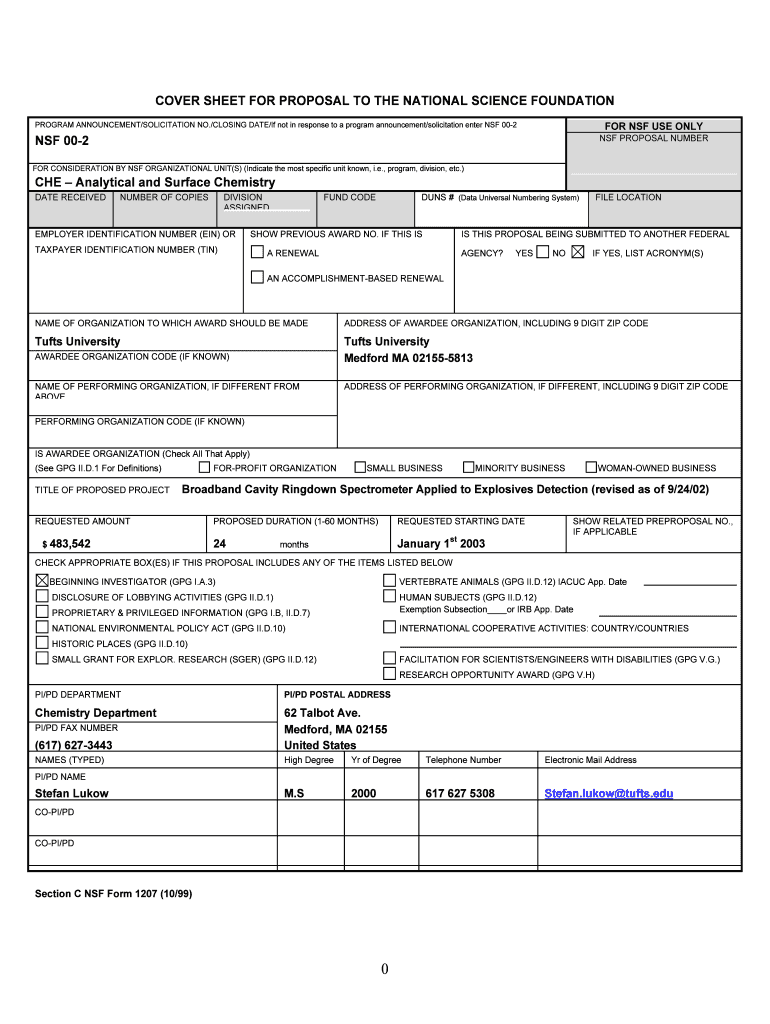

NSF Form 1207 1099

What is the NSF Form

The NSF Form is a specific tax form used in the United States to report certain types of income. This form is essential for individuals and businesses that have received payments that are not classified as wages, salaries, or tips. It serves to inform the Internal Revenue Service (IRS) about income that may not have been reported through traditional employment channels. Understanding the purpose of this form is crucial for accurate tax reporting and compliance.

How to use the NSF Form

Using the NSF Form involves several steps to ensure accurate reporting of income. First, gather all relevant financial information related to the payments received. This includes the amount, date of payment, and the source of income. Next, complete the form by entering the necessary details, ensuring that all information is accurate and complete. Once filled out, the form must be submitted to the IRS and a copy provided to the recipient. It is important to keep a copy for your records as well.

Steps to complete the NSF Form

Completing the NSF Form requires careful attention to detail. Follow these steps:

- Gather all necessary documentation related to the income being reported.

- Fill in the payer's information, including name, address, and taxpayer identification number.

- Enter the recipient's information, ensuring accuracy in their name and identification number.

- Report the total amount of income paid to the recipient in the appropriate box.

- Review the completed form for any errors or omissions before submission.

Legal use of the NSF Form

The NSF Form is legally binding when filled out correctly and submitted in compliance with IRS regulations. It is important to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be issued to recipients by the deadline set by the IRS, typically by January thirty-first of the following year. Adhering to these legal requirements helps maintain compliance and avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the NSF Form are crucial for compliance. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which the payments were made. Additionally, recipients must receive their copies by the same date. It is advisable to mark these dates on your calendar to ensure timely submission and avoid penalties for late filing.

Who Issues the Form

The NSF Form is typically issued by businesses or individuals who have made payments to others that fall under the reporting requirements. This includes various entities such as corporations, partnerships, and sole proprietors. It is the responsibility of the payer to ensure that the form is completed accurately and distributed to the appropriate parties, including the IRS and the recipient.

Quick guide on how to complete nsf form 1207 1099

Finish NSF Form 1207 1099 effortlessly on any gadget

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to generate, alter, and eSign your documents swiftly and without interruption. Handle NSF Form 1207 1099 on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign NSF Form 1207 1099 with ease

- Obtain NSF Form 1207 1099 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to distribute your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or disorganized documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Edit and eSign NSF Form 1207 1099 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nsf form 1207 1099

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NSF Form 1207 1099, and why is it important?

The NSF Form 1207 1099 is a tax form used to report miscellaneous income by businesses and individuals. Its importance lies in ensuring compliance with IRS regulations and avoiding penalties by accurately reporting non-employee compensation. Understanding the NSF Form 1207 1099 helps businesses keep their accounting in order and maintain proper tax documentation.

-

How can airSlate SignNow help with completing the NSF Form 1207 1099?

airSlate SignNow streamlines the process of filling out and electronically signing the NSF Form 1207 1099. Our platform provides easy-to-use templates and tools, enabling users to complete and send the form quickly. This saves time and helps ensure accuracy when reporting miscellaneous income.

-

Is there a cost associated with using airSlate SignNow for the NSF Form 1207 1099?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that simplify the completion and signing of forms like the NSF Form 1207 1099. Sign up for a trial to explore our competitive pricing options and find the best fit for your organization.

-

What features does airSlate SignNow offer for handling documents like the NSF Form 1207 1099?

airSlate SignNow provides several features for managing documents such as the NSF Form 1207 1099, including templates, electronic signatures, and collaboration tools. The platform also includes functionality for tracking document status and secure storage, ensuring that your important forms are always accessible and secure.

-

Can airSlate SignNow integrate with other accounting software for the NSF Form 1207 1099?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions to facilitate the management of the NSF Form 1207 1099. This integration helps streamline the workflow, making it easier to sync data between different systems. As a result, businesses can manage their tax documentation more efficiently.

-

Are electronic signatures on the NSF Form 1207 1099 legally binding?

Absolutely! Electronic signatures on the NSF Form 1207 1099 are legally recognized under the ESIGN Act and UETA. airSlate SignNow ensures that all electronic signatures meet legal requirements, providing businesses with confidence in the validity of their completed forms and documents.

-

How does airSlate SignNow enhance the security of the NSF Form 1207 1099?

airSlate SignNow prioritizes security by employing robust encryption and compliance protocols to protect sensitive information on forms like the NSF Form 1207 1099. Features such as document access control and audit trails further enhance security, giving users peace of mind that their data is safe.

Get more for NSF Form 1207 1099

Find out other NSF Form 1207 1099

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy