1040a Form

What is the 1040A Form

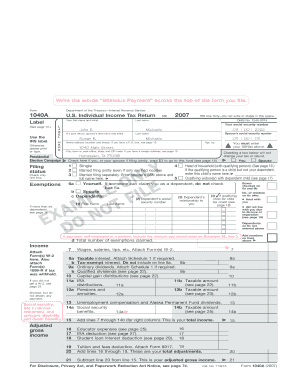

The 1040A form is a simplified version of the standard IRS Form 1040, designed for taxpayers with straightforward tax situations. This form allows individuals to report income, claim deductions, and calculate their tax liability. It is particularly suited for those with income from wages, salaries, pensions, and interest, as well as certain tax credits. The 1040A form streamlines the filing process for eligible taxpayers, making it easier to complete their tax returns without the complexity of additional schedules.

How to Use the 1040A Form

Using the 1040A form involves several key steps. First, gather all necessary documentation, such as W-2 forms, 1099 forms, and records of any other income. Next, follow the instructions provided on the form to fill in your personal information, including your filing status and dependents. Report your income in the designated sections, and claim any deductions or credits you qualify for. Finally, review your completed form for accuracy before submitting it to the IRS, either electronically or by mail.

Steps to Complete the 1040A Form

Completing the 1040A form requires careful attention to detail. Start by entering your personal information at the top of the form. Then, proceed to report your income, ensuring you include all relevant sources. Next, claim any adjustments to income, such as educator expenses or student loan interest. After calculating your adjusted gross income, apply any deductions and credits available to you. Finally, determine your tax liability and any refund or amount owed before signing and dating the form.

Legal Use of the 1040A Form

The 1040A form is legally recognized by the IRS as a valid means for reporting income and calculating taxes. To ensure compliance, taxpayers must accurately complete the form and submit it by the designated filing deadline. Failure to file correctly can result in penalties or interest on unpaid taxes. It is essential to retain copies of the submitted form and any supporting documentation for at least three years in case of an audit.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines when filing the 1040A form. The standard deadline for submitting your federal tax return is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension, typically allowing for an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To complete the 1040A form accurately, several documents are essential. These include W-2 forms from employers, 1099 forms for other income sources, and documentation for any deductions or credits claimed. Taxpayers should also gather records of interest income, dividends, and any other pertinent financial information. Having these documents organized will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete 1040a form 5430840

Finalize 1040a Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely store it digitally. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage 1040a Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign 1040a Form without hassle

- Find 1040a Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as an ordinary ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Alter and electronically sign 1040a Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040a form 5430840

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040a form and how is it used?

The 1040a form is a simplified version of the U.S. Individual Income Tax Return designed for taxpayers with straightforward tax situations. It allows you to report income, claim tax credits, and calculate your tax refund or amount owed. Using the 1040a form can streamline the filing process, making it easier for you to meet tax obligations.

-

Can I eSign my 1040a form using airSlate SignNow?

Yes, with airSlate SignNow, you can easily eSign your 1040a form and submit it securely. Our platform offers a user-friendly interface that allows for quick signing of documents, ensuring you can complete your tax paperwork promptly. Digital signatures on the 1040a form enhance security and simplify the submission process.

-

What features does airSlate SignNow offer for managing the 1040a form?

airSlate SignNow provides features such as document templates, real-time collaboration, and secure cloud storage to help you manage your 1040a form efficiently. You can create, edit, and share your forms with ease, ensuring every aspect of your tax return is covered. Additionally, automated reminders for signing and deadlines keep you on track.

-

Is airSlate SignNow cost-effective for filing the 1040a form?

Absolutely! airSlate SignNow offers a cost-effective solution that can save you both time and money when filing your 1040a form. With flexible pricing plans, you can choose a subscription that fits your needs, and the efficiency of our platform can lead to savings on professional tax services. Experience the value of eSigning and managing your documents all in one place.

-

How does airSlate SignNow ensure the security of my 1040a form?

Security is a top priority at airSlate SignNow. Your 1040a form is protected with bank-level encryption and secure storage options, ensuring your sensitive data remains safe. We comply with legal standards and provide authentication methods so you can eSign your forms confidently, knowing that your information is safeguarded.

-

Can I integrate airSlate SignNow with other tax preparation tools for my 1040a form?

Yes, airSlate SignNow seamlessly integrates with various tax preparation tools to streamline the process of submitting your 1040a form. These integrations enhance workflow by allowing you to access important documents in one place. By connecting your preferred tools with airSlate SignNow, you can optimize your tax filing experience.

-

What are the benefits of using airSlate SignNow for my 1040a form?

Using airSlate SignNow to manage your 1040a form comes with numerous benefits, including simplified eSigning, quick document sharing, and efficient collaboration. Our platform enhances productivity by reducing the time spent on paperwork, allowing you to focus on other important tasks. Plus, our intuitive interface makes it easy for anyone to use, regardless of tech skills.

Get more for 1040a Form

- Employment or job termination package kentucky form

- Newly widowed individuals package kentucky form

- Employment interview package kentucky form

- Employment employee personnel file package kentucky form

- Assignment of mortgage package kentucky form

- Assignment of lease package kentucky form

- Lease purchase agreements package kentucky form

- Satisfaction cancellation or release of mortgage package kentucky form

Find out other 1040a Form

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free