ST 236 the South Carolina Department of Revenue Sctax Form

What is the ST 236 The South Carolina Department Of Revenue Sctax

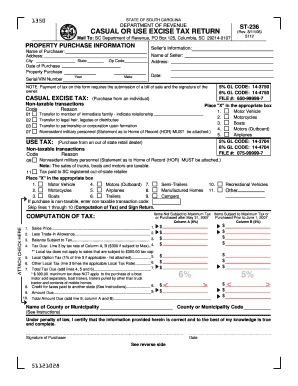

The ST 236 form is a document issued by the South Carolina Department of Revenue, primarily used for reporting and remitting sales and use tax. This form is essential for businesses operating within South Carolina, as it ensures compliance with state tax laws. The ST 236 is designed to facilitate the accurate calculation and timely payment of taxes owed, helping to maintain transparency and accountability in business operations.

How to use the ST 236 The South Carolina Department Of Revenue Sctax

To effectively use the ST 236 form, taxpayers must first gather all necessary sales data, including total sales and any applicable exemptions. The form requires detailed entries of taxable sales, tax rates, and the total tax due. Once completed, the ST 236 should be submitted to the South Carolina Department of Revenue by the specified deadline, either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the ST 236 The South Carolina Department Of Revenue Sctax

Completing the ST 236 involves several key steps:

- Gather sales records and relevant tax information.

- Fill out the form with accurate figures, including total sales and tax collected.

- Review the completed form for accuracy to avoid errors.

- Submit the form by the due date, ensuring compliance with state regulations.

Legal use of the ST 236 The South Carolina Department Of Revenue Sctax

The ST 236 form is legally binding when completed and submitted according to South Carolina tax laws. It serves as an official record of sales tax collected and remitted, and failure to submit the form can result in penalties. Businesses must ensure that all information provided is accurate and truthful to maintain compliance and avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the ST 236 form vary based on the reporting period. Generally, businesses must submit their sales tax returns monthly, quarterly, or annually, depending on their sales volume. It is crucial to be aware of these deadlines to avoid late fees and interest charges. Keeping a calendar of important dates can help businesses stay organized and compliant.

Penalties for Non-Compliance

Failure to file the ST 236 form on time or inaccuracies in reporting can lead to significant penalties. The South Carolina Department of Revenue may impose fines based on the amount of tax due, and interest may accrue on unpaid taxes. Businesses should prioritize timely and accurate submissions to mitigate these risks.

Quick guide on how to complete st 236 the south carolina department of revenue sctax

Easily handle ST 236 The South Carolina Department Of Revenue Sctax on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Manage ST 236 The South Carolina Department Of Revenue Sctax on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

How to edit and electronically sign ST 236 The South Carolina Department Of Revenue Sctax with ease

- Find ST 236 The South Carolina Department Of Revenue Sctax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign ST 236 The South Carolina Department Of Revenue Sctax to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 236 the south carolina department of revenue sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ST 236 The South Carolina Department Of Revenue Sctax?

ST 236 The South Carolina Department Of Revenue Sctax is a specific form used for filing sales and use tax in South Carolina. It is essential for businesses to comply with state tax laws efficiently. Using airSlate SignNow, you can easily complete and eSign this form to ensure timely submissions.

-

How can airSlate SignNow simplify the process of filing ST 236 The South Carolina Department Of Revenue Sctax?

airSlate SignNow streamlines the filing of ST 236 The South Carolina Department Of Revenue Sctax by allowing you to create, send, and eSign documents digitally. This reduces the time and effort spent on paperwork, ensuring you can focus on your business operations while maintaining compliance.

-

What are the pricing options for using airSlate SignNow for ST 236 The South Carolina Department Of Revenue Sctax?

airSlate SignNow offers various pricing plans that cater to different business needs, whether you are a small business or a larger enterprise. Each plan provides access to features that make processing ST 236 The South Carolina Department Of Revenue Sctax both efficient and cost-effective. You can choose a plan that best fits your workflow.

-

Are there any features in airSlate SignNow specifically designed for tax forms like ST 236 The South Carolina Department Of Revenue Sctax?

Yes, airSlate SignNow includes features like customizable templates, automated reminders, and secure storage which are particularly beneficial for managing forms like ST 236 The South Carolina Department Of Revenue Sctax. These features help you maintain organization and ensure timely completion of your tax requirements.

-

Can airSlate SignNow integrate with accounting software to help with ST 236 The South Carolina Department Of Revenue Sctax?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting software solutions. This integration is particularly useful for businesses needing to manage ST 236 The South Carolina Department Of Revenue Sctax alongside their financial records, enhancing workflow efficiency.

-

What benefits do businesses gain from using airSlate SignNow for ST 236 The South Carolina Department Of Revenue Sctax?

Businesses benefit from increased efficiency, reduced errors, and enhanced compliance when using airSlate SignNow for ST 236 The South Carolina Department Of Revenue Sctax. The platform’s user-friendly interface and automation capabilities make managing tax documents straightforward and stress-free.

-

Is airSlate SignNow secure for filing sensitive documents like ST 236 The South Carolina Department Of Revenue Sctax?

Yes, airSlate SignNow prioritizes the security of your documents. It employs advanced encryption and authentication measures to ensure that sensitive information, such as that found in ST 236 The South Carolina Department Of Revenue Sctax, remains secure during the eSigning process.

Get more for ST 236 The South Carolina Department Of Revenue Sctax

- Minnesota possession form

- Annual minutes minnesota minnesota form

- Notices resolutions simple stock ledger and certificate minnesota form

- Minutes for organizational meeting minnesota minnesota form

- Sample transmittal letter to secretary of states office to file articles of incorporation minnesota minnesota form

- Hearing notice form

- Js 44 civil cover sheet federal district court minnesota form

- Guardian ad litem 497312759 form

Find out other ST 236 The South Carolina Department Of Revenue Sctax

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy