Form 1041 U S Income Tax Return for Estates and Trusts Irs

What is the Form 1041 U S Income Tax Return For Estates And Trusts Irs

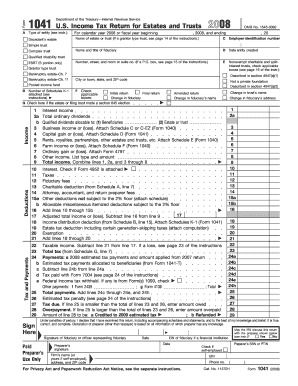

The Form 1041 U S Income Tax Return For Estates And Trusts is a tax document used by estates and trusts to report income, deductions, gains, and losses. This form is essential for fiduciaries managing an estate or trust, as it ensures compliance with federal tax regulations. The income generated by the estate or trust must be reported to the IRS, and the form allows for the calculation of any tax owed. Understanding the purpose of this form is crucial for proper tax reporting and compliance.

Steps to complete the Form 1041 U S Income Tax Return For Estates And Trusts Irs

Completing the Form 1041 involves several key steps:

- Gather all necessary financial documents related to the estate or trust, including income statements, expense records, and prior tax returns.

- Fill out the identifying information, including the name and taxpayer identification number of the estate or trust.

- Report income by entering amounts from various sources, such as dividends, interest, and rental income.

- Deduct allowable expenses, including administrative costs and distributions to beneficiaries, which can reduce taxable income.

- Calculate the total tax liability based on the reported income and deductions.

- Review the completed form for accuracy before submission.

How to obtain the Form 1041 U S Income Tax Return For Estates And Trusts Irs

The Form 1041 can be obtained directly from the IRS website or through various tax preparation software. It is available in PDF format, allowing for easy downloading and printing. Tax professionals may also provide copies of the form as part of their services. Ensure that you have the most recent version of the form to comply with current tax laws.

Legal use of the Form 1041 U S Income Tax Return For Estates And Trusts Irs

The legal use of Form 1041 is critical for ensuring that estates and trusts meet their tax obligations. Filing this form correctly helps avoid penalties and interest charges from the IRS. It is important to adhere to the specific guidelines set forth by the IRS, as failure to do so may result in legal complications. The form must be signed by the fiduciary, affirming that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for Form 1041 are typically set for the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to file the form on time to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

Form 1041 can be submitted through various methods:

- Electronically via IRS e-file services, which is the quickest method for processing.

- By mail, sending the completed form to the appropriate IRS address based on the estate or trust's location.

- In-person submission is generally not available, as the IRS encourages electronic filing for efficiency.

Quick guide on how to complete form 1041 u s income tax return for estates and trusts irs

Complete Form 1041 U S Income Tax Return For Estates And Trusts Irs effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 1041 U S Income Tax Return For Estates And Trusts Irs on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Form 1041 U S Income Tax Return For Estates And Trusts Irs with ease

- Locate Form 1041 U S Income Tax Return For Estates And Trusts Irs and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact confidential information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over missing or lost documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Revise and eSign Form 1041 U S Income Tax Return For Estates And Trusts Irs and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1041 u s income tax return for estates and trusts irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1041 U S Income Tax Return For Estates And Trusts Irs?

Form 1041 U S Income Tax Return For Estates And Trusts Irs is a tax form used by estates and trusts to report their income, deductions, gains, and losses. This form helps fiduciaries accurately report and pay taxes on behalf of the estate or trust. Understanding how to complete this form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow assist with Form 1041 U S Income Tax Return For Estates And Trusts Irs?

airSlate SignNow offers an efficient platform for preparing and signing Form 1041 U S Income Tax Return For Estates And Trusts Irs electronically. Our solution streamlines the process, ensuring that your documents are securely signed and stored, simplifying your tax preparation needs. This saves time and reduces the risk of errors.

-

What features does airSlate SignNow provide for managing Form 1041 U S Income Tax Return For Estates And Trusts Irs?

AirSlate SignNow provides features like document templates, automated workflows, and real-time collaboration for managing Form 1041 U S Income Tax Return For Estates And Trusts Irs. These features enable users to create, edit, and share documents easily. Our platform also offers mobile access, allowing you to manage your forms on-the-go.

-

Is airSlate SignNow cost-effective for preparing Form 1041 U S Income Tax Return For Estates And Trusts Irs?

Yes, airSlate SignNow is designed to be a cost-effective solution for preparing Form 1041 U S Income Tax Return For Estates And Trusts Irs. Our pricing plans are competitive, ensuring that both small and large organizations can afford our services. By minimizing paperwork and enhancing efficiency, our solution can ultimately save you money.

-

Can airSlate SignNow integrate with accounting software for Form 1041 U S Income Tax Return For Estates And Trusts Irs?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software to facilitate the preparation of Form 1041 U S Income Tax Return For Estates And Trusts Irs. This integration enables users to streamline their workflow, ensuring all financial data is easily accessible and up-to-date for accurate tax reporting.

-

What are the benefits of using airSlate SignNow for Form 1041 U S Income Tax Return For Estates And Trusts Irs?

Using airSlate SignNow for Form 1041 U S Income Tax Return For Estates And Trusts Irs offers numerous benefits, including enhanced speed, security, and accessibility. Our platform ensures the documents are signed electronically, making it easier to track and manage submissions. Additionally, the user-friendly interface allows anyone to navigate the process with ease.

-

How does airSlate SignNow ensure the security of Form 1041 U S Income Tax Return For Estates And Trusts Irs data?

AirSlate SignNow prioritizes the security of your data when handling Form 1041 U S Income Tax Return For Estates And Trusts Irs. We implement advanced encryption and security protocols to protect your sensitive information. Furthermore, our regular security updates ensure that your data remains safe, giving you peace of mind while managing important documents.

Get more for Form 1041 U S Income Tax Return For Estates And Trusts Irs

- Offer of settlement minnesota form

- Addendum to stipulation and order amending judgment and decree minnesota form

- Minnesota satisfaction judgment 497312548 form

- Satisfaction of lien on real property minnesota form

- Screening information client interview form minnesota

- Minnesota partition form

- Minnesota service publication form

- Minnesota instructions form

Find out other Form 1041 U S Income Tax Return For Estates And Trusts Irs

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure