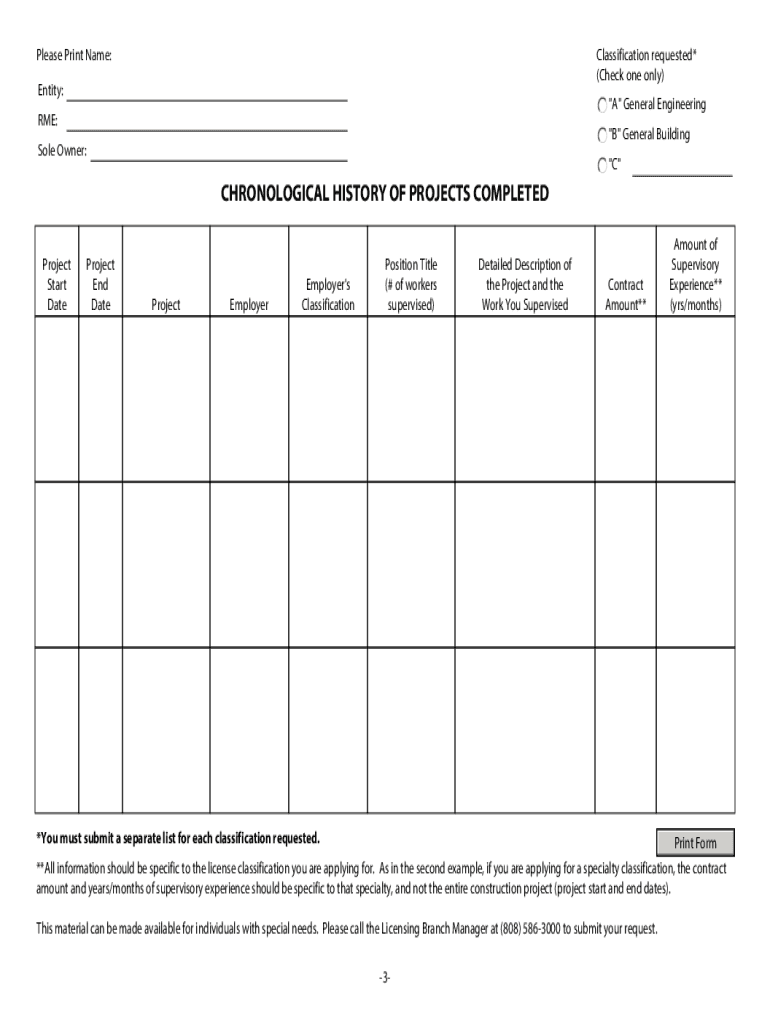

Chronological History of Projects Form

What is the form 5498?

The form 5498 is an IRS document used to report contributions to individual retirement accounts (IRAs). It provides essential information about contributions made to traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. This form is crucial for both taxpayers and the IRS, as it helps ensure that contributions are reported accurately and that taxpayers comply with contribution limits. The form includes details such as the type of IRA, the amount contributed, and the fair market value of the account at year-end.

Filing deadlines and important dates

Understanding the filing deadlines for form 5498 is essential for compliance. The IRS typically requires that form 5498 be filed by May 31 of the year following the tax year for which contributions were made. This gives taxpayers ample time to make contributions for the previous tax year, as contributions can often be made up until the tax filing deadline, which is usually April 15. It is important to keep track of these dates to avoid penalties and ensure accurate reporting.

Steps to complete the form 5498

Completing form 5498 involves several straightforward steps. Begin by entering your personal information, including your name, address, and Social Security number. Next, indicate the type of IRA for which you are reporting contributions. Then, fill in the total contributions made during the tax year, ensuring that you adhere to the annual contribution limits set by the IRS. Finally, report the fair market value of the account as of December 31 of the tax year. It is advisable to review the form for accuracy before submission.

IRS guidelines for form 5498

The IRS provides specific guidelines for completing and filing form 5498. These guidelines outline the types of contributions that must be reported, including regular contributions, rollover contributions, and conversions. It is essential to understand these requirements to ensure compliance and avoid potential issues with the IRS. Additionally, the IRS emphasizes the importance of accurate reporting, as discrepancies can lead to audits or penalties.

Legal use of form 5498

Form 5498 serves a legal purpose in documenting contributions to IRAs, making it a critical component of tax compliance. The information reported on the form is used by the IRS to verify that taxpayers are adhering to contribution limits and other regulations. Properly completing and submitting this form ensures that taxpayers can take advantage of the tax benefits associated with their retirement accounts. It is important to maintain a copy of the form for personal records as well.

Who issues the form 5498?

Form 5498 is typically issued by the financial institution or custodian that manages the IRA. These institutions are responsible for reporting the contributions made to the account and providing the necessary information to both the IRS and the account holder. It is essential for taxpayers to ensure that they receive their copy of form 5498 from their financial institution, as it contains critical information needed for accurate tax reporting.

Quick guide on how to complete chronological history of projects form

Accomplish Chronological History Of Projects Form seamlessly on any device

Managing online documents has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as it allows you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Chronological History Of Projects Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to alter and electronically sign Chronological History Of Projects Form effortlessly

- Obtain Chronological History Of Projects Form and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes a matter of seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from a device of your choice. Alter and electronically sign Chronological History Of Projects Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chronological history of projects form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5498 IRS?

Form 5498 IRS is a tax form used by financial institutions to report contributions to individual retirement accounts (IRAs) and other qualified plans. This form provides important information about contributions made and is essential for taxpayers to accurately file their taxes. It's crucial to keep this form for your records, as it can impact your retirement planning.

-

How can airSlate SignNow help with form 5498 IRS?

AirSlate SignNow offers a streamlined process for signing and sending form 5498 IRS securely and efficiently. With our user-friendly interface, users can easily fill out the form, eSign it, and send it to financial institutions or clients. This simplifies the document management process greatly, ensuring compliance and timely submission.

-

Is airSlate SignNow cost-effective for managing form 5498 IRS?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing documents, including form 5498 IRS. Our pricing plans are flexible and cater to businesses of all sizes, allowing you to choose the features that best fit your needs without breaking the bank. The efficiency gained can lead to signNow cost savings over time.

-

What features does airSlate SignNow offer for form 5498 IRS?

AirSlate SignNow includes several features that enhance the management of form 5498 IRS, such as templates, eSignature capabilities, and in-app workflow automation. These features allow users to simplify the entire process, reduce errors, and ensure all documents are completed accurately and securely. With real-time tracking, you can also keep an eye on document status efficiently.

-

Can I integrate airSlate SignNow with other software for managing form 5498 IRS?

Absolutely! AirSlate SignNow offers integrations with various software applications, making it easier to manage form 5498 IRS and other documents. Whether you’re using accounting software, CRM systems, or cloud storage solutions, our platform can be connected seamlessly to streamline your workflows and enhance productivity.

-

What are the benefits of using airSlate SignNow for form 5498 IRS processing?

Using airSlate SignNow for processing form 5498 IRS offers numerous benefits including faster turnaround times, improved accuracy, and enhanced security for your sensitive information. Our electronic signature solution ensures that documents are signed in compliance with legal standards while providing a trackable audit trail. This ultimately increases efficiency and minimizes frustrations for businesses and their customers.

-

Is there customer support available for airSlate SignNow users handling form 5498 IRS?

Yes, airSlate SignNow provides robust customer support to assist users with any questions related to form 5498 IRS and its features. Our support team is available to guide users through the document preparation and signing processes, ensuring they get the most out of our platform. Help is just a click away, enhancing the overall user experience.

Get more for Chronological History Of Projects Form

- How to fill out bankruptcy schedule c the property you claim form

- Add the amounts of all form

- Schedule d creditors holding secured claims superseded form

- Form leases pdffiller

- Fillable online caeb uscourts schedule i current income of form

- 1 67 sample master mailing list requirements pursuant to form

- Statement of financial affairs for individuals filing for form

- United nations framework convention on climate unfccc form

Find out other Chronological History Of Projects Form

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online