Ny Form Au 67

What is the NY Form AU 67?

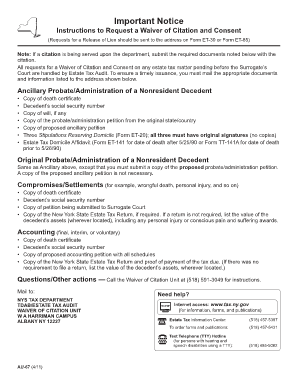

The NY Form AU 67, also known as the waiver of citation to the New York estate tax audit unit, is a crucial document used in the context of estate tax audits in New York State. This form allows executors or administrators of estates to request a waiver from the New York State Department of Taxation and Finance when they are undergoing an estate tax audit. The completion of this form signifies the estate's compliance with state tax regulations and helps facilitate the audit process.

How to Use the NY Form AU 67

To effectively use the NY Form AU 67, individuals should first ensure they meet the eligibility criteria for submitting the form. The form must be filled out accurately, providing all required information, including the estate's details and any relevant tax identification numbers. Once completed, the form should be submitted to the appropriate state department, either electronically or via mail, depending on the specific instructions provided. It is essential to retain a copy of the submitted form for personal records.

Steps to Complete the NY Form AU 67

Completing the NY Form AU 67 involves several important steps:

- Gather necessary information about the estate, including the decedent's details and tax identification number.

- Fill out the form with accurate and complete information, ensuring all sections are addressed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the New York State Department of Taxation and Finance, following the specified submission method.

- Keep a copy of the submitted form for your records.

Legal Use of the NY Form AU 67

The legal use of the NY Form AU 67 is significant in ensuring compliance with New York estate tax laws. By submitting this form, the executor or administrator formally requests a waiver, which can expedite the audit process. It is important to understand that the form must be completed in accordance with state regulations to be considered valid. Failure to adhere to these legal requirements may result in delays or complications during the estate tax audit.

Required Documents for the NY Form AU 67

When preparing to submit the NY Form AU 67, certain documents may be required to support the application. These documents typically include:

- The death certificate of the decedent.

- Proof of the executor or administrator's authority, such as letters testamentary or letters of administration.

- Any prior tax returns related to the estate.

- Documentation of the estate's assets and liabilities.

Having these documents ready will help streamline the submission process and ensure compliance with state requirements.

Form Submission Methods

The NY Form AU 67 can be submitted through various methods, catering to different preferences and situations. Individuals may choose to submit the form online through the New York State Department of Taxation and Finance's website or send it via traditional mail. In-person submissions may also be possible at designated offices. It is advisable to check the latest guidelines from the state department to determine the most appropriate submission method.

Quick guide on how to complete ny form au 67

Prepare Ny Form Au 67 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Ny Form Au 67 on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Ny Form Au 67 with ease

- Obtain Ny Form Au 67 and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and electronically sign Ny Form Au 67 to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ny form au 67

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is au 67 in the context of airSlate SignNow?

au 67 refers to a specific feature or compliance requirement within airSlate SignNow. This tool is designed to enhance the document signing process by ensuring that it meets specific legal and operational standards, making it ideal for businesses aiming to streamline their workflows.

-

How does airSlate SignNow pricing relate to au 67?

AirSlate SignNow offers competitive pricing plans that accommodate features pertinent to au 67 compliance. This ensures that businesses can access necessary tools without overspending, making it a cost-effective solution for document management and eSigning.

-

What are the main features of airSlate SignNow relevant to au 67?

Key features of airSlate SignNow that align with au 67 include customizable templates, secure document storage, and audit trails. These features help businesses maintain compliance while improving efficiency and reducing manual errors in document handling.

-

Can airSlate SignNow integrate with other platforms while ensuring au 67 compliance?

Yes, airSlate SignNow integrates seamlessly with multiple platforms such as CRM systems and cloud storage services, all while adhering to au 67 requirements. This ensures that your documents remain compliant across various applications, streamlining your overall workflow.

-

What benefits does airSlate SignNow provide for businesses using au 67?

By using airSlate SignNow with au 67 considerations, businesses benefit from improved efficiency, compliance assurance, and reduced paper usage. This directly translates to cost savings and a faster turnaround on document processes, enabling businesses to focus on core operations.

-

Is training necessary to use airSlate SignNow for au 67 requirements?

While airSlate SignNow is user-friendly, businesses may choose to provide training to staff to maximize their use of the platform in relation to au 67. This training can help teams understand compliance standards and utilize all features effectively to ensure proper document handling.

-

How does airSlate SignNow support compliance with au 67 in document workflows?

AirSlate SignNow supports compliance with au 67 through secure encryption, verification processes, and comprehensive audit trails. These features ensure that every document signed meets necessary compliance standards, enhancing trust and legality in the signing process.

Get more for Ny Form Au 67

- Satisfaction cancellation or release of mortgage package district of columbia form

- Premarital agreements package district of columbia form

- Painting contractor package district of columbia form

- Framing contractor package district of columbia form

- Foundation contractor package district of columbia form

- Plumbing contractor package district of columbia form

- Brick mason contractor package district of columbia form

- Roofing contractor package district of columbia form

Find out other Ny Form Au 67

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document