Irs F1040sc Form

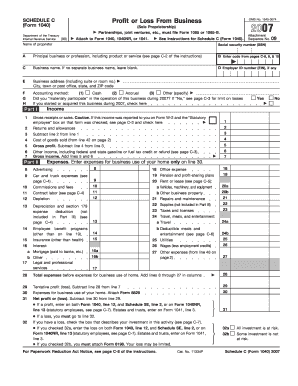

What is the IRS F1040SC?

The IRS F1040SC form is a simplified tax return form specifically designed for certain taxpayers in the United States. It is primarily used by individuals who meet specific criteria, such as those with straightforward tax situations or lower income levels. The F1040SC allows taxpayers to report their income, claim deductions, and calculate their tax liability in a more streamlined manner compared to the standard Form 1040. This form is particularly beneficial for those who may not need to itemize deductions or have complex financial situations.

How to Use the IRS F1040SC

Using the IRS F1040SC involves several straightforward steps. First, ensure that you meet the eligibility requirements to use this form. Next, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Once you have your information ready, fill out the form by entering your income, deductions, and credits as applicable. After completing the form, review it for accuracy before submitting it to the IRS. You can file the F1040SC electronically or by mail, depending on your preference.

Steps to Complete the IRS F1040SC

Completing the IRS F1040SC requires careful attention to detail. Follow these steps for a successful submission:

- Determine your eligibility to use the F1040SC form.

- Collect all relevant financial documents, such as W-2 forms and 1099s.

- Fill out the form by entering your personal information and income details.

- Claim any deductions or credits that apply to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for mailing to the IRS.

Legal Use of the IRS F1040SC

The IRS F1040SC is legally recognized as a valid tax return form when completed and submitted according to IRS guidelines. It is essential to ensure that all information provided is accurate and truthful to avoid potential penalties or legal issues. Filing this form electronically can enhance its legal standing, as eSignatures and digital submissions are compliant with federal regulations. Always keep a copy of your submitted form for your records.

Filing Deadlines / Important Dates

Filing deadlines for the IRS F1040SC follow the same schedule as the standard tax return forms. Typically, individual taxpayers must file their returns by April fifteenth of each year. If you require additional time, you may request an extension, which usually extends the deadline by six months. However, it is crucial to note that an extension to file does not extend the time to pay any taxes owed, which are still due by the original deadline.

Required Documents

To successfully complete the IRS F1040SC, you will need several key documents, including:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as receipts for charitable contributions

- Any relevant tax credits information

Form Submission Methods

The IRS F1040SC can be submitted through various methods, providing flexibility for taxpayers. You may choose to file electronically using IRS-approved e-filing software, which often simplifies the process and allows for quicker processing times. Alternatively, you can print the completed form and mail it to the IRS. Ensure that you send it to the correct address based on your state of residence to avoid delays in processing.

Quick guide on how to complete irs f1040sc

Effortlessly prepare Irs F1040sc on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without holdups. Handle Irs F1040sc on any platform via airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign Irs F1040sc with ease

- Obtain Irs F1040sc and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the specialized tools airSlate SignNow provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as an ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management requirements with just a few clicks, from any device you choose. Alter and electronically sign Irs F1040sc to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs f1040sc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS F1040SC 2007 form used for?

The IRS F1040SC 2007 form is primarily used for reporting income, calculating taxes owed, and claiming any refunds for the tax year 2007. Understanding this form is crucial for accurate tax filing and ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with the IRS F1040SC 2007 form?

AirSlate SignNow streamlines the process of signing and submitting the IRS F1040SC 2007 form. With our platform, you can easily create, send, and eSign documents, enhancing your productivity and ensuring timely submissions.

-

Is there a cost associated with using airSlate SignNow for IRS F1040SC 2007 forms?

Yes, airSlate SignNow offers flexible pricing plans tailored to various business needs. By selecting the appropriate plan, you can access tools that simplify the management of IRS F1040SC 2007 forms at a competitive price.

-

What features does airSlate SignNow provide for handling the IRS F1040SC 2007?

AirSlate SignNow includes features like document templates, collaborative signing, and secure storage that make processing the IRS F1040SC 2007 form efficient. These features help ensure that your documents are completed accurately and securely.

-

Are there any integrations available to help with IRS F1040SC 2007 document processing?

Absolutely! AirSlate SignNow integrates seamlessly with various business applications, allowing for easy management and access of IRS F1040SC 2007 forms. These integrations streamline your workflow, making it easier to gather necessary data and signatures.

-

Can I track the status of my IRS F1040SC 2007 submissions using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that let you monitor the status of your IRS F1040SC 2007 submissions in real-time. You will receive notifications for each step, ensuring you never miss an update on your document's progress.

-

What are the benefits of using airSlate SignNow for IRS F1040SC 2007 forms compared to traditional methods?

Using airSlate SignNow eliminates the need for paper and ink while ensuring your IRS F1040SC 2007 forms are processed quickly. Our platform enhances efficiency, reduces errors, and saves time compared to traditional methods of document handling.

Get more for Irs F1040sc

- Control number wa 015 78 form

- Warrant unto and husband and wife as form

- Prorated between grantors and grantees as of the date form

- Accordance with the applicable laws of the state of washington and form

- Washington to wit form

- Notice to owner corporation form

- Notice of furnishing professional services form

- Unmarried hereinafter grantee the following lands and property together with all form

Find out other Irs F1040sc

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template