1099 Fire Form

What is the 1099 Fire

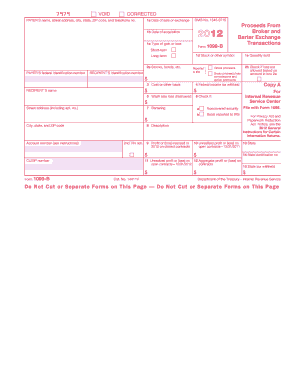

The 1099 Fire form is a specific tax document used primarily for reporting income received by independent contractors, freelancers, and other non-employees. This form is essential for the Internal Revenue Service (IRS) as it helps track income that is not subject to withholding taxes. The 1099 Fire form is part of a broader category of 1099 forms, which are used to report various types of income, including interest, dividends, and rental income. Understanding this form is crucial for both payers and recipients to ensure accurate reporting and compliance with tax regulations.

How to use the 1099 Fire

Using the 1099 Fire form involves several steps to ensure proper completion and submission. First, the payer must gather all necessary information about the recipient, including their name, address, and Social Security number or Employer Identification Number (EIN). Next, the payer fills out the form, detailing the amount paid during the tax year. It is important to keep accurate records of all payments made, as this information will be reported to the IRS. Once completed, the form must be sent to the recipient by January thirty-first of the following year, and a copy must be filed with the IRS by the end of February if submitted on paper or by March thirty-first if filed electronically.

Steps to complete the 1099 Fire

Completing the 1099 Fire form requires careful attention to detail. Follow these steps:

- Gather recipient information: Collect the recipient's name, address, and taxpayer identification number.

- Fill in the payer's details: Include your name, address, and taxpayer identification number.

- Report the payment amount: Enter the total amount paid to the recipient during the tax year in the appropriate box.

- Check for accuracy: Review all information for correctness to avoid penalties or delays.

- Submit the form: Send the completed form to the recipient and file a copy with the IRS.

Legal use of the 1099 Fire

The legal use of the 1099 Fire form is governed by IRS regulations. It is essential for both payers and recipients to understand their responsibilities regarding this form. Payers must issue the form for any payments totaling six hundred dollars or more made to non-employees for services rendered. Recipients must accurately report the income on their tax returns. Failure to comply with these requirements can lead to penalties, including fines and additional taxes owed. Ensuring that the form is filled out correctly and submitted on time is vital for legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Fire form are critical to avoid penalties. Payers must provide the form to recipients by January thirty-first of the year following the tax year in which payments were made. Additionally, the form must be filed with the IRS by February twenty-eighth if submitted on paper, or by March thirty-first if filed electronically. Being aware of these deadlines helps ensure compliance and avoids potential fines.

Penalties for Non-Compliance

Non-compliance with the requirements for the 1099 Fire form can result in significant penalties. The IRS imposes fines for failing to file the form, providing incorrect information, or not issuing the form to recipients. Penalties can range from fifty dollars to five hundred dollars per form, depending on how late the form is filed. In cases of intentional disregard of the filing requirements, the penalties can be even more severe. Understanding these consequences underscores the importance of timely and accurate filing.

Quick guide on how to complete 1099 fire

Accomplish 1099 Fire effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 1099 Fire across any platform using airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

The easiest method to modify and electronically sign 1099 Fire with ease

- Obtain 1099 Fire and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Select important sections of your documents or cover sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to submit your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign 1099 Fire while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099 fire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 1099 fire and how does it relate to airSlate SignNow?

1099 fire refers to the process of managing and filing 1099 forms, which are essential for reporting income paid to independent contractors. airSlate SignNow simplifies this process by providing a streamlined platform to create, send, and eSign 1099 forms securely and efficiently.

-

How can airSlate SignNow help me with my 1099 fire needs?

With airSlate SignNow, you can easily create and distribute 1099 forms to your contractors. Our user-friendly interface and eSigning capabilities ensure that you can manage all your 1099 fire requirements effortlessly, saving you time and reducing paperwork.

-

What are the pricing options for airSlate SignNow's services related to 1099 fire?

AirSlate SignNow offers various pricing plans to cater to different business sizes and needs, including packages that specifically support 1099 fire management. You can choose a plan that aligns with your budget and features needed to handle your documentation effectively.

-

Does airSlate SignNow offer integrations for 1099 fire reporting?

Yes, airSlate SignNow integrates seamlessly with several accounting and financial software tools that can assist in the 1099 fire process. This ensures that you can synchronize your data and streamline your workflow without hassle.

-

What features does airSlate SignNow include for managing 1099 fire documents?

AirSlate SignNow includes features like customizable templates, automated workflows, and secure cloud storage specifically for 1099 fire documents. These tools help you manage your forms effectively while ensuring compliance and security.

-

Is airSlate SignNow secure for handling sensitive 1099 fire information?

Absolutely, airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your sensitive 1099 fire information. You can trust that your data is secure during the entire document management process.

-

Can I customize my 1099 fire forms using airSlate SignNow?

Yes, you can fully customize your 1099 fire forms with airSlate SignNow. Our platform allows you to add your branding, modify fields, and tailor the documents to meet your specific needs, making the process more personal and professional.

Get more for 1099 Fire

Find out other 1099 Fire

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast