OUT of STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth of Kentucky DEPARTMENT of REVENUE Document for Use by Taxpayers Form

What is the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09?

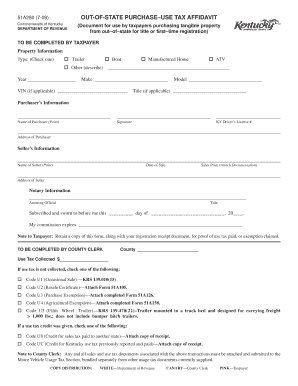

The OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 is a legal document issued by the Commonwealth of Kentucky's Department of Revenue. It is designed for taxpayers who purchase tangible property from out of state and need to report this transaction for tax purposes. This affidavit serves as a declaration that the taxpayer has acquired property outside of Kentucky and is responsible for remitting the appropriate use tax to the state. It is essential for ensuring compliance with state tax laws and avoiding penalties.

How to use the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09

To use the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09, taxpayers must fill out the form accurately, providing necessary details such as the type of property purchased, the purchase price, and the seller's information. Once completed, the affidavit should be submitted to the Kentucky Department of Revenue along with any required payments. It is important to keep a copy of the affidavit for personal records and future reference.

Steps to complete the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09

Completing the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 involves several key steps:

- Obtain the latest version of the affidavit from the Kentucky Department of Revenue.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Provide details about the tangible property purchased, including description, purchase date, and amount paid.

- Sign and date the affidavit to certify that the information provided is accurate.

- Submit the completed affidavit to the appropriate state agency, along with any required payment.

Key elements of the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09

Key elements of the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 include:

- Taxpayer Information: Name, address, and taxpayer identification number.

- Property Details: Description of the tangible property, including its type and purchase price.

- Purchase Information: Date of purchase and seller's information.

- Signature: A declaration by the taxpayer affirming the accuracy of the provided information.

Legal use of the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09

The OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 is legally binding when properly filled out and submitted. It must comply with Kentucky state laws regarding use tax on out-of-state purchases. By submitting this affidavit, taxpayers affirm their responsibility to remit the appropriate use tax, thereby ensuring compliance with state tax regulations and avoiding potential legal issues.

State-specific rules for the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09

Each state has specific rules regarding the use of tax affidavits. In Kentucky, the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 must be used for all out-of-state purchases subject to use tax. Taxpayers should familiarize themselves with Kentucky's tax laws, including rates and exemptions, to ensure proper compliance. Failure to adhere to these rules may result in penalties or additional tax liabilities.

Quick guide on how to complete out of state purchase use tax affidavit 51a280 7 09 commonwealth of kentucky department of revenue document for use by

Effortlessly Prepare OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE Document For Use By Taxpayers on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Manage OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE Document For Use By Taxpayers on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to Modify and Electronically Sign OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE Document For Use By Taxpayers with Ease

- Obtain OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE Document For Use By Taxpayers and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE Document For Use By Taxpayers and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the out of state purchase use tax affidavit 51a280 7 09 commonwealth of kentucky department of revenue document for use by

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE document?

The OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE document is essential for taxpayers purchasing tangible property from out of state. It serves as a declaration to ensure that the correct use tax is collected on out-of-state purchases, facilitating compliance with Kentucky tax laws.

-

How can I obtain the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 document?

The OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 document can be obtained directly from the Kentucky Department of Revenue's website. Once there, you can download the form, fill it out, and submit it as needed for your out-of-state purchases.

-

What benefits does using the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 document provide?

Using the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 document can help you avoid possible tax penalties and ensure that you are in compliance with Kentucky tax regulations. This document allows for proper tax reporting when acquiring tangible property from another state.

-

Is there a cost associated with filing the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09?

The OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE document itself is available at no cost to taxpayers. However, ensure you check for any associated fees with the taxable property or the use tax that may apply during your purchase.

-

How does airSlate SignNow support the use of the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 document?

airSlate SignNow offers an efficient solution for sending and eSigning the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 document. Our platform simplifies the signing process, ensuring that you stay compliant while managing your out-of-state purchase documents effortlessly.

-

Can I integrate airSlate SignNow with my existing systems for managing the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09?

Yes, airSlate SignNow can be easily integrated with a variety of existing systems to streamline the management of the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 document. Our integrations help enhance overall document workflow efficiency for taxpayers and businesses alike.

-

What features does airSlate SignNow offer for managing the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 document?

airSlate SignNow provides features such as secure eSigning, document tracking, template creation, and cloud storage. These features ensure that the OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 document is handled efficiently and securely throughout its lifecycle.

Get more for OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE Document For Use By Taxpayers

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497309831 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective form

- Massachusetts property form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective form

- Massachusetts dissolution form

- Massachusetts llc 497309837 form

- Living trust for husband and wife with no children massachusetts form

Find out other OUT OF STATE PURCHASE USE TAX AFFIDAVIT 51A280 7 09 Commonwealth Of Kentucky DEPARTMENT OF REVENUE Document For Use By Taxpayers

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online