Ri 009 Form

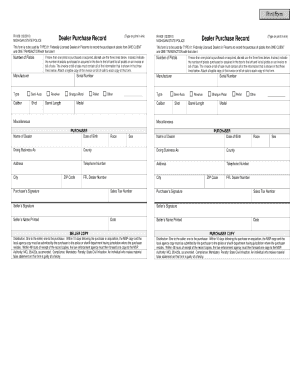

What is the Ri 009 Form

The Ri 009 Form is a specific document used in various administrative processes. It serves particular functions depending on the context in which it is utilized. Understanding its purpose is crucial for ensuring compliance and effective communication with relevant authorities. This form may be associated with applications, requests, or declarations that require formal submission to governmental or organizational entities.

How to obtain the Ri 009 Form

Obtaining the Ri 009 Form is a straightforward process. Individuals can typically access the form through official government websites or designated offices that handle its distribution. It is important to ensure that you are downloading the most current version of the form to avoid any issues during submission. Some organizations may also provide the form in physical locations, allowing for in-person acquisition.

Steps to complete the Ri 009 Form

Completing the Ri 009 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information and documents that may be required for the form. Next, carefully fill out each section, ensuring that all details are correct and clearly legible. After completing the form, review it thoroughly for any errors or omissions. Finally, sign and date the form as required before submitting it to the appropriate authority.

Legal use of the Ri 009 Form

The legal use of the Ri 009 Form is contingent upon adherence to specific guidelines and regulations. To be considered valid, the form must be completed accurately and submitted in accordance with the relevant laws governing its use. This includes ensuring that any signatures are properly executed and that all required documentation is included. Understanding the legal implications of the form is essential for its acceptance by the receiving entity.

Key elements of the Ri 009 Form

Key elements of the Ri 009 Form include the sections that require specific information, such as personal details, dates, and any relevant identifiers. Each part of the form serves a distinct purpose, contributing to the overall function of the document. It is important to pay attention to these elements to ensure that the form is completed correctly and fulfills its intended purpose.

Form Submission Methods

The Ri 009 Form can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include online submission, mailing the completed form, or delivering it in person to the appropriate office. Each method may have specific guidelines and deadlines, so it is advisable to check the instructions provided with the form to ensure compliance.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Ri 009 Form can result in penalties. These penalties may vary depending on the nature of the non-compliance, such as late submission or incomplete information. Understanding the potential consequences is important for individuals and businesses to avoid unnecessary complications and ensure that all submissions are handled appropriately.

Quick guide on how to complete ri 009 form

Effortlessly prepare Ri 009 Form on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed materials, as you can locate the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage Ri 009 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Ri 009 Form with ease

- Obtain Ri 009 Form and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which is completed in seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign Ri 009 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 009 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ri 009 Form and how is it used?

The Ri 009 Form is a specific document designed for various administrative purposes. It is often used in regulatory or compliance contexts, making it essential for businesses to familiarize themselves with its requirements. With airSlate SignNow, you can easily fill out and eSign the Ri 009 Form, ensuring it is processed efficiently.

-

How does airSlate SignNow help with the Ri 009 Form?

airSlate SignNow streamlines the completion and signing of the Ri 009 Form with its user-friendly interface. Users can quickly fill in necessary information and send the form for electronic signatures. This not only saves time but also reduces errors associated with manual handling of the form.

-

Is there a cost associated with using airSlate SignNow for the Ri 009 Form?

Yes, airSlate SignNow offers several pricing plans, each designed to suit different business needs. Users can select a plan based on their frequency of use and the number of users needing access to the Ri 009 Form. The pricing is competitive, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for the Ri 009 Form?

AirSlate SignNow provides various features to enhance the experience of managing the Ri 009 Form. These include templates for easy reuse, integration with cloud storage, and real-time tracking of form status. These tools help ensure that the form is handled efficiently from start to finish.

-

Can I integrate airSlate SignNow with other applications for the Ri 009 Form?

Absolutely! airSlate SignNow allows for seamless integration with numerous applications, streamlining your workflow when handling the Ri 009 Form. Whether it’s a CRM, cloud storage, or project management tool, you can connect your systems to enhance productivity and reduce manual tasks.

-

What are the benefits of using airSlate SignNow for the Ri 009 Form?

Using airSlate SignNow for the Ri 009 Form provides numerous benefits, including quick turnaround times, reduced paperwork, and enhanced security. Electronic signatures are legally binding, making your transactions secure and verifiable. Additionally, the visual audit trails help maintain compliance and accountability.

-

Is airSlate SignNow mobile-friendly for signing the Ri 009 Form?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to access and sign the Ri 009 Form from any device. This flexibility ensures you can manage your documents wherever you are, which is especially beneficial for busy professionals and on-the-go users.

Get more for Ri 009 Form

- Life documents planning package including will power of attorney and living will indiana form

- General durable power of attorney for property and finances or financial effective upon disability indiana form

- Essential legal life documents for baby boomers indiana form

- General durable power of attorney for property and finances or financial effective immediately indiana form

- Revocation of general durable power of attorney indiana form

- Essential legal life documents for newlyweds indiana form

- Essential legal life documents for military personnel indiana form

- Essential legal life documents for new parents indiana form

Find out other Ri 009 Form

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure