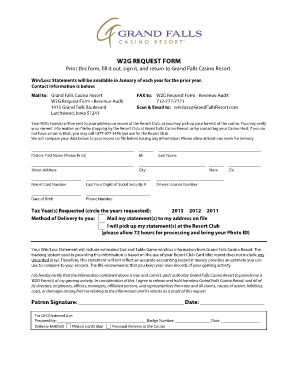

W2g Form

What makes the w2g form legally binding?

Because the world takes a step away from in-office work, the execution of documents increasingly takes place electronically. The w2g form isn’t an exception. Working with it using electronic tools is different from doing so in the physical world.

An eDocument can be viewed as legally binding given that certain needs are fulfilled. They are especially critical when it comes to signatures and stipulations associated with them. Typing in your initials or full name alone will not ensure that the institution requesting the sample or a court would consider it accomplished. You need a trustworthy solution, like airSlate SignNow that provides a signer with a electronic certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your w2g form when filling out it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make document execution legal and safe. Furthermore, it provides a lot of possibilities for smooth completion security smart. Let's quickly run through them so that you can stay assured that your w2g form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy regulations in the USA and Europe.

- Two-factor authentication: adds an extra layer of security and validates other parties identities through additional means, like an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information securely to the servers.

Filling out the w2g form with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete w2g form

Ease of Preparing W2g Form on Any Device

The management of online documents has gained traction among companies and individuals alike. It offers an ideal, eco-conscious substitute for conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents swiftly without any hold-ups. Manage W2g Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

Effortlessly Modify and eSign W2g Form

- Find W2g Form and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form: email, text message (SMS), or an invitation link, or download it directly to your PC.

Eliminate concerns about lost or misfiled documents, painstaking form searches, or errors necessitating new document prints. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you select. Modify and eSign W2g Form to ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w2g form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W2g Form and why is it important?

The W2g Form is a tax document used to report gambling winnings to the IRS. It's important because it ensures that both the payer and recipient report the correct income for tax purposes. Accurately completing the W2g Form can prevent tax issues and fines.

-

How can airSlate SignNow help with the W2g Form?

AirSlate SignNow simplifies the process of creating, sending, and eSigning the W2g Form. With our user-friendly interface, you can efficiently handle all necessary documentation, ensuring compliance and timely submissions. Plus, our platform minimizes the risk of errors in tax reporting.

-

What features does airSlate SignNow offer for the W2g Form?

AirSlate SignNow offers features tailored for the W2g Form, including customizable templates, secure eSigning, and automated reminders. Additionally, our platform allows for real-time tracking of document status, making it easier to manage submissions. These features help streamline your workflow and enhance accuracy.

-

Are there any costs associated with using airSlate SignNow for the W2g Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs while providing excellent value for managing the W2g Form. Our plans are designed to fit budgets of all sizes, from small businesses to large enterprises, with scalable options as your needs grow.

-

Can I integrate airSlate SignNow with other software for the W2g Form?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, providing a smooth process for managing your W2g Form. This integration allows for automatic data transfer, eliminating manual entry and reducing errors, which saves time and effort.

-

Is it easy to learn how to use airSlate SignNow for the W2g Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy to learn how to manage your W2g Form. Our intuitive interface and helpful resources, including tutorials and customer support, ensure you can quickly become proficient in using the platform.

-

What are the benefits of using airSlate SignNow for tax-related documents like the W2g Form?

Using airSlate SignNow for the W2g Form offers several benefits, including enhanced efficiency, improved accuracy, and secure document handling. With our platform, you can save time on administrative tasks and focus on core business activities while ensuring compliance with tax regulations.

Get more for W2g Form

Find out other W2g Form

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document