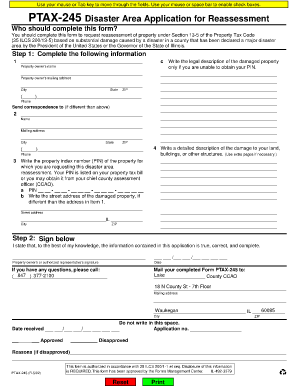

Ptax 245 Form

What is the Ptax 245 Form

The Ptax 245 Form is a specific tax document used in the United States primarily for property tax purposes. It is designed to assist property owners in reporting their property’s value and any relevant exemptions they may qualify for. This form is crucial for ensuring that property taxes are assessed accurately and fairly. By providing detailed information about the property, owners can ensure compliance with local tax regulations and potentially reduce their tax liability.

How to use the Ptax 245 Form

Using the Ptax 245 Form involves a few straightforward steps. First, property owners need to gather all necessary information regarding their property, including its current market value, any improvements made, and applicable exemptions. Once this information is collected, the form can be filled out accurately. It is important to follow the instructions provided on the form carefully to ensure that all sections are completed correctly. After filling out the form, it should be submitted to the appropriate local tax authority for processing.

Steps to complete the Ptax 245 Form

Completing the Ptax 245 Form requires attention to detail. Here are the steps to follow:

- Gather necessary documents, including property deeds and previous tax statements.

- Determine the current market value of your property through appraisal or comparative market analysis.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form to your local tax authority by the specified deadline.

Legal use of the Ptax 245 Form

The Ptax 245 Form is legally binding when completed and submitted in accordance with local regulations. It serves as an official declaration of property value and is used by tax authorities to assess property taxes. To ensure its legal standing, property owners must provide truthful and accurate information. Misrepresentation or failure to file the form can lead to penalties, including fines or increased property tax assessments.

Filing Deadlines / Important Dates

Filing deadlines for the Ptax 245 Form vary by jurisdiction. Typically, property owners must submit the form by a specified date each year to ensure their property is assessed correctly for the upcoming tax year. It is essential to check with local tax authorities for specific deadlines to avoid late penalties. Marking these dates on a calendar can help ensure timely submission.

Who Issues the Form

The Ptax 245 Form is issued by local tax authorities or property assessment offices. Each state may have its own version of the form, tailored to meet specific local requirements. Property owners should obtain the form directly from their local tax office or its official website to ensure they are using the correct and most current version.

Quick guide on how to complete ptax 245 form

Effortlessly Prepare Ptax 245 Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Ptax 245 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

Edit and eSign Ptax 245 Form with Ease

- Locate Ptax 245 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you would like to share your form, by email, SMS, or invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Alter and eSign Ptax 245 Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 245 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ptax 245 Form and why do I need it?

The Ptax 245 Form is an important document used for property tax assessment in certain regions. Businesses need it to accurately report property values, ensuring they meet local tax obligations. Utilizing the airSlate SignNow platform can streamline the process of preparing and signing the Ptax 245 Form efficiently.

-

How can airSlate SignNow help with completing the Ptax 245 Form?

airSlate SignNow provides an intuitive platform to fill out the Ptax 245 Form accurately and quickly. With user-friendly templates and eSigning capabilities, you can complete and submit necessary documents without the hassle of paper forms. This improves efficiency and reduces the likelihood of errors during form submission.

-

Is there a cost associated with using airSlate SignNow for the Ptax 245 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, allowing you to choose the level of service that fits your budget. Each plan provides features to streamline the signing process, including handling the Ptax 245 Form. Visit the pricing page for detailed information on costs and features.

-

What features does airSlate SignNow offer for the Ptax 245 Form?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking that are perfect for managing the Ptax 245 Form. You can enjoy easy collaboration with team members and any necessary stakeholders, enhancing the efficiency of your document management processes.

-

Can I integrate airSlate SignNow with other software for the Ptax 245 Form?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to manage the Ptax 245 Form alongside your existing workflows. Whether it's CRM systems, document storage, or accounting software, integrations help maintain a cohesive operational flow.

-

What are the benefits of using airSlate SignNow for the Ptax 245 Form?

Using airSlate SignNow for the Ptax 245 Form streamlines your property tax reporting process, saves time, and reduces paperwork. The secure eSigning feature ensures your documents are legally binding and protected, giving you peace of mind as you manage your tax obligations.

-

How do I get started with airSlate SignNow for the Ptax 245 Form?

Getting started with airSlate SignNow for the Ptax 245 Form is easy! Simply sign up for an account, select the Ptax 245 Form template, and fill in the necessary details. You can start eSigning immediately, making your tax management process much more efficient.

Get more for Ptax 245 Form

- Painting contract for contractor hawaii form

- Trim carpenter contract for contractor hawaii form

- Fencing contract for contractor hawaii form

- Hvac contract for contractor hawaii form

- Landscape contract for contractor hawaii form

- Commercial contract for contractor hawaii form

- Excavator contract for contractor hawaii form

- Renovation contract for contractor hawaii form

Find out other Ptax 245 Form

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation