Ftb Form 3522

What is the Ftb Form 3522

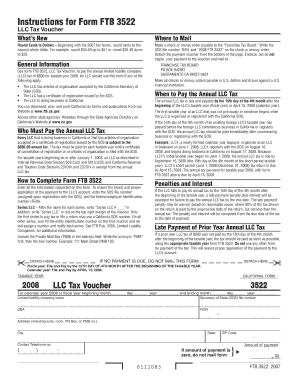

The Ftb Form 3522, also known as the LLC Tax Voucher, is a crucial document used by Limited Liability Companies (LLCs) in California. This form is specifically designed to facilitate the payment of the annual minimum franchise tax to the California Franchise Tax Board (FTB). The Ftb Form 3522 ensures that LLCs remain compliant with state tax obligations, which is essential for maintaining good standing and avoiding penalties.

How to use the Ftb Form 3522

Using the Ftb Form 3522 involves several straightforward steps. First, ensure that your LLC is registered with the California Secretary of State. Once registered, you can access the form online or through the FTB. Fill out the required information, including your LLC's name, address, and the amount due. After completing the form, submit it along with your payment to the FTB by the specified deadline. This process can be done electronically, making it convenient for business owners.

Steps to complete the Ftb Form 3522

Completing the Ftb Form 3522 requires attention to detail. Follow these steps:

- Gather necessary information about your LLC, including the entity number and tax identification number.

- Access the Ftb Form 3522 from the California Franchise Tax Board website.

- Fill in the required fields, ensuring accuracy in your LLC's details and payment amount.

- Review the form for any errors or omissions.

- Submit the form electronically or print it for mailing, along with your payment.

Legal use of the Ftb Form 3522

The legal use of the Ftb Form 3522 is essential for compliance with California tax laws. Filing this form ensures that your LLC meets its annual tax obligations, which helps avoid penalties and interest charges. The form must be submitted by the due date to maintain compliance and protect your business's legal standing. Proper execution of the form also provides a record of payment, which can be important for future reference.

Key elements of the Ftb Form 3522

The Ftb Form 3522 includes several key elements that are important for accurate completion. These elements include:

- LLC Name: The legal name of your Limited Liability Company.

- Entity Number: The unique identification number assigned to your LLC by the California Secretary of State.

- Payment Amount: The minimum franchise tax amount due, which is subject to change based on state regulations.

- Signature: An authorized representative of the LLC must sign the form to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Ftb Form 3522 are critical for maintaining compliance. Typically, the form must be submitted by the 15th day of the fourth month after the close of your LLC's tax year. For most LLCs operating on a calendar year, this means the deadline is April 15. It is important to keep track of these dates to avoid late fees and penalties.

Quick guide on how to complete ftb form 3522 16984843

Effortlessly Prepare Ftb Form 3522 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage Ftb Form 3522 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric operation today.

Edit and eSign Ftb Form 3522 with Ease

- Obtain Ftb Form 3522 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight signNow portions of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your adjustments.

- Select how you would like to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ftb Form 3522 and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb form 3522 16984843

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ftb form 3522?

The ftb form 3522, also known as the Vehicle Registration Fee, is a form required by the California Franchise Tax Board for certain vehicles. It is used to calculate and report vehicle registration fees owed to the state. Completing the ftb form 3522 is essential for anyone looking to comply with California's vehicle regulations.

-

How can airSlate SignNow help with ftb form 3522?

airSlate SignNow provides a streamlined way to eSign and send the ftb form 3522, making it easier to submit your documents efficiently. With its user-friendly interface, you can quickly upload your form and add signatures from multiple parties. This reduces the hassle of printing and mailing, ensuring timely submissions.

-

Is there a cost to use airSlate SignNow for ftb form 3522?

Yes, using airSlate SignNow involves a subscription fee, which varies based on the features you choose. Our pricing is designed to be cost-effective, providing access to tools that simplify the process of managing the ftb form 3522 and other documents. Consider the value of saving time and improving compliance when evaluating costs.

-

Are there any integrations available with airSlate SignNow for ftb form 3522?

airSlate SignNow offers seamless integrations with various applications, including CRMs and document management systems, which can support the processing of the ftb form 3522. These integrations help automate workflows, enabling faster transactions and better document organization. Check our integration options to find what suits your needs best.

-

What features does airSlate SignNow offer for processing ftb form 3522?

Our platform provides key features such as electronic signatures, document management, and templates specifically designed for forms like the ftb form 3522. These features enable users to efficiently fill out, sign, and store forms in a secure environment. This enhances collaboration and compliance for all participants involved.

-

Can I track the status of my ftb form 3522 with airSlate SignNow?

Yes, you can easily track the status of your ftb form 3522 through airSlate SignNow’s dashboard. It allows you to see who has viewed, signed, or returned the document, ensuring transparency during the entire process. This feature helps you stay informed and meet deadlines with confidence.

-

What are the benefits of using airSlate SignNow for ftb form 3522 over traditional methods?

Using airSlate SignNow for your ftb form 3522 offers signNow benefits over traditional paper methods, including reduced processing time, increased security, and the elimination of mailing costs. Electronic signatures are legally binding and accepted by government agencies, providing peace of mind in your compliance efforts. Transitioning to digital methods leads to overall improved efficiency.

Get more for Ftb Form 3522

- Indiana standby form

- Notice appeal form 497307007

- Destruction certification form indiana

- Indiana bankruptcy 13 form

- Indiana southern district bankruptcy guide and forms package for chapters 7 or 13 indiana

- Bill sale warranty form

- Bill of sale with warranty for corporate seller indiana form

- Bill of sale without warranty by individual seller indiana form

Find out other Ftb Form 3522

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement