Delaware 1120 Amended Form

What is the Delaware 1120 Amended Form

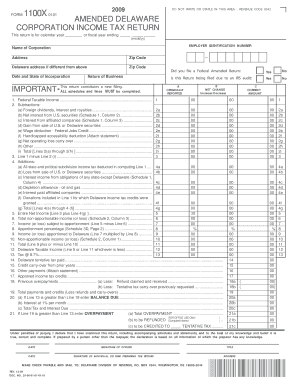

The Delaware 1120 Amended Form is a tax document used by corporations to correct errors or make changes to a previously filed Delaware corporate income tax return. This form allows businesses to amend their reported income, deductions, or credits, ensuring compliance with state tax regulations. It is essential for corporations that need to adjust their tax obligations due to mistakes or new information that affects their tax liability.

How to use the Delaware 1120 Amended Form

To use the Delaware 1120 Amended Form, corporations must first obtain the correct version of the form from the Delaware Division of Revenue. After filling out the necessary sections, including the specific changes being made, the amended form must be submitted along with any required documentation that supports the amendments. It is crucial to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the Delaware 1120 Amended Form

Completing the Delaware 1120 Amended Form involves several key steps:

- Obtain the latest version of the form from the Delaware Division of Revenue website.

- Fill in the corporation's information, including name, address, and federal employer identification number (EIN).

- Indicate the tax year being amended and provide details of the original return.

- Clearly state the changes being made, including any adjustments to income, deductions, or credits.

- Attach any supporting documentation that justifies the amendments.

- Review the completed form for accuracy before submission.

Legal use of the Delaware 1120 Amended Form

The Delaware 1120 Amended Form is legally binding once submitted to the Delaware Division of Revenue. It must comply with all relevant state tax laws and regulations. Corporations are responsible for ensuring that the information provided is truthful and accurate, as any discrepancies may lead to penalties or legal issues. Proper use of this form is crucial for maintaining compliance with state tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware 1120 Amended Form typically align with the original tax return deadlines. Corporations should submit the amended form within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Being aware of these deadlines is essential to avoid late fees and ensure timely processing of the amendments.

Form Submission Methods (Online / Mail / In-Person)

The Delaware 1120 Amended Form can be submitted through various methods:

- Online: Some corporations may have the option to file electronically through the Delaware Division of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate address provided by the Delaware Division of Revenue.

- In-Person: Corporations may also choose to deliver the form in person to the local Division of Revenue office.

Quick guide on how to complete delaware 1120 amended form

Complete Delaware 1120 Amended Form effortlessly on any device

Web-based document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-conscious substitute to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, adjust, and electronically sign your documents swiftly without delays. Handle Delaware 1120 Amended Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The best method to modify and electronically sign Delaware 1120 Amended Form without hassle

- Locate Delaware 1120 Amended Form and click on Get Form to initiate the process.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Delaware 1120 Amended Form and ensure superior communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delaware 1120 amended form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Delaware 1120 Amended Form?

The Delaware 1120 Amended Form is used by corporations to modify their previously filed corporate tax return in Delaware. This form allows businesses to correct any inaccuracies, such as income discrepancies or deductions that were overlooked, ensuring compliance with state tax regulations.

-

How can airSlate SignNow assist with the Delaware 1120 Amended Form?

AirSlate SignNow streamlines the process of preparing and submitting the Delaware 1120 Amended Form by providing an easy-to-use interface for eSigning and sending documents. With our service, you can ensure that your amended form is completed accurately and securely, saving you time and hassle.

-

Is there a cost associated with using airSlate SignNow for the Delaware 1120 Amended Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion of the Delaware 1120 Amended Form, all while being cost-effective for businesses of any size.

-

What features does airSlate SignNow offer for the Delaware 1120 Amended Form?

AirSlate SignNow includes features that simplify the electronic signing process, cloud storage for your documents, and collaboration tools that allow multiple users to engage on the Delaware 1120 Amended Form. These features enhance efficiency and reduce the likelihood of errors.

-

Are there integrations available with airSlate SignNow for filing the Delaware 1120 Amended Form?

Yes, airSlate SignNow integrates seamlessly with various business applications that you may already be using. This includes accounting software and document management systems, allowing for a streamlined workflow when preparing your Delaware 1120 Amended Form.

-

How secure is the process of eSigning the Delaware 1120 Amended Form with airSlate SignNow?

AirSlate SignNow prioritizes security, employing encryption and secure storage methods to protect your documents and personal information. When you use our service to eSign the Delaware 1120 Amended Form, you can be assured that your data is safe and compliant with regulations.

-

Can I track the status of my Delaware 1120 Amended Form with airSlate SignNow?

Absolutely! AirSlate SignNow offers tracking capabilities that allow you to monitor the status of your Delaware 1120 Amended Form at any time. This feature ensures transparency throughout the document signing process, giving you peace of mind.

Get more for Delaware 1120 Amended Form

- Md quitclaim form

- Maryland warranty deed form

- Agreement between a maryland not for profit organization and its members to produce compilation recording with profits to go to form

- Deed parents 497310165 form

- Md special form

- Discovery interrogatories from plaintiff to defendant with production requests maryland form

- Maryland defendant form

- Maryland interrogatories form

Find out other Delaware 1120 Amended Form

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament