806 Instructions

Completing the CA Form 5806 involves several key steps:

- Gather all necessary documents, including income statements and any relevant tax records.

- Review the specific instructions provided for each section of the form to understand what information is required.

- Fill out the form carefully, ensuring that all entries are accurate and complete.

- Double-check your calculations and ensure that all required signatures are included.

- Submit the completed form by the designated deadline to avoid penalties.

Legal Use of the CA Form 5806 Instructions

The CA Form 5806 Instructions serve as a legal framework for taxpayers to report their financial information accurately. Compliance with these instructions is essential for ensuring that the submitted form is legally binding. This includes adhering to the guidelines for signatures and ensuring that all necessary documentation is provided. Utilizing a reliable electronic signature solution can further enhance the legal standing of the form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the CA Form 5806. Typically, the form must be submitted by the tax deadline, which is usually April 15 for most taxpayers. However, if you are filing for an extension, ensure that you submit the form by the extended deadline. Late submissions may result in penalties, so adhering to these dates is essential for compliance.

Form Submission Methods (Online / Mail / In-Person)

The CA Form 5806 can be submitted through various methods, providing flexibility for taxpayers. You can file the form online through the California Franchise Tax Board's website, which is often the quickest option. Alternatively, you may choose to mail the completed form to the designated address provided in the instructions. In-person submissions may also be available at certain tax offices, depending on local regulations.

Required Documents

To complete the CA Form 5806, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Records of any deductions you plan to claim.

- Previous tax returns for reference.

- Identification information, such as Social Security numbers.

Having these documents ready will facilitate a smoother completion process.

Quick guide on how to complete ca form 5806 instructions

Effortlessly Prepare Ca Form 5806 Instructions on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ca Form 5806 Instructions from any device with the airSlate SignNow apps for Android or iOS and enhance any document-centered process today.

The easiest way to modify and electronically sign Ca Form 5806 Instructions without hassle

- Find Ca Form 5806 Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you select. Edit and electronically sign Ca Form 5806 Instructions to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 5806 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the CA form 5806 instructions for 2018?

The CA form 5806 instructions for 2018 guide individuals on how to accurately complete the form, which is essential for reporting certain income tax information. These instructions provide detailed steps to ensure compliance with California tax regulations, making it crucial for taxpayers. Always refer to the latest resources for the most accurate guidelines regarding the completion of CA form 5806.

-

How can airSlate SignNow assist with CA form 5806 in 2018?

airSlate SignNow simplifies the process of filling out the CA form 5806 by providing users with an intuitive platform for electronic signatures and document management. With our user-friendly interface, you can easily upload, sign, and send the completed form. This streamlines the process, ensuring you meet the deadlines required for the CA form 5806 instructions for 2018.

-

What features does airSlate SignNow offer for handling CA form 5806 documentation?

Our platform includes robust features like templates, collaboration tools, and automated workflows that cater specifically to documents like CA form 5806. Users can create, edit, and share forms while tracking document status in real-time. These features not only save time but also enhance the accuracy and compliance of your 2018 submissions.

-

Is airSlate SignNow cost-effective for handling CA form 5806 instructions 2018?

Yes, airSlate SignNow offers a cost-effective solution for managing CA form 5806 transactions, especially when compared to traditional paper-based methods. Our pricing plans are designed to cater to a variety of business needs, helping you save on both time and resources. By using our platform, you can efficiently stay organized and compliant with the CA form 5806 instructions for 2018.

-

Can airSlate SignNow integrate with other software for CA form 5806?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, including CRMs and accounting tools that may be relevant to the CA form 5806 instructions 2018. This integration facilitates easy data transfer and enhances workflow efficiency. Leveraging these integrations can help ensure a smooth process when managing your documents.

-

What are the benefits of using airSlate SignNow for CA form 5806 instructions?

Using airSlate SignNow for your CA form 5806 instructions offers numerous benefits including improved efficiency, enhanced security, and better compliance. Our platform allows for quick document turnaround times and minimizes errors associated with manual entry. You'll find that the streamlined eSignature process is not just faster, but also facilitates better record-keeping for your tax documentation.

-

Is it secure to use airSlate SignNow for submitting CA form 5806?

Yes, airSlate SignNow prioritizes security, ensuring that all documents, including the CA form 5806, are encrypted and stored safely. With advanced encryption protocols and secure access controls, your sensitive data is protected at all times. This security framework ensures that your submissions and signatures are both reliable and compliant with regulations.

Get more for Ca Form 5806 Instructions

- Commercial sublease colorado form

- Colorado lease form

- Exercising option purchase 497299979 form

- Assignment of lease and rent from borrower to lender colorado form

- Assignment of lease from lessor with notice of assignment colorado form

- Letter from landlord to tenant as notice of abandoned personal property colorado form

- Guaranty or guarantee of payment of rent colorado form

- Letter from landlord to tenant as notice of default on commercial lease colorado form

Find out other Ca Form 5806 Instructions

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word