Payroll Calculation Worksheet LFS Pro Form

What is the payroll calculation worksheet?

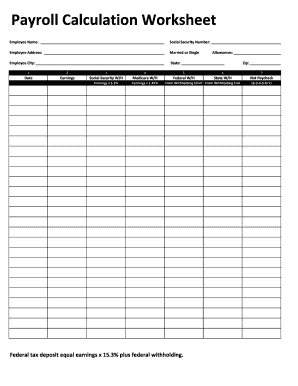

The payroll calculation worksheet is a crucial document used by businesses to calculate employee wages, deductions, and taxes. This worksheet helps ensure that payroll is processed accurately, reflecting all necessary withholdings such as federal and state taxes, Social Security, and Medicare contributions. By utilizing this form, employers can maintain compliance with tax regulations while providing clear records for their employees.

How to use the payroll calculation worksheet

Using the payroll calculation worksheet involves several straightforward steps. First, gather all relevant employee information, including hours worked, pay rates, and any applicable deductions. Next, input this data into the designated sections of the worksheet. Calculate gross pay by multiplying the number of hours worked by the hourly rate. Then, subtract any deductions to arrive at the net pay. This process ensures that all calculations are transparent and verifiable for both the employer and employee.

Steps to complete the payroll calculation worksheet

Completing the payroll calculation worksheet requires attention to detail. Follow these steps:

- Collect employee data, including name, Social Security number, and pay rate.

- Record the total hours worked during the pay period.

- Calculate gross pay by multiplying hours worked by the pay rate.

- Identify and list all deductions, such as taxes and benefits.

- Subtract total deductions from gross pay to find net pay.

- Review the completed worksheet for accuracy before finalizing payroll.

Key elements of the payroll calculation worksheet

Several key elements must be included in the payroll calculation worksheet to ensure accuracy and compliance:

- Employee Information: Name, Social Security number, and pay rate.

- Hours Worked: Total hours for the pay period, including regular and overtime hours.

- Gross Pay: Total earnings before deductions.

- Deductions: Federal and state taxes, Social Security, Medicare, and any other withholdings.

- Net Pay: Final amount received by the employee after all deductions.

Legal use of the payroll calculation worksheet

The payroll calculation worksheet serves as an important legal document that helps businesses comply with federal and state employment laws. Accurate payroll records are essential for tax reporting and can be required during audits. Employers must retain these records for a specified period to ensure they meet legal obligations. By using a standardized worksheet, businesses can demonstrate adherence to regulations and provide clarity in their payroll processes.

IRS guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding payroll calculations and tax withholdings. Employers must familiarize themselves with these guidelines to ensure compliance. This includes understanding tax rates, filing requirements, and deadlines for submitting payroll taxes. The IRS also offers resources to assist businesses in accurately completing payroll calculations and maintaining proper records.

Quick guide on how to complete payroll calculation worksheet lfs pro

Easily Prepare Payroll Calculation Worksheet LFS Pro on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers a great eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Payroll Calculation Worksheet LFS Pro on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Modify and eSign Payroll Calculation Worksheet LFS Pro Effortlessly

- Find Payroll Calculation Worksheet LFS Pro and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Alter and eSign Payroll Calculation Worksheet LFS Pro while guaranteeing outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll calculation worksheet lfs pro

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll calculation worksheet?

A payroll calculation worksheet is a tool used to summarize and calculate employee wages, deductions, and taxes for payroll processing. It helps businesses ensure accurate and efficient payroll management, ultimately leading to timely payments and compliance with tax regulations.

-

How can airSlate SignNow help with payroll calculation?

airSlate SignNow streamlines the process of managing payroll calculation worksheets by allowing users to easily send, sign, and store payroll documents securely. This enhances collaboration among HR professionals and provides a reliable process for keeping payroll records organized and accessible.

-

What features does airSlate SignNow offer for payroll management?

With airSlate SignNow, users can utilize features such as template creation for payroll calculation worksheets, electronic signatures for approvals, and document storage for compliance and auditing purposes. These features simplify the payroll process and ensure businesses can efficiently manage their documents.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By utilizing our platform, companies can streamline their payroll calculation worksheet process and save on costs associated with manual paperwork and inefficiencies.

-

Can airSlate SignNow integrate with other payroll systems?

Absolutely! airSlate SignNow offers integrations with various payroll systems, allowing seamless data transfer and document management. This ensures that your payroll calculation worksheet aligns with your existing processes and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for payroll documents?

Using airSlate SignNow for payroll calculation worksheets enhances accuracy, reduces time spent on manual processing, and minimizes the risk of errors. Furthermore, our electronic signature capabilities ensure that payroll documents are legally binding and compliant with industry standards.

-

Is it easy to set up and start using airSlate SignNow for payroll calculations?

Yes, airSlate SignNow is user-friendly and easy to set up. Once you create your account, you can quickly create and share your payroll calculation worksheets, making the transition smooth for your team.

Get more for Payroll Calculation Worksheet LFS Pro

- Warranty deed for separate or joint property to joint tenancy hawaii form

- Warranty deed to separate property of one spouse to both spouses as joint tenants hawaii form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries hawaii form

- Warranty deed from limited partnership or llc is the grantor or grantee hawaii form

- Hawaii quitclaim deed 497304723 form

- Warranty deed from individual to trustees hawaii form

- Hawaii warranty 497304725 form

- Quitclaim deed trust to husband and wife hawaii form

Find out other Payroll Calculation Worksheet LFS Pro

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy